United States base oil production for the first half of 2023 dropped to its lowest half-year total since 2020, and the lowest since 2009 in a non-pandemic year, as a number of facilities faced turnovers and reduced output. Meanwhile, imports and exports remained rock solid in the post-pandemic era, and little changed in where the country is sourcing its domestic production.

Net production reached just 26.7 million barrels of base oil from January through June this year, according to data from the U.S. Energy Information Administration. That total is down 11% from 30.1 million barrels in the first half of 2022 and 8.5% from 29.2 million barrels in the first half of 2021.

While 26.7 million barrels still top the 25.9 million barrels the country produced in the first half of 2020 at the onset of the COVID-19 pandemic, one would have to go all the way back to the first half of 2009 to find a lower total in a non-pandemic year. During that period, the country produced 24.9 million barrels.

This drop comes after a steady recovery from the pandemic. Production looked to be on its way to pre-2020 numbers, with 31.9 million barrels manufactured in the second half of 2021 and 30.1 million in the first half of 2022.

But production suddenly slipped to 27.5 million barrels from July to December last year, with higher base oil prices due to trickle-down effects from Russia’s war on Ukraine plus tight supply and turnarounds in different regions.

“I believe that because demand has been lackluster since the beginning of the year, producers have dialed down operating rates to keep inventories in check,” said Gabriela Wheeler, Lubes’n’Greases base oils editor. “I think that we can assume that producers were not operating at 100% operating rates for most of the year.”

Another contributing factor to the decreased base oil production may be a disruption in additive supplies. “The additive shortages would not have affected base oil production per se, but of course, if lubricant blenders that use additives to make lubricants had to cut lubricant production because of an additive shortage, that means that they were consuming less base oil,” Wheeler said. “As a consequence, base oil demand was down, and base oil producers trimmed operating rates accordingly.”

Furthermore, additive packages are dissolved in a certain amount of base oil, inextricably tying additives and base stocks together. “A huge component of additives is base oil, so if additive manufacturers weren’t manufacturing additives because of technical issues or unexpected weather events, then the additive manufacturers would also be buying fewer raw materials, including base oils,” Wheeler said.

For instance, flooding in the Midwest region closed down an Afton plant for a short period of time last year, forcing the company to declare force majeure on additives for a little over a month. The industry is still feeling the effects of this interruption even now.

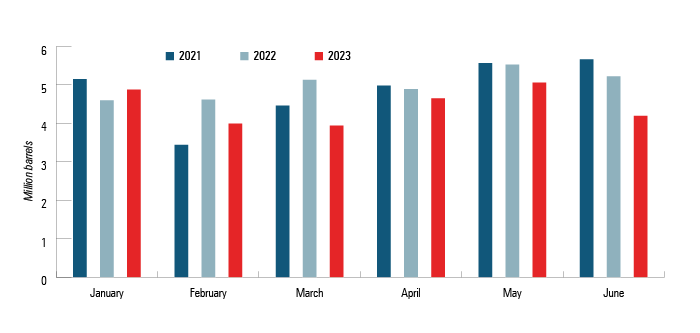

Monthly base oil production this year peaked in May at just over 5 million barrels, while February and March both dipped below 4 million barrels at 3.99 million and 3.94 million barrels, respectively. Those totals are all down year-over-year: 10% for May, 13% for February and 23% for March. The last time monthly production dipped below 4 million barrels—excluding 2020—was 3.3 million barrels in February 2021 and 3.6 million barrels in February 2016.

Figure 1. Monthly U.S. Base Oil Production

Source: U.S. Energy Information Administration

This drop in production coincided with a turnaround at an Excel Paralubes Group II plant in Westlake, Louisiana, which was taken offline during those low-production months. However, there was no producer confirmation about the turnaround schedule.

Other domestic plants faced shorter turnarounds throughout the first half of the year.

Naturally, both paraffinic and naphthenic base oil production dropped by 11% each. Paraffinic fell from 25.3 million barrels in the first half of 2022 to 22.5 million barrels during the first six months of this year, while naphthenic production fell from 4.7 million to just under 4.2 million.

