The United Kingdom formally left the European Union in January 2020. A year later, new border controls were introduced affecting goods coming in and out of the country. Since January 2022, full customs form declaration has been required for all non-controlled goods at the point of import. So two years in, Brexit is having an effect on the U.K. lubricants industry and those who are involved in importing and exporting additives, base stocks and finished lubes.

Brexit Background

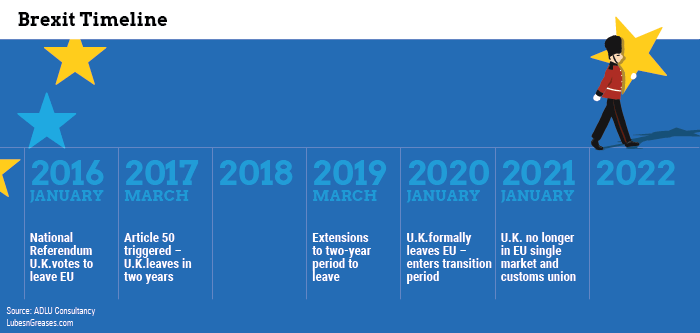

In 2016, the European Union was a group of 28 countries that traded freely with one another and allowed people to easily move between the countries to live and work. In June 2016, the U.K. held a national referendum in which British citizens voted to leave the EU. The date for British Exit, which became known popularly as Brexit, was set for March 29, 2019. But the move was delayed until January 31, 2020, when the U.K. ended 47 years as a member of the EU. A “transition period” lasted until December 31, 2020, when the U.K. left the EU single market and customs union and followed a Trade and Cooperation Agreement. After this period of uncertainty, companies are adjusting to the new environment.

Effects on Product Import and Export

For lubricant and related industries, the key changes are related to the import and export of goods and the associated regulations.

The exporting of goods from the U.K. to the EU involve new customs procedures, including U.K. export declarations and import requirements on entry to EU Member States. The importing of goods to the U.K. from the EU involve border controls that were phased in, with full customs checks in place since January 2022.

Goods must meet the Rules of Origin requirements to be free of tariffs and quotas. The rules relate to the amount of U.K. or EU content in a particular product and the amount of processing undertaken in the U.K. or the EU before export. They determine whether goods qualify as originating in the U.K. or the EU and therefore qualify for zero tariffs and quotas. Goods not sufficiently produced or processed in the U.K. or the EU cannot be re-exported tariff free under preferential tariff rates. The value-added tax and excise rules that apply to goods coming into or leaving the U.K. and the EU or non-EU countries are now the same.

A customs and regulatory border between Northern Ireland and Great Britain has been created. Some goods entering Northern Ireland from Great Britain are subject to additional checks and tariffs.

Regulations

The U.K. has autonomy over the technical regulations and standards for products sold into its market. To sell into the U.K., materials need to meet U.K. regulatory requirements; selling into the EU market requires EU regulatory requirements to be met. For the lubricants industry, this is particularly important for the requirements known as REACH (Registration, Evaluation, Authorization and Restriction of Chemicals).

REACH registration is legally mandated for any chemical substance entering the EU even if it is subsequently re-exported and is managed by the European Chemicals Agency (ECHA). Because of Brexit, the U.K. established its own version of REACH that started on Jan. 1, 2021.

U.K. REACH and EU REACH regulations operate independently from each other. Companies that are supplying and purchasing substances or mixtures going to and from the EU and Northern Ireland and Great Britain need to ensure that the relevant duties are met under both pieces of legislation. Under the Northern Ireland Protocol, EU REACH regulations continue to apply to Northern Ireland, while U.K. REACH provides the regulatory framework for chemicals in Great Britain.

Products already registered in EU REACH are still covered by U.K. REACH if pre-registered. But new products need to have EU and U.K. REACH registration if moving between the two places.

The EU Classification for Labelling and Packaging continues to apply in the U.K.

U.K. Business Environment

A U.K. Parliamentary committee recently reported that increased costs, delays and paperwork were making it more difficult for U.K. businesses to trade, and while it was complicated to disentangle the impact of COVID and global economic problems, the committee found that Brexit had reduced U.K. trade with the EU.

|

“Brexit has helped the U.K. to go it alone on matters such as vaccination procurement, which has helped it as one of the first countries to exit lockdown measures.”

– David Wright, UKLA |

David Wright, director general of the U.K. Lubricants Association told Lubes’n’Greases: “The U.K. is benefitting from its strong vaccination program with the Organisation for Economic Co-operation and Development upgrading GDP growth this year to 6.9% from 6.7% in September 2021. Energy prices are a cause for concern, as they will push up producer prices. Brexit has helped the U.K. to go it alone on matters such as vaccination procurement, which has helped it as one of the first countries to exit lockdown measures.”

Brexit Impact on Lubricant Business

Lubes’n’Greases contacted several companies to gain further insight into their experiences in the lubricants sector.

