Just like other segments of the lubricants industry, the lubricant additives market has experienced significant—and sometimes jarring—changes during the past several years.

For instance, in late July last year, severe flooding in the Midwest region of the United States forced Afton Chemical Corp., one of the Big Four additive suppliers, to temporarily close its production facility in Sauget, Illinois. As a result of the flooding, the company declared force majeure, resulting in a shortage of materials to be used in such products as engine oil additive packages as well as some off-road products. The company lifted the force majeure just over a month later, but the interruption to production had lingering effects.

The global additives market was no stranger to supply issues before then, either. In September 2019, a fire broke out at Lubrizol’s additives plant in Rouen, France. (Lubrizol is another one of the Big Four additives suppliers. In fact, according to an April 6 webinar hosted by global consultancy Kline & Co., it is the largest supplier in the world.) The blaze caused extensive damage to the company’s facilities and took large volumes of additives out of the supply system for some time.

Additives supply woes were also intensified by the COVID-19 pandemic. Many companies worldwide responded to the virus by implementing strict restrictions, and many employees were unable to go to work as the virus rapidly spread. As a result, several additive plants around the world cut production or temporarily shuttered their operations in an attempt to slow the spread of the deadly virus and to protect employees.

Developments in Demand

According to Kline & Co., global demand for lubricant additives totaled about 4 million tons last year.

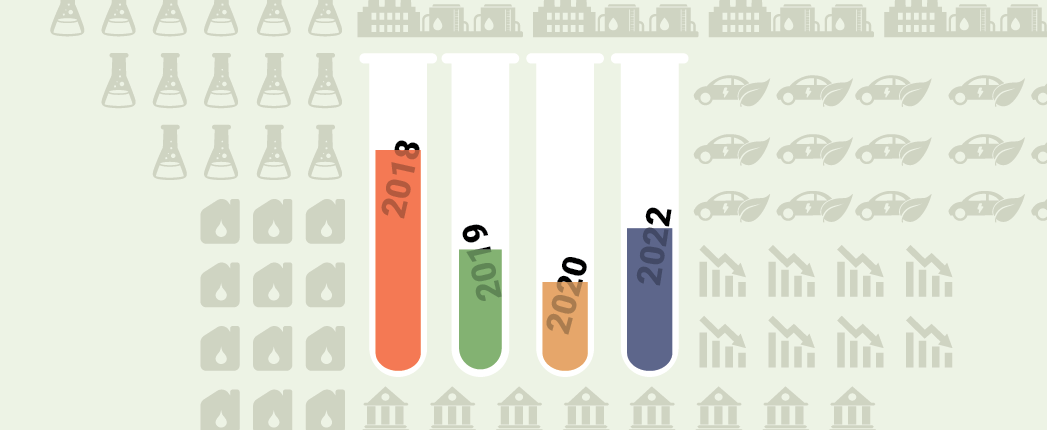

Demand fell short of 2018 levels—the year that many industry experts consider to be the zenith of finished lubricant demand. Of course, additive demand fell sharply in 2020 due to fallout from the COVID-19 pandemic. It had managed to perk up a bit by the end of 2022, and Kline projects that it will continue to rebound—albeit short of 2018 levels—over the next few years.

Of those 4 million tons consumed in 2022, automotive engine oil applications—both heavy-duty engine oil and passenger car motor oil—accounted for more than half. Metalworking fluid applications claimed the third-place spot, followed by industrial and other lubricants.

The Asia-Pacific region consumed the largest volume of additives last year, followed by North America and Europe.

(For more in-depth information on additive demand and major trends, check out the June 2023 issue of Lubes’n’Greases magazine.)

Additive Functions

The types of lubricant additives as well as treat rates have naturally evolved over the years as researchers and developers have made groundbreaking progress in the quest for higher performing, more sustainable and more cost effective finished lubricant formulations. However, the main additive categories have more or less stayed constant. The table above outlines the major additive functions as well as some of the materials that fall into each respective category.

| Category | Type | Function | Examples |

|---|---|---|---|

| Surface Protection | Antiwear Agents | Protect loaded metal parts from wear and tear. Typically activated by heat to form a protective film. | ZDDP |

| Surface Protection | Corrosion Inhibitors | Minimize or eliminate rust and corrosion by neutralizing acids and creating a protective barrier to protect hardware from moisture. They do this through passivation or neutralization. | ZDDP |

| Surface Protection | Detergents (alkaline or basic) | Often used in cooperation with dispersants. Keep metal components clean and neutralize acids. | Metal compounds of calcium or magnesium, phosphates and sulfonates |

| Surface Protection | Dispersants | Ensure insoluble particles of engine soot are dissipated or suspended in the oil. | Polymeric alkylthiophosphonates, alkylsuccinimides |

| Surface Protection | Friction Modifiers | Alter friction between the engine and transmission parts. | Molybdenum dithiophosphate, stearic acid |

| Performance Boost | Pour Point Depressants | Reduce size of wax crystals in the oil. Increase flowability at low temperatures. | Polyalkyl methacrylates |

| Performance Boost | Seal Swell Agents | React with elastomer to cause slight swelling of elastomeric seals. | Organic phosphates |

| Performance Boost | Viscosity Modifiers | Prevent lubricant from losing viscosity as temperatures rise. Increase oil flow at low temperatures. | Olefin copolymers, polyisobutylene, PAMA, HSD |

| Lubricant Protection | Antioxidants | Enhance service life of lubricant. | ZnDTP, hindered phenols, dithiocarbamates, alkylated diphenylamines |

| Lubricant Protection | Metal Deactivators | Stabilize lubricant by deactivating metal ions. | Organic substances that contain nitrogen or sulfur (aromatic triazoles, azoles, substituted thiadiazoles) |

| Lubricant Protection | Anti-foaming Agents | Reduce surface tension and prevent formation of bubbles (foam). | Silicone polymers, organic copolymers |

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com