A Somnolent Spring

The past three years have been quite unusual, but now that most of the restrictions linked to the coronavirus pandemic have been lifted, base oil market participants questioned why lubricant activity remained so unexpectedly slumberous.

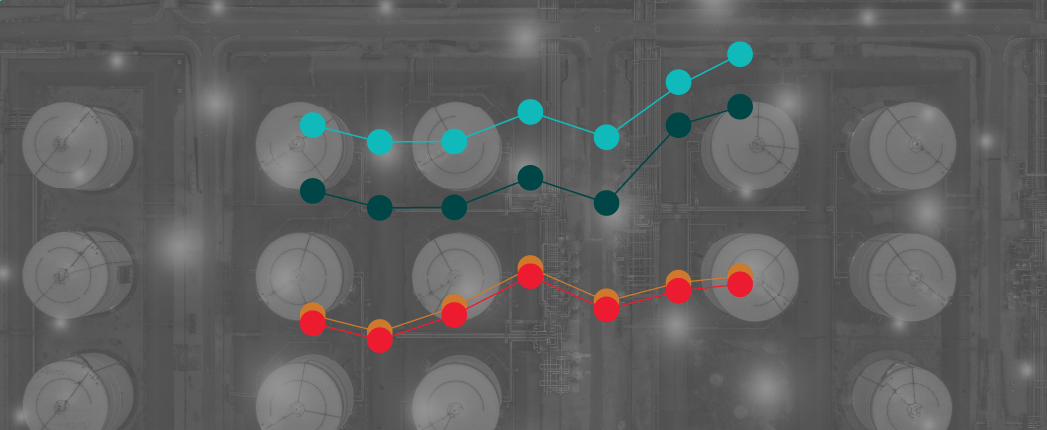

Base oil suppliers had hoped that lowering posted prices in April would spur more demand at a time when requirements should have flourished. They implemented posted base oil price decreases of 15, 20, 30, 35, 40 and 45 cents per gallon—depending on the grade and the supplier—between March 28 and April 25.

In spite of these efforts, in mid-May, there were still few signs that demand had started to take off in earnest, particularly in the automotive segment, even though the summer driving season was just around the corner.

While a few producers saw a slight uptick in base oil orders, demand was lagging compared to the same month in previous years. Economic uncertainties and ample inventories continued to muffle lubricant consumption, and this in turn resulted in subdued base stock requirements. Consumers adopted a cautious attitude and postponed family outings and leisure travel because of the higher cost of fuel, meals, accommodations and airfares, dampening economic activity.

Nevertheless, base oil suppliers remained optimistic that blenders would eventually have to replenish stocks and the posted price decreases would offer additional incentives for them to increase order volumes. Blenders, on the other hand, appeared comfortable securing just enough product to run daily operations, while they kept a vigilant eye on slipping crude oil values.

West Texas Intermediate crude futures were hovering slightly above $80 per barrel in early April, but weaker-than-expected manufacturing activity in China, higher interest rates in the United States and concerns about a potential global economic recession resulted in significant downward pressure, with values falling to levels below $70 per barrel in early May.

The start of the hurricane season in the Atlantic basin—which runs from June 1 to November 30—was anticipated to prompt base oil consumers and producers to begin padding inventories to cover requirements in case of potential output disruptions during severe weather. However, the National Hurricane Center predicted a slightly below-average number of hurricanes and tropical storms this year, and this might discourage base oil market participants from carrying hefty inventories.

While most base oil segments appeared to be well-supplied, a scheduled turnaround at a key API Group II facility might lead to a tightening of spot availability. Chevron was heard to be building inventories ahead of a planned three-week turnaround and catalyst change at its Group II plant in Pascagoula, Mississippi, starting in June.

The Chevron turnaround will follow a shutdown at another key Group II facility, the Excel Paralubes plant in Lake Charles, Louisiana, which completed an extended maintenance program in April, including a catalyst change. In early May, the supplier was meeting contract commitments as scheduled but was not able to offer spot supplies.

Some participants worried that increased production, thanks to the new catalysts, would lead to an oversupply of Group II grades in the domestic market, but producers appeared to have made provisions by shipping product to India, Europe and other destinations.

The Group I segment was generally balanced. A Group I producer was using more of its output for internal lubricant production, leading to a tightening of spot supplies, and several cargoes were exported to Brazil and Mexico.

Within the Group III category, an upcoming turnaround in Asia might lead to strained availability in the second quarter, although heightened domestic production of Group III grades was helping keep this segment well supplied. Buying interest from Europe was also diverting some cargoes to that region away from the Americas. Demand for the 4-cSt grade was healthy, but consumption of the 6- and 8-cSt grades remained lackluster.

In the naphthenic base oils camp, prices were stable, supported by feedstock values and balanced-to-snug supply and demand. Healthy requirements from Europe and Asia along with firm prices in those regions encouraged suppliers to conclude export business. This contributed to the tightening of some pale oil grades in the U.S., particularly as demand from the transformer oil segment was strong and the availability of heavy grades was gradually becoming more limited as well.

Lubricant manufacturers also observed that demand for finished products was lagging compared to the spring season of previous years. Suppliers have not communicated any price adjustments since January when only two major lubricant manufacturers announced price decreases. Sources said that some discounts were being granted on a case-by-case basis, particularly when a supplier sought to protect or regain market share. Blenders were also disappointed that additive producers had not decreased prices, despite ample supply, with the exception of special discounts awarded to a number of accounts, depending on volumes and other terms.

Perhaps the summer will bring renewed buying interest and base oil requirements will blossom. Or perhaps this year will be an exception and conditions will remain impassive, with no disconcerting fluctuations to shake up fundamentals—which might not be a bad thing, either.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com