U.K.-based Millers Oils is a blender of automotive and industrial lubes with most sales in the U.K. and a significant export market. “It is very difficult to dissociate the impacts of COVID and Brexit,” Andy Ogley, technical manager for Millers Oils, told Lubes’n’Greases. “There have been several wider issues around additive and base oil supply and demand, raw material shortages and price increases. For Brexit, we planned ahead for longer lead times on imported raw materials, bought more raw materials and increased our U.K. storage, which was primarily a one-off cost.”

There have been some difficulties. “Continental haulers are reluctant to travel back from U.K. with empty trucks,” the company said, “tariff codes are closely scrutinized for some countries and exports to Ireland require additional paperwork.” Overall, the company has embraced Brexit and taken a flexible, adaptable approach to the challenges.

At Ashdowne, a U.K.-based additive and chemical distributor, Brexit is viewed as having no positive aspects. “Administration has increased and imported products are taking longer to arrive in U.K. due to the increasing amount of customs paperwork,” Tony Ball, director of Ashdowne, said. “Some change in duties and more administration have increased costs, which have been passed on to customers by necessity.”

|

“Administration has increased and imported products are taking longer to arrive in U.K. due to the increasing amount of customs paperwork.”

– Tony Ball, Ashdowne |

Ball added: “Export to Ireland is now significantly more difficult relative to distributors based in EU who are in the customs union and deal in the Euro. We have lost some volume due to Brexit, however continue to adapt to the new business environment.”

One oil marketer and distributor with headquarters in the U.K. told Lubes’n’Greases that it had not been too badly affected by Brexit because most of their market is in the EU and beyond. “Most product storage is in the EU and establishment of an EU legal company entity has simplified administration,” the company said. “Bringing materials into U.K. can be more difficult now with new border regulations and customs forms and tariffs.”

Multisol UK distributes additives, base oils and chemicals in the U.K. “Brexit has brought some challenges to our U.K. business from both an import and export perspective,” Simon Brander, Multisol’s commercial director, said. “We have seen some increased lead times, additional administration burdens and higher costs.” He added that “having U.K. manufacturing and storage capabilities, experienced logistics resources and good pre-planning has enabled us to mitigate ‘security of supply’ concerns for U.K. customers and maintain supply to the U.K. market. It has been a very difficult period, which was exacerbated by COVID and the global supply chain problems.”

Brander added that “moving product from the U.K. into the EU is now more complex, given the new registrations and processes required of the importer, so we have had to find new ways to maintain and develop new business when supplying from the U.K. into the EU.”

One EU-based manufacturer of additives for industrial lubricants told Lubes’n’Greases: “There has been lots of additional administration work, for instance pre-registering trucks before they go onto the ferry, and additional paperwork, which is adding cost. Sales to U.K. contribute less than 10% to our business; however, they have shrunk since Brexit. The additional costs have been added to U.K. prices. If U.K. REACH adds further to the cost base, we may stop all business to U.K.”

Although global additive supplier Infineum has its headquarters in the U.K., the nation is a relatively small market for the company, and its customers and distributors were well prepared. “We had some concerns about recruitment and retention of EU colleagues for our business and technical center; however, it does not appear to have had a significant effect,” Kiko Franchini, executive customer centricity manager, said.

Impact of New U.K. REACH Requirements

The transition from EU REACH to U.K. REACH had a pre-registration period and now allows the full registration to be completed over the next two to six years, depending on product volumes. But there is a level of duplication, as costs will be incurred to register materials independently in the EU and U.K.

“On U.K. REACH, the government has agreed to look again at the requirements to resubmit full data dossiers,” Wright said. “It will consult in 2Q’22 on adopting a risk-based approach, which means it may not be asking for every single test result for every single substance registered. This is positive news, especially as the U.K. market is about 15% of that of Europe, and the costs to register a substance with the U.K. regulator was the same as for the EU.”

Post-Brexit Business Environment

In the post-Brexit world, the business environment has clearly changed for the lubricants industry in the U.K. While the COVID pandemic and other global industry issues have affected business, the impacts of Brexit have been:

- Increased administration and storage costs.

- Delays and longer lead times for importing materials and products into the U.K.

- More onerous customs paperwork to import and export to and from the U.K. and the EU.

Brexit costs are ultimately passed on to customers and end-users but have been only a part of several recent price increases caused by supply-demand imbalance, material shortages and rising crude and petroleum product costs.

The U.K. remains one of the largest lubricant markets in Europe, and the businesses involved are adapting to the new environment. Additional storage in the U.K. helps mitigate against longer lead times and border delays, maintaining supply security. New approaches to exports to the EU are being tried and companies are also looking to export to non-EU countries where there are no major changes to pre-Brexit practices.

U.K. REACH raises concerns for many businesses both inside and outside the U.K. because it will effectively duplicate the cost and effort already needed for EU REACH. UKLA is working to reduce the burden going forward, which would be good news for smaller companies with fewer resources.

Life after Brexit is not “business as usual” for the lubricant sector. Instead, it is about business continuity and adapting to the new business environment with its various challenges.

Philip Reeve is a chemist with 40 years of experience in the global lubricants and additives industry. He’s held positions at Afton, Infineum and ExxonMobil and is now a director of ADLU Consultancy. Contact him at philipreeve@adlu-consultancy.com.