“The other thing to consider is that majors are now commenting on their ability to make Group III domestically, for example Motiva,” said Ernie Henderson, president of K&E Petroleum Consulting. “As more companies begin to produce, it will come at the expense of Group II production, as no new capacity is being formally announced.

“When Group III is produced, yield and daily production will be reduced. So this could partially influence any directional decline in domestic paraffinic base oil production.”

Regional Production

Regionally, only one of the five Petroleum Administration for Defense Districts upped its production during the first half of the year.

PADD 1, consisting of refineries along the East Coast, output just over 2 million barrels for the first half of 2023, down from more than 2.1 million barrels in the first half of 2022. Split between the two PADD subdistricts—the East Coast and Appalachian—the former contributed 974,000 barrels while the latter contributed 1.1 million barrels. In 2022, the share was slightly flipped: The East Coast put out just over 1.1 million barrels, while the Appalachian district made 1.06 million barrels.

Figure 4. First-half U.S. Base Oil Production

| Year | Paraffinic | Naphthenic | Total |

|---|---|---|---|

| 2013 | 22,842 | 4,982 | 27,824 |

| 2014 | 24,228 | 4,625 | 28,853 |

| 2015 | 27,292 | 4,494 | 31,786 |

| 2016 | 24,723 | 4,357 | 29,080 |

| 2017 | 25,837 | 4,930 | 30,767 |

| 2018 | 29,005 | 4,987 | 33,992 |

| 2019 | 23,770 | 5,077 | 28,847 |

| 2020 | 22,008 | 3,898 | 25,906 |

| 2021 | 24,599 | 4,672 | 29,271 |

| 2022 | 25,255 | 4,740 | 29,995 |

| 2023 | 22,516 | 4,196 | 26,712 |

PADD 2, made up of Midwest refineries, saw a small 4% bump in its production, from 1.17 million barrels in 2022 to 1.22 million barrels in 2023. Production from this region comes solely from the Oklahoma-Kansas-Missouri subdistrict.

PADD 3, consisting of refineries along the Gulf Coast and the most productive region by a significant margin, produced just under 21.3 million barrels, down almost 13% from 24.4 million during the first half of last year. In the Texas Gulf Coast subdistrict, production slightly rose from 9.9 million barrels to 9.93 million. Production in the Louisiana Gulf Coast, however, dropped 27%, from 9.2 million barrels in 2022 to 6.7 million barrels. The North Louisiana-Arkansas subdistrict output also fell from 5.1 million barrels to 4.5 million barrels—a 12% decrease.

PADD 5, housing refineries on the West Coast, saw production drop 8% from 2.3 million barrels to 2.1 million barrels.

Imports

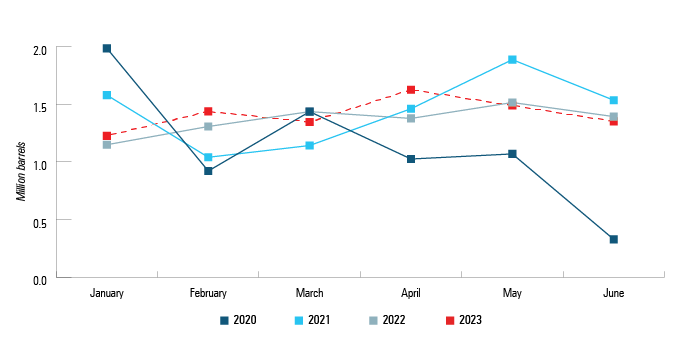

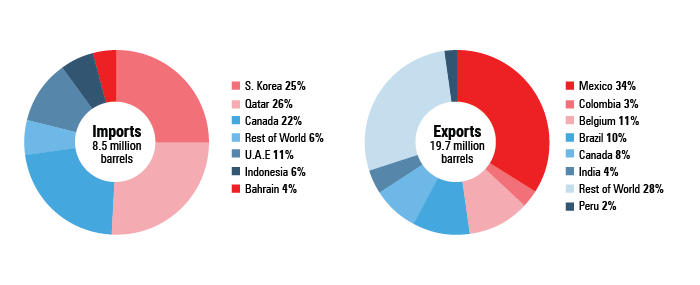

The U.S. imported 8.4 million barrels of base oil in the first half of 2023, up 4% from 8.1 million in 2022. Qatar overtook South Korea as the top source for base oil imports in 2023, edging it out at 2.17 million barrels—a 30% raise from 2022. Last year, Korea led the way, with 2 million barrels, while Qatar came in third with 1.6 million.

