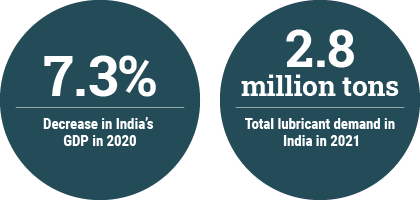

With a population of more than 1.4 billion people, India was hit particularly hard by the COVID-19 pandemic. In fact, consultancy Kline & Co. announced in an August 3 webinar that the country showed its worst economic performance on record in 2020 as a result of the virus. According to data from the World Economic Outlook Database, India’s gross domestic product dropped by more than 24% from April to June in 2020. For the entire year, the country’s GDP saw a 7.3% decrease.

With India’s economic contraction came a subsequent squeeze on the country’s lubricants market. How well has the Indian lubricants market recovered from the pandemic, and what challenges is it still working through? What opportunities for growth exist in the country now and in the coming years?

These questions and more are answered in Kline’s study, “Opportunities in Lubricants: An Overview of the Indian Market.” The study explores lubricant demand in the commercial and consumer automotive and industrial segments by product type, application and end use. It also reveals drivers of growth in the market and offers profiles of prominent installed and retail channels as well as the country’s leading lubricant marketers. The study’s base year is 2021 with forecasts reaching out to 2026.

The study broke the Indian lubricants market into three main segments: consumer automotive, commercial automotive and industrial. These three categories were further divided. The consumer automotive segment encompassed lubricant demand from factory fill, dealerships, fuel stations and garages. Lubricants in this segment include motorcycle oils, transmission fluids, gear oils, greases and passenger car motor oils. Demand in the commercial automotive segment came from factory fill, on-highway applications (fleets and dealerships as well as owner-operators) and off-highway applications (agricultural, construction and mining). This segment is represented by various products, including heavy-duty engine oils, transmission fluids, gear oils and greases. Demand in the industrial segment was comprised of all other industrial lubricants, such as metalworking fluids, industrial engine oils, turbine oils, greases, hydraulic fluids and more.

What’s the Deal with Demand?

“The most important thing that each of us want to understand—and this was also a prime objective of the study—was how good the market was in 2021,” Hareesh Nalam, product manager, energy, for Kline, said in the August 3 webinar. “We saw the lubricant demand—and not only the lubricant demand but demand across the segments for all the products and commodities—decline in 2020 due to the COVID-19 pandemic.”

However, total lubricant demand in India rebounded in 2021 to narrowly surpass pre-pandemic levels by just 1%, reaching 2.8 million tons, Nalam said. Demand in the country in 2020 was just 2.5 million tons.

Of the three segments examined in Kline’s study, “the lubricant demand in industrial is still the largest,” Nalam said. Partially responsible for the high ranking of industry lubricant demand in the country was process oil, which accounted for nearly 800,000 metric tons of the country’s total lubricant demand.

Consumer Automotive Lubricant Demand

According to Kline, demand for lubricants in the consumer automotive segment rang in just below 500,000 tons in 2021.

“The strongest growth in 2021 was in the consumer automotive segment,” Nalam said. “The consumer automotive segment’s growth was primarily driven by the two-wheeler segment; motorcycle oil demand has grown significantly, and that is what is driving the lubricant demand in the consumer automotive segment.”

Why such an increase in MCO demand, though?

“In 2021, the demand for MCO was strong, mainly because of people using personal mobility to commute and avoiding public transport,” Nalam explained. “Yes, definitely the vehicle parc has increased for two-wheelers and four-wheelers both, but in four-wheelers the lubricant demand has not yet recovered.” In fact, demand for passenger car motor oil still lagged behind pre-pandemic levels through 2021. However, trends in 2022 show that PCMO demand is currently growing significantly in the country.

The rest of demand in the consumer automotive segment was comprised of gear oils, greases and automatic transmission fluids.

How did demand in the segment differ by installation point?

“There has been an ongoing shift away from garages toward more organized channels of vehicle servicing,” Nalam said. However, garages still accounted for more than half of the consumer automotive lubricant consumption in India in 2021. The next highest consumption in the segment came from vehicle dealerships.

As is the case in countless other countries around the globe, demand for lower-viscosity oils increased in India last year, with 0W and 5W grades accounting for about 40% of the total PCMO demand. Similarly, 10W grades made up around 40% of MCO demand in 2021.

Demand also varied considerably based on API service category. “When it comes to the two-wheeler segment, API SL is still the predominate category for MCO demand,” Nalam said. As for the passenger car segment, over 30% of demand in the country was for oils meeting API SM and SN standards.

