Need to Know

While the word is often overused, the lubricants industry has truly been through “unprecedented” challenges and changes over the past three years. It started with the outbreak of COVID-19 in 2020. The pandemic caused rapid and massive disruptions in lubricant supply chains and a historic drop in demand. It also set off a domino effect that resulted in skyrocketing costs and prices.

Although lubricant demand rebounded in 2021, supply chain issues deteriorated in 2021 and 2022 due to plant accidents, hurricanes, a historic freeze in the Gulf Coast region, a flood in the Midwest, and other unexpected disruptions. Taken together, these events resulted in extraordinarily tight supply of lubricant additives and a consequently constrained supply of lubricants that lasted well into 2022.

With that, there were deep allocations placed on products, and stockouts were common. This caused notable brand shifting and erosion of brand loyalties. It also accelerated growth in private label.

But as the industry is now returning to some semblance of normalcy, lubricant distributors and blenders say the outlook for 2023 is muddled—so muddled that some say they can’t remember any time when the direction of the market has been so difficult to predict and plan for. One reason is that there are few, if any, historic market conditions analogous to what we have experienced since COVID that would help predict the future. There are also several external variables that have the potential to shatter predictions. Because of this, 2023 is fraught with risk and uncertainty.

In addition to the enormous uncertainty around such external concerns as new variants of COVID, the global economy, geopolitical tensions, and weather events, lubricant blenders and marketers have numerous other worrisome and complicated variables to consider. Among the top concerns is a contraction in lubricant demand and the potential for a race to the bottom should competition intensify in response to falling demand.

While lubricant demand bounced back in 2021 and held its own throughout much of 2022, marketers report a significant drop in sales during Q4 2022 and into the first month of 2023. In part, this is believed to be a function of marketers working down inventory levels in an effort to move higher-priced products out in anticipation of retreating raw materials and finished lubricant prices. Understanding marketers were feeling pushback from the multitude of lubricant price increases implemented from 2020 to 2022, demand was slipping, and there was an overhang in base oil supply, many felt price compression was inevitable. And they were right.

In September 2022, base oil producers announced a $0.40-per-gallon decrease in posted prices for Group II. This move did little more than counter the additive price increases of up to 12% that came a month earlier. Blenders and marketers were still seeing higher labor, packaging, and shipping costs, so it came as no surprise that, sparing some marginal price reductions, lubricant price movements in response to the September decrease were unremarkable.

Another more substantial decrease in base oil posting came in January 2023. The workhorse Group II grades dropped by $0.50-$0.60 a gallon, and Group III went down by $0.20. But this time, lubricant prices did respond. Within two weeks, Chevron and CITGO each implemented decreases of up to 8% on the price of finished lubricants. While at the time of writing there had been no additional lubricant price decreases announced, the prices of many other brands did move down following the January base oil decrease.

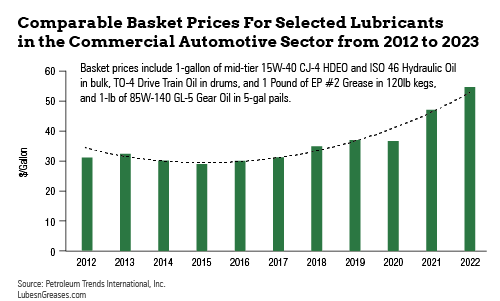

Lubricant price decrease announcements are rare in this business. In fact, there have only been two over the past 15 years: one in 2012 and another in 2015. Both occurred shortly after a notable drop in the price of base oil. To this extent, there is some historic precedence to look back on to help understand where the market might be heading and how to respond. But market conditions were very different then.

Although the economy in 2012 and 2015 was not particularly strong, inflation was not a threat. Over the past three years, however, inflation has run rampant. To underscore its impact, consider that while there were only four lubricant price increases from 2012 to 2015, ranging from 6%-8%, there have been a total of 15 from 2020 to 2022—most in the range of 12%-15%, with some as high as 30%. Moreover, where the U.S. was recovering from a recession then, it is now facing a high probability of another recession.

Many marketers are now asking if the sharp drop-off in lubricant demand in 4Q22 and the recent decrease in base oil and lubricant prices are an aberration or a harbinger of what’s to come. Given the uncertainties, it’s difficult to tell. But one thing many say they know for certain is that they are now being very cautious about building inventories, overextending themselves, managing costs and pricing product. While it’s not hard to make money in a growing economy, they say history taught many painful lessons about how easy it is to lose it in a falling market.

Whether we are looking at a recession, wild swings in demand, supply line disruptions, force majeures, severe weather, or any other disruptive conditions, many lubricant blenders and marketers say they have seen it all over the past three years. While there are few analogous market conditions to look back at that might help predict the future in these unusual times, a great deal was learned over the past three years about succeeding when the market is muddled. Primary among them is the value of flexibility, agility, technology, relationships and creative solutions.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com