You’ve Got to Have Faith

The base oils and lubricants industry—and the whole world, for that matter—have had a difficult year, with humanitarian crises and geopolitical turmoil on many fronts having an impact on everything from political decisions to food prices.

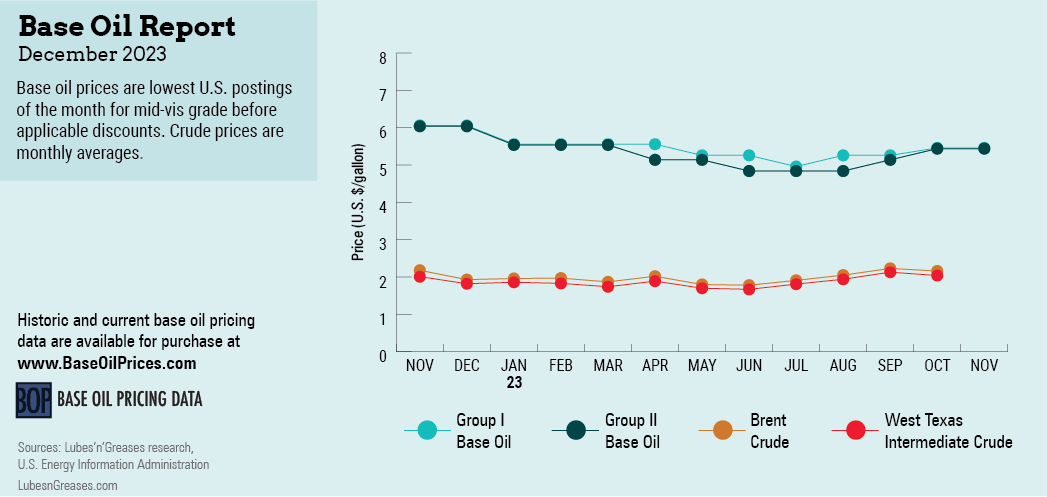

The Israel-Hamas war that began in early October resulted in a crude oil price spike that drove West Texas Intermediate futures to slightly above $90 per barrel. This development exerted upward pressure on base oil values at a time when demand typically starts to decline as lubricant consumption hits a seasonal slowdown.

However, the crude oil price surge was short-lived. By early November, futures had plunged to around $75 per barrel on a strong dollar and concerns about shrinking oil demand following weak economic data from the European Union and China against unchanged production quotas from OPEC+ member countries.

At the same time, unexpected production hiccups and scheduled turnarounds, both in the paraffinic and the naphthenic base oils segments, helped keep the market fairly balanced, despite signs that demand had started to weaken and inventories had begun to mount.

Newly implemented restrictions on U.S. base stock exports to Mexico that required petrochemical importers to apply for a license were expected to result in lengthening spot supplies—at least for a few weeks until the application process was completed. This factor, together with increased domestic availability of certain grades, placed downward pressure on spot pricing.

The price trend was mostly noticeable in the API Group III segment, as supply of most grades was plentiful and demand had been partly dampened by the United Auto Workers strike on the three largest U.S. automakers (Ford, General Motors and Stellantis). Paralyzed operations at several auto plants had resulted in reduced consumption of Group III oils used in factory-fill lubricants and transmission fluids. A shortage of car parts due to the strike also led to lower consumption of engine oils at garages that repair cars and offer oil changes. The strike ended on Oct. 30 with a tentative agreement between the manufacturers and the union. Lubricant suppliers were expected to have enough inventories to cover immediate requirements once car production resumed.

The downward pressure on Group III pricing was evidenced by SK Enmove’s implementation of a posted price decrease of 10 cents per gallon on the company’s Group II+ and Group III base oils, which went into effect on Nov. 1. The decrease was expected to bring the company’s prices more in line with those of other Group II+ and Group III suppliers. Aside from plentiful imports, the Group III segment had seen increased domestic production of most grades.

Slowing demand for heavy grades in the Group I and Group II categories also started to place pressure on values, although a 45-day turnaround at HollyFrontier’s Group I unit that was completed in the first half of November limited Group I supply. Unplanned production issues and a brief shutdown at the Excel Paralubes Group II base oil unit in Lake Charles, Louisiana, was heard to have put a small dent on Group II spot availability, too.

Group II supplies had started to lengthen due to a seasonal slowdown in the domestic market, coupled with the aforementioned restrictions on exports to Mexico. Base oil premiums over competing fuel prices were firm, encouraging refiners to maintain production rates as well.

Spot supply was also expected to increase due to softening demand from Latin America and Europe. Brazil stood out as a bright spot, given an extended turnaround at a key Brazilian base oil facility that compelled buyers to look for base stocks from alternative sources, including the U.S.

On the naphthenic base oils front, business remained healthy, with the light oils described as snug compared to their heavier counterparts. There was also brisk export activity into Asia, Europe and Latin America, which helped support prices.

Just like in the paraffinic segment, availability in the naphthenic market was impacted by a brief unexpected production outage at one plant and the start of a turnaround at another. Cross Oil’s plant in Smackover, Arkansas, experienced a brief unplanned shutdown in the second half of October, while San Joaquin Refining began a three-week turnaround at its naphthenic base oils plant in Bakersfield, California, on Nov. 13. The producer was expected to have built inventories to maintain supply during the outage but was unlikely to have extra availability after the maintenance program, particularly of the light grades.

In downstream markets, there were expectations that blenders would seek price increases of up to 10%-18% on lubricants and greases, and up to 9% for brake fluids in the second half of October and the first half of November to reflect the base oil posted price increases that had taken effect in August and September, along with elevated packaging and transportation costs. Two additive suppliers also communicated price markups of up to 8%-12% due to steeper base oil prices and inflation, to be implemented in mid-November.

Despite all the uncertainties and vicissitudes experienced throughout the year, base oil market participants did not lose hope that 2024 would bring the industry more stability and fresh opportunities, and that the difficulties it had faced in 2023 would only make it stronger, more diversified and nimble.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com