This was only the third time the U.S. imported more base oil from Qatar than South Korea in a half-year period in the past five years. The other two instances were the back half of 2022 at 2.4 million barrels versus 2.3 million barrels and the first half of 2021 at 2.1 million barrels versus 1.5 million.

Figure 2. Imports

Source for all: U.S. Energy Information Administration

Coming in third this year was Canada with 1.8 million barrels, dropping from second place last year when the U.S. imported 1.7 million barrels from its neighbor to the north. This year’s mark was the second-highest half-year total in the past five years, behind only the first half of 2021 when it imported 2.1 million barrels.

Retaining their spots in fourth and fifth were the United Arab Emirates and Indonesia, respectively. The UAE exported 954,000 barrels of base oil to the U.S., down slightly from 959,000 barrels in 2022. Indonesia was the source of 477,000 barrels, down 14%.

The last three six-month periods have seen the highest number of imports from the UAE in the past five years, peaking at 1.2 million in the second half of 2022. Indonesian imports this year were relatively tame during that same five-year period coming off a high mark of 690,000 barrels in the final six months of last year.

Exports

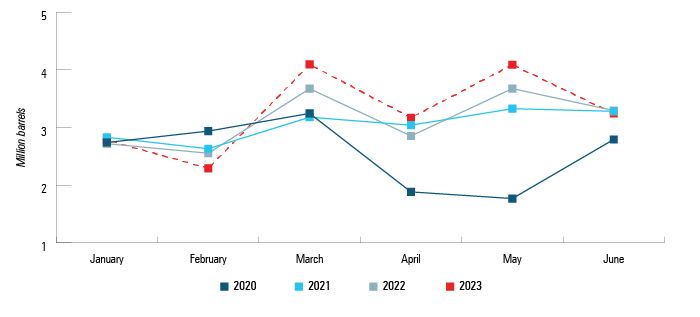

The U.S. exported 19.7 million barrels of base oils, up slightly from 19.2 million in the first half of 2022. Mexico was handily the most popular destination for U.S. base oils, with almost 6.8 million barrels shipped to the country. That was up 44% from 4.7 million in the first half of 2022 and a healthy rebound from the second half of last year when it only shipped 3.6 million barrels.

In fact, that 6.8 million barrel first-half mark is the most base oil the U.S. has ever exported to a single country in a six-month period since the EIA began tracking the data in 1993. The next highest total was 6.5 million barrels exported to Mexico in the first half of 2019.

Figure 3. Exports

Source for all: U.S. Energy Information Administration

Keeping its spot in second was Belgium with over 2 million barrels exported there—down 13% from

2.4 million barrels in 2022. Meanwhile, Brazil leapt from fifth place in 2022 with 1.6 million barrels to third in 2023 with just under 2 million barrels—an 18% rise.

Staying at fourth was Canada with 1.6 million barrels—down 6% from 1.7 million in 2022. After peaking at 1.8 million barrels in the second half of 2021, exports to the country have slowly dropped in consecutive periods. Rising into the top five was India, which received 798,000 barrels from the U.S., up almost 31% from 610,000 barrels. That number also topped its second-half 2022 total of 220,000 barrels by a significant margin—a 262% increase.

Figure 5. Top U.S. Trading Partners for Base Oils – First-half 2023

Falling out of the top five was Colombia. The South American country took in an uncharacteristically high amount of U.S. base oils for all of 2022—including 2.2 million barrels in the first half—likely due to the shutdown of a Group I base oil plant in Barrancabermeja. This year, the U.S. has only exported 580,000 barrels there.

In terms of total share, Mexico received 34% of all U.S. base oil exports, up from 24% in 2022 and hovering around some of its highest share totals in recent years.

Will Beverina is assistant editor for Lubes’n’Greases. Contact him at Will@LubesnGreases.com