Need to Know

The passenger car motor oil business in the United States has seen considerable change over the past two decades. Among the changes are continuing demand erosion due to longer drain intervals, less top-off oil and electrification; shifts to lower-viscosity grades; a move up the quality continuum from conventional and synthetic blends to full synthetic, reductions in phosphorus levels and a rebalancing of calcium and magnesium in additive formulations. In addition, specifications have advanced and splintered, and new and innovative packaging has made significant inroads in the market.

These changes have and continue to reshape the PCMO business, but another area of very meaningful change is seen in the migration of sales from do-it-yourself to do-it-for-me. Although car enthusiasts, hobbyists and others still find satisfaction in changing oil, their numbers are dwindling due to the compelling convenience and economics of getting oil changed by a fast lube, new car dealer or other installer. Changing oil has become increasingly difficult due to the complexity and compact nature of modern engine compartments. Further, disposing of the used oil can be a hassle.

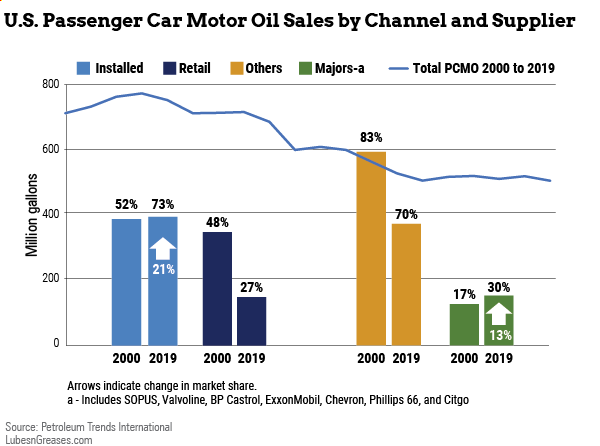

For these and other reasons, oil change service providers have experienced robust growth. In just under 20 years, demand for PCMO in this sector reached just over 70% of the total in the U.S., up from 52% in 2000. In addition to this shift, there are also undercurrents of change taking place within the DIFM segment. While new car dealers accounted for an estimated 13% of PCMO demand in 2000, they now account for close to 25%–just a few percentage points lower than demand in fast lubes.

Assuming the growth trajectories are maintained, market share by installers is on track to reach close to 85% of the total in 2027. While fast lubes currently have an edge in the tug of war for business and have demonstrated tremendous resourcefulness in diversifying their offerings, new car dealers continue to pull oil change volume from fast lubes by way of aggressive marketing and promotions that draw customers in with discounted oil change prices and assurances that original equipment manufacturer parts and services will be used and backed should there be any warranty claims. With that, PCMO demand by new car dealers could push past fast lubes over the next five years.

Another significant shift that continues to challenge PCMO marketers is the move from major brands to genuine oil, private label and the brands of independent lubricant manufacturers. In 2000, majors served up 83% of the PCMO sold in the U.S. but today account for roughly 70%. Private label and independent brands have moved up to 30% from 17% over the period. This change in market share is a function of several factors, including the price delta between major brands and others, ability of private label PCMOs to meet specifications and standards, distributors’ interest in maintaining control over brands and improving margins and competitiveness, desire for OEMs to sell their own brands, the shift from DIY to DIFM, and online reviews and blogs, among others.

Although the major brands continue to enjoy strong brand equity and command the lion’s share of the PCMO market, the shift to private label continues unabated. And even within private label there are undercurrents of change, particularly at new car dealers. To take full advantage of OEM genuine part program incentives, a growing number of new car dealers are pushing back on the use of anything other than genuine oil.

While the shift to DIFM and private label are certainly important trends reshaping the PCMO business, it is important to consider that these trends are taking place in a declining market. While PCMO demand in the U.S. reached nearly 750 million gallons in 2000, it was just under 550 million gallons in 2019. To illustrate the impact of declining demand, consider that while DIFM has grown considerably in terms of market share, the change in DIFM volume from 2000 to 2019 represents a net gain of roughly 10 million gallons for the sector. And when the shift from DIY to DIFM is taken together with the organic decline in demand volume, DIY has seen net loss of close to 200 million gallons in the 20-year period.

While the rate and pattern of the shifts in the PCMO market and the decline in volume may not bode well for some, they represent opportunities for others, particularly for companies with a low-cost position and the ability to provide exceptional customer value. They may also explain why some marketers are realigning their strategies to focus on more stable and sustainable business in the industrial and heavy-duty sectors and enhancing their value to customers by expanding service offerings into such areas as equipment fueling, cleaning, training and consulting.

These and other activities are consistent with strategies proven to be successful in markets where demand is decaying. Such strategies encourage others to examine the future of their businesses and either step up or step out of the increasingly competitive PCMO business.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com