As electrification accelerates and economies around the globe experience increasing levels of strain, some might be led to believe that the future of the North American lubricants market is all doom and gloom. However, the clouds on the horizon are not all dark, with growth in some segments expected during the next three to four years.

During a September 20 webinar hosted by global consultancy Kline & Co., David Tsui, project manager, energy, estimated global lubricant demand in 2022 to be about 12 billion gallons. The North American market makes up about 24% of that demand, with the United States being the country with the most impact and accounting for about 20% of global demand.

Industrial Lubes Thrive in North America

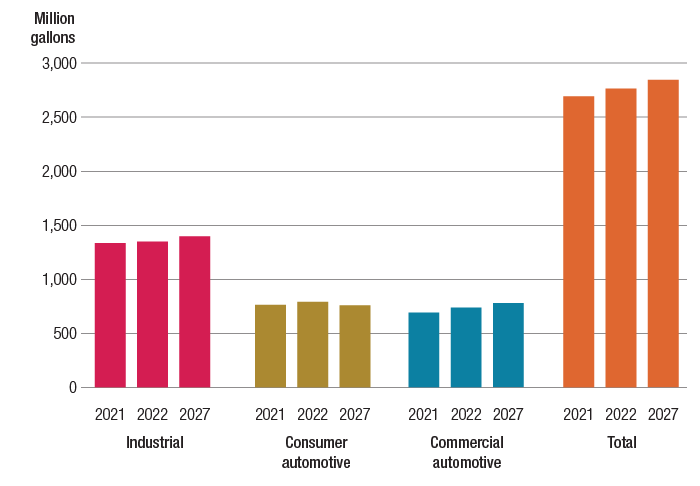

While some segments are forecast to take a bit of a hit in the coming years, industrial lubricants appear to be the shining exception.

“When we look at it overall, as far as North America, industrial lubricants are by far the lion’s share of the lubricants volume,” Tsui said. “This is expected to continue growing.”

What factors may be contributing to this growth?

Figure 2. Finished Lubricant Demand Outlook in North America, 2021, 2022 and 2027

“A lot of the growth in the industrial segment will be kind of stimulated by a couple of recent acts, such as the Build America, Buy America and the Inflation Reduction Act,” Tsui said. “These things are bringing more nearshoring, bringing more manufacturing back into America and North America in general.”

However, there are some recent disruptions that may interrupt this growth in local manufacturing, such as the United Auto Workers strike in the U.S. “But in general, there has been a trend to bring production, manufacturing and assembly back into the North America region,” Tsui said. “Certainly, industrial is going to be a growth segment.”

Consumer Automotive Segment Contracting

The consumer automotive segment accounted for the second-largest demand levels in 2022. But unlike its industrial counterpart, Kline predicts that this segment will experience a certain level of decline in the coming years. A major reason for this forecast is the growing adoption of electric vehicles.

“The consumer decline has been happening for a while; it’s not like it’s something new,” Tsui said. “As consumers, we’ve been growing more accustomed to 10,000-mile drains versus our traditional 3,000 or 5,000 miles. A lot of OEMs are recommending the longer drains, and consumers are getting more comfortable with it. We’re certainly starting to see a larger portion of the population accept that.”

Another reason for the continuing decline of the consumer automotive segment is related to ancillary products, like automatic transmission fluids, gear oils and greases. “For the past period of time, essentially most new vehicles come with fill-for-life fluids in those particular applications,” Tsui said. “Because of that, as these vehicles start to age, you’re not seeing them come into the service fill market, so you’re seeing those products start to see larger declines than engine oil.”

Commercial Automotive Segment Rolls Along

According to Kline, some growth is expected in the North American commercial automotive segment. “That growth, however, is highly dependent on the economy,” Tsui said. “While we do estimate growth into 2027, I’d estimate there will be a dip at the end of this year and into 2024-ish, as we see whatever plays out with the economy.”

Supplier Shares

According to Kline, the U.S. market is fed by more than 300 suppliers of both automotive and industrial lubricants. Those suppliers are made up of majors, independent manufacturers and a growing private label section.

Which producers are dominating the market right now?

“Shell and ExxonMobil are your market leaders in this region,” Tsui said. “Shell has a very strong commercial and consumer automotive segment. While ExxonMobil is certainly no slouch in those segments, they actually have a larger share of the industrial lubricants segment. Each supplier tends to have some of their stronger suits.”

Other major suppliers in the country are Ergon, Chevron, HollyFrontier, Valvoline, BP, Phillips 66, Calumet and TotalEnergies, respectively.

A Rundown of the U.S. Market

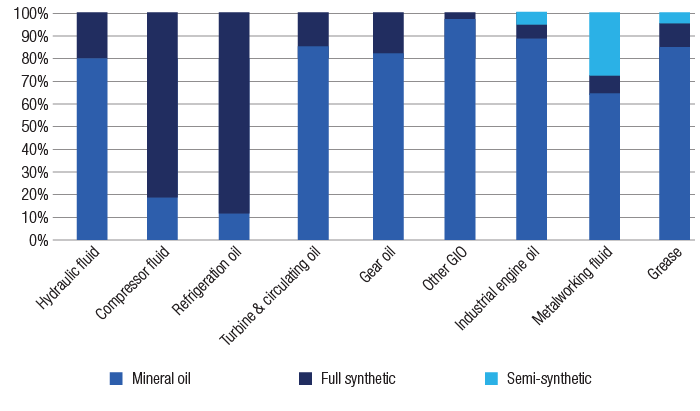

In the U.S., synthetic lubricant demand is growing as a result of the increasing popularity of lower-viscosity oils. (Check out Steve Haffner’s article about passenger car motor oil viscosity trends in the October 2023 issue.)

“0Ws have gained quite a bit of market volume, so now they rank second behind 5Ws and have already surpassed 10Ws,” Tsui said. “This, in part, has been a large driver of synthetic lubricant growth. But as such, it’s also driven an interesting play, which is that private label synthetics have seen a lot of growth … where in the past, the off-name, private label brands had been something you were used to seeing on a bottom self as something people didn’t pay attention to. These brands have actually built up enough of a name that they do actually have some branding. Now, some consumers are equating them to typical products.”

How is demand split by service category in the U.S.?

According to Kline, API SP makes up the majority of U.S. demand. “Most lube marketers, especially the majors, switch on first license dates, so you might be wondering why there is still older product in the market,” Tsui said. “Part of that is driven by the fact that we still have a significant European vehicle market, and a lot of those are looking at 5W-40s and other 40-weight products that meet ACEA quality standards. Those might only be an API SN, for instance. There’s no reason to upgrade those to API SP, because the target specification is maybe a VW or Mercedes spec, plus ACEA.”

Figure 1. Penetration of Synthetics in U.S. Industrial Oils and Fluids, 2022

How are the installed channels evolving in the country?

“Overall, you see the continued shift from DIY to DIFM,” Tsui said. “So you’re seeing retail go down. You’re also seeing independent workshop channels shrink as some of those workshops get swallowed by the larger chains. That’s part of the reason for the retail decline.”

Tsui explained that the increasing move toward DIFM could be partly attributed to the complexity of new vehicle models as well as the higher cost of new vehicles.

The commercial automotive lubricant segment in the country is split between on-highway and off-highway demand. “On-highway tends to have more demand for FA-4 quality fluids. They tend to use a little more of the 10W and 5W side, whereas in off-highway, it tends to be a lot more conventional 15W-40 CK-4 or older specs,” Tsui said.

What factors have changed consumption and buying habits in the past few years? According to Tsui, a significant portion of changes to the commercial segment have been related to problems that arose during the COVID-19 pandemic.

“Some of the effects have lasted,” Tsui said. “What happened was that during COVID, certainly you had lockdowns that caused supply chain issues. But then you also had force majeure happen during that time, and these have been issues where people were not able to get proper supply of HDEO, so they’ve been shortchanged on what they were able to blend and make. This has happened from the additive industry and up to base oils and others. Either way, it’s been proven to people that the old model of putting all your eggs into one basket for the best price” is not necessarily a viable model anymore.

The U.S. industrial segment has also undergone some major changes in the past few years. One of the most significant, according to Kline, is the nearshoring trend. “We are starting to see things change as far as some manufacturing coming back to the region,” Tsui said. “Some of it is driven by supply chain issues and lockdowns. In the past, a lot of supply came from China, which is a huge manufacturing location. Because of their very stringent shutdowns and the fact that people weren’t able to get product in or

out of the country, this has changed a lot of the investment and supply strategies.”

Additionally, the U.S. government has been allocating some funding to rail and air freight, taking some attention away from on-highway transportation of goods.

Decline in Canada

Lubricant demand in Canada experienced a slight decline in 2022, mostly due to a worsening economy. Consumer automotive lubricant demand is forecast to decline at a faster rate in the country than the commercial automotive segment. Part of that has to do with consumer spending, while the other part is largely attributed to the transition to electric vehicles.

Is there a bright spot for lubricants in the country’s future? Kline forecast that there is. “Within the commercial segment, agriculture and mining will continue to help maintain some demand,” Tsui said. “Certainly, the mining in Canada is tending to grow as they’re looking to expand their EV raw material supply as well as for renewable energy.”

Industrial lubricant demand is expected to experience only a modest decline in Canada. According to Tsui, this slight dip will likely be a result of nearshoring. “Canada is a large manufacturing hub for transportation equipment, so certainly they produce a lot.”

Growth in Mexico

While Mexico’s lubricant demand volume is smaller than its American and Canadian peers, it has been growing and will likely continue to grow in the coming years. This is likely due to expansion of manufacturing in the country, growth in consumer spending as well as the implementation of new government regulations to help manage emissions and fight climate change.

According to Tsui, the ambition to lower emissions in the country has led to a newer vehicle parc. These newer vehicles have ushered in demand for lower-viscosity lubricants, despite the fact that the country has been stubbornly hanging on to some heavier viscosity grades.

The industrial segment in the country is expected to grow in the next few years. “The UAW strike in the U.S. might shift some investment into Mexico, where maybe the plants in Mexico that were going to build EVs get expanded further to handle a little more capacity or another model,” Tsui said.

General Outlook

The outlook for North American lubricant demand is fairly moderate, with slight growth projected into 2027 in all segments except the consumer automotive segment, which is expected to dip slightly.

“Overall, we see North American lubes growing slowly. But it’s a large market, and it will continue to be a very important market.” Tsui said. “While it might not have insane growth, there’s a lot of volume here at play.”

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com