Can a Slow Start Help Win the Race?

At Kenyan and Ethiopian training camps for runners, athletes often start their daily run at a notoriously slow pace. Experts see a proper warm-up routine—which involves starting leisurely—as an important strategy for both enhancing performance and injury prevention. As is evident from marathon results around the world, Ethiopian and Kenyan runners often finish first, so the strategy seems to work.

Perhaps this is a good technique that can also apply to the base oils market. Suppliers typically see a significant pickup in demand as the lubricant spring production cycle gets underway. This year, however, activity has been lagging compared to the same period the previous year. But maybe it is the slow start to a great sprint.

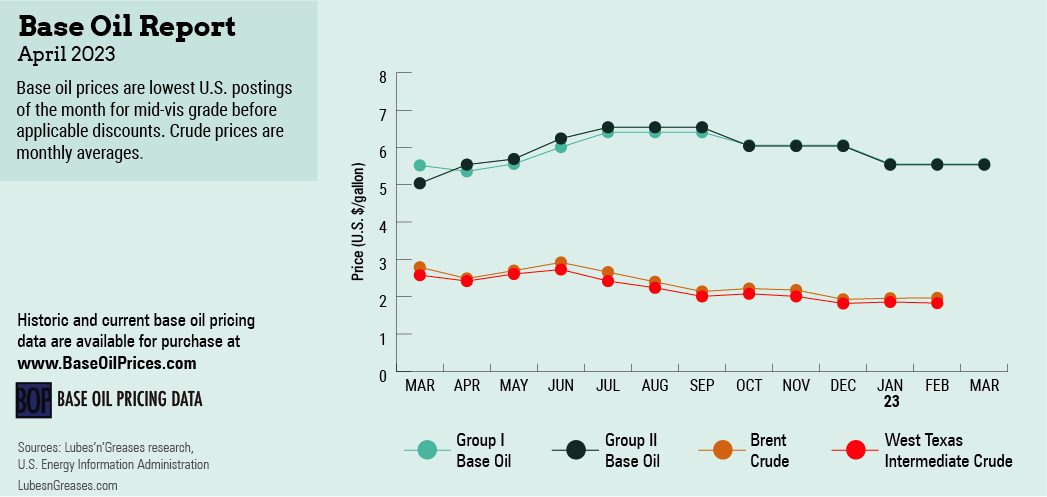

One of the differences between this year and last is that base oil prices were on an upward trajectory during the first half of 2022, and this prompted buyers to acquire as much product as possible to avoid potential increases later. Conversely, this year, posted base oil prices decreased in January, and downward pressure persisted into March, feeding hopes of further decreases down the road and making buyers delay orders.

Demand was expected to gain impetus as blenders build inventories ahead of the summer driving season, which was anticipated to be stronger than in the previous three years given that COVID-19 restrictions have largely dissipated.

It was not clear what was dampening buying appetite, but a number of base oil consumers were likely using up existing stocks before venturing out in search of additional barrels. Many blenders were also happy to run operations with volumes acquired under contract and were staying away from the spot market. There was speculation that blenders were waiting for lubricant demand to pick up, while buyers were delaying purchases in hopes that finished product prices would decline.

One of the surprising facts was that the automotive segment remained muted, and passenger car motor oil volumes were well below what most participants expected at this time of the year.

Inflation and economic uncertainties were afflicting the lubricants segment, and finished product buyers started to pressure suppliers for discounts on the heels of base oil price decreases in January, along with a fresh decrease announcement for API Group III base oils in early March.

SK Enmove—formerly SK Lubricants Americas—reduced the posted price of its Group III base oils by 10 cents per gallon, effective March 1, but left the price of its Group II+ 70N grade unchanged.

SK’s decrease did not immediately trigger additional posted price adjustments—perhaps because price pressure was mostly confined to Group III supplies, which had started to mount. Plentiful availability had already prompted some Group III suppliers to grant temporary voluntary allowances or adjustments in the previous weeks.

Additionally, softer crude oil and feedstock values, together with a need to remain competitive and protect market share amid growing domestic supplies were also thought to have driven the SK initiative.

Base stock posted prices had been holding at steady levels since mid-January as the supply and demand ratio had tightened in most sectors, supporting the prevailing price structure. However, by early March, a few pockets of the market had begun to show some lengthening, unnerving suppliers, and spot prices for some of the Group I and Group II cuts slipped.

Group II base oil availability was more abundant than expected despite a two-month turnaround at the Excel Paralubes Group II plant in Westlake, Louisiana, and an upcoming shutdown at another key unit in the second quarter. The producer was thought to be building inventories to cover requirements during the outage. A third producer had contemplated starting a turnaround in March, but the shutdown has been postponed.

Meanwhile, on the naphthenic side, demand was heard to be steadily growing in line with expectations for heightened activity in the spring and revived buying interest from Latin America, Europe and Asia. Most U.S. plants were running well, following the restart of San Joaquin Refining’s unit in Bakersfield, California, which completed a turnaround in mid-February.

Some lubricant and finished product manufacturers caved to the price pressure and granted decreases in the first quarter, hoping to attract business, but others expected consumption to pick up and refrained from adjusting prices.

Even additive values came under pressure, despite earlier efforts by suppliers to hold prices steady. The tepid activity levels in the different lubricant segments resulted in reduced demand for additives, and inventories were growing, which prompted a few suppliers to grant discounts in the realm of 2%-4% into select accounts. Thankfully, the market was no longer plagued by severe additive shortages, as production levels have improved and most additives became available.

While participants do not have a magic formula to determine when consumption of base oils and lubricants might increase in earnest, most agreed that patience and a steady pace would likely pay off in the end.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com