Commercial Automotive Lubricant Demand

Demand for lubricants encompassed by the commercial automotive segment was just over 800,000 tons in 2021, but demand in the commercial automotive segment in India was still trailing behind 2019 levels last year.

However, not every subcategory in the segment experienced the same lag. “Interestingly, there are two components to this commercial automotive segment,” Nalam said. “One is on-highway and one is off-highway. The off-highway segment has recovered to 2019 levels, but the on-highway segment has yet to recover.” The on-highway segment includes three-wheelers, buses and trucks.

Lubricants used in off-highway applications accounted for the bulk of the segment’s demand at about 450,000 tons.

Lubricant Demand in India, 2021

Why has the off-highway segment shown improvement while the on-highway segment hasn’t? “A part of the reason the on-highway segment hasn’t recovered is the low mileage traveled by trucks and also the fact that oil drain intervals are gradually widening,” Nalam said. The slight shift away from public transportation could also be a contributing factor in the decline of on-highway demand.

According to Kline, heavy-duty engine oils made up the largest portion of demand in the commercial automotive segment last year, followed by hydraulic and transmission fluids, gear oils and greases.

The most sought-after viscosity grade for HDEO was 15W-40, which accounted for more than half the demand for HDEO in 2021.

“The demand share for monogrades has been declining significantly,” Nalam said. “But having said that, we are unlikely to see that monogrades demand would vanish completely over the next few years in the HDEO market.”

Conversely, demand for 10W oils “has started gaining pace in the HDEO segment, but some of the Indian OEMs in the truck and bus segment haven’t recommended 10W grades” yet, Nalam said.

Industrial Lubricant Demand

The industrial segment is nearly even with pre-pandemic levels, with a slight growth in demand in 2021. This is quite the achievement because demand in the segment had contracted by almost 10% in 2020.

Demand for industrial lubricants in India last year rang in at about 1.6 million tons. More than half of that volume was made up of process oils, followed by hydraulic fluids, metalworking fluids, industrial engine oils, greases and other general industrial oils.

However, industrial lubricant demand in the manufacturing sector still has not recovered to pre-pandemic levels, and demand for industrial engine oils is actually declining.

For instance, metalworking fluid demand did not recover to pre-pandemic levels in 2021. “A large share of metalworking fluid is used in the [automotive manufacturing] sector, which has not completely recovered” from the pandemic, Nalam said.

Meanwhile, demand for industrial engine oils is gradually decreasing. However, unlike railway lubricants, “not all the segments in industrial engine oils are contracting,” Nalam said. “Industrial oils would include marine oils, which are definitely going up. It also includes aviation lubricants, which are also growing slightly.”

Which industries have the greatest demand for industrial lubricants? According to Kline, the power generation industry, the chemicals manufacturing industry, and the automotive manufacturing and general engineering industry comprised 75% of demand in the segment in 2021.

Which Suppliers Are on the Top of the Heap?

It is reasonable to believe that some lubricant suppliers active in the Indian market would have fared the pandemic better than others. To a certain extent that may be true, but Kline’s study indicated that the top dogs of the Indian lubricants market more or less stayed the same from 2019 through 2021.

“We didn’t see any major lubricant suppliers gaining or losing market share tremendously,” Nalam said. “However, lubricant suppliers lost some of their market volume in 2020. In fact, all the lubricant suppliers lost market volumes in 2020, but some saw larger losses while others saw minimal losses. While some lubricant suppliers’ shares have grown in 2021, we did not see that major lubricant suppliers’ rankings have grossly changed.”

Which lubricant suppliers had the most market share in India in 2021?

According to Kline, nationalized oil companies possessed the biggest piece of the pie last year. Leading the pack was Hindustan Petroleum Corp., followed by Indian Oil Corp., Apar, Bharat Petroleum Corp., BP, Raj Petro, Shell, Savita Oil, Columbia, Gulf Oil and Valvoline.

Future Growth

While the pandemic and other factors significantly stunted India’s economy, the current recovery observed in the country bids well for the lubricants industry. In fact, Kline projects that India will continue to be one of the world’s fastest growing economies in the coming years and that lubricant demand in the country will grow at a compound annual growth rate of 2% through 2026.

“The strongest growth in demand would be from the consumer automotive segment, followed by the commercial automotive segment and the industrial segment,” Nalam said. “The industrial segment still has a high potential for growth, but with greater maintenance practices and with oil analysis and filtration, the growth would be somewhat subdued. To some extent, this applies to the commercial automotive segment, but the growth is still projected between 2%-3%.”

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com