Protecting the internal components of heavy-duty engines is about more than efficiency. High-quality engine oil is the lifeblood of the machine and will determine how an operator’s time and resources are spent.

Given its importance, there is a consistent industry drive to advance heavy-duty engine oils to meet the needs of evolving engine hardware. Such developments reflect the increased demands placed on hard-working fleets and the thinning margins involved in running them efficiently.

Add into the mix environmental concerns and resulting legislation, and it’s clear that the evolution of heavy-duty engine oil has a number of influencing factors. The market is also highly competitive, with original equipment manufacturers, lubricant manufacturers and fleet owners all playing their part in driving it forward.

The arrival of the API FA-4 heavy-duty engine oil specification in 2016 shook up the industry. This article looks at how and why FA-4 has made its mark and then assesses the direