Stormy Weather

While conditions in the base oils market seemed temperate at the end of the summer, with balanced-to-tight supply and demand and steep feedstock values supporting prices, there was an underlying feeling that dark storm clouds might be forming on the horizon.

The approach of the end of the year—when both buyers and sellers do their best to reduce inventories and start planning operations for the year ahead—infuses the market with a certain degree of anxiety. The fourth quarter is also typically the time when suppliers release the extra barrels they had been keeping in case of potential output disruptions during the hurricane season along the U.S. Gulf Coast, where many base oil plants are located.

These efforts might result in a flood of product hitting the market just when demand tends to slow down. At the time of writing in early October, it was too early to tell if this was going to be this year’s scenario. Buyers were still busy absorbing the posted price increases that were implemented in late September, and from all indications, inventories were not particularly high.

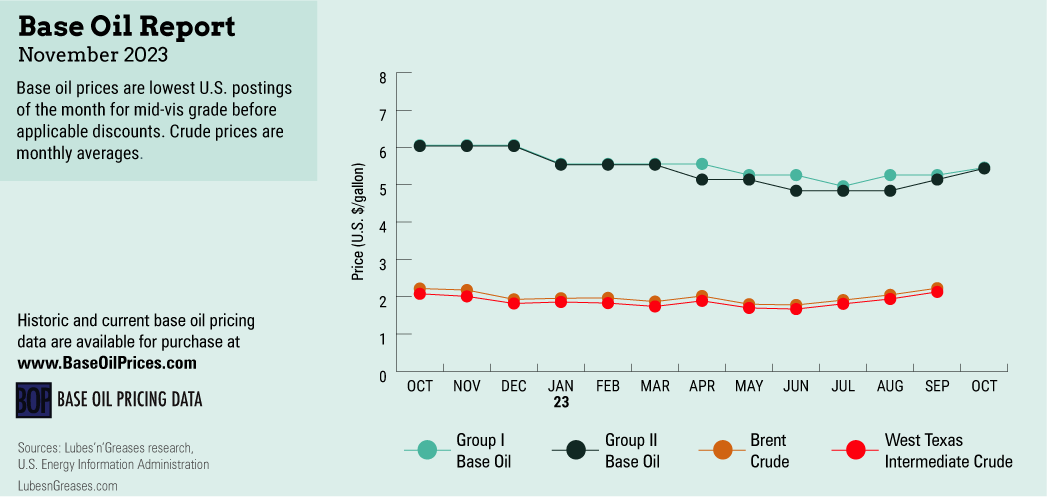

The increase initiatives raised most API Group I prices by 20 cents per gallon, with the exception of bright stock, which was left unchanged. Group II prices were generally lifted by 15, 25 and 30 cents per gallon, and Group II+/Group III prices by 15, 20, and 30 cents per gallon, with the increases going into effect between September 15 and September 25.

On the naphthenic base oils front, producers also increased prices in September by 25 and 30 cents per gallon, depending on product and location, driven by steep crude oil and feedstock prices and higher diesel values. Suppliers reported balanced-to-tight supply and demand fundamentals, with the lighter pale oils said to be particularly sought-after. Healthy buying interest for U.S. naphthenic products from South and Central America and Asia also propped up prices.

While supply and demand conditions on the paraffinic side were described as mostly balanced, the Group III category showed some lengthening on account of increased domestic production, ample imports from Asia and the Middle East, and sluggish demand. Group III suppliers adjusted the volumes brought into the United States to avoid a significant product overhang and downward price pressure.

The Group I segment was described as balanced-to-tight due to reduced base oil output at some refineries in favor of increased distillates production and an ongoing turnaround at HollyFrontier’s Group I plant in Tulsa, Oklahoma. The unit was taken down for a 45-day maintenance program in September. The producer limited its spot sales ahead and during the turnaround to build inventories and to fulfill contractual obligations during the outage.

Within the Group II sector, despite the fact that a number of Group II plants had undergone turnarounds or had experienced production issues in the previous months, supply was deemed plentiful to meet domestic requirements as well as export business.

Suppliers were able to finalize several export transactions—including shipments to Europe, Brazil and Mexico—which helped keep U.S. inventories in check. Ongoing and imminent production shutdowns in Brazil were expected to maintain buying interest in U.S. base oils buoyant until the end of the year, provided prices remained competitive.

Domestic base oil demand continued to be dampened by uncertainties in downstream markets. According to suppliers polled regarding base oil consumption, the September posted price increases seemed to have had little effect on orders, but some buyers were holding back on acquiring additional base oils, as lubricant consumption had been generally lackluster.

The United Autoworkers’ union strike on the three largest U.S. car manufacturers—Ford, General Motors and Stellantis—started in mid-September and impacted operations at several auto plants. Some industry participants were concerned that this might affect demand for factory fill lubricants and other automotive fluids. However, other players were of the opinion that the strike would be less impactful than expected. They explained that the bigger issue might be that some repair parts may become short because of the production disruptions. This might lead to a reduced number of drivers getting their cars repaired, which is when they typically also have their engine oil changed, leading to fewer oil changes and lower demand for lubricants.

At the same time, prospects of lubricant price increases might trigger an uptick in finished product orders as buyers try to beat the price hikes.

Entering late October, there was a certain degree of hesitation to raise prices, as some suppliers were concerned about further discouraging demand and the possible loss of market share. Nevertheless, the mounting cost pressures—not only from climbing base oil prices, but also from steeper additives, packaging and freight values—made it necessary for lubricant manufacturers to transfer the increases down the supply chain.

Whether some of the dark clouds that may threaten market prospects in the coming weeks will disappear without a major downpour was difficult to assess. At least some of the cost pressures, such as sky-high crude oil values, have weakened, with West Texas Intermediate crude oil futures falling to the low $80s per barrel in early October, from values slightly above $90 per barrel in mid-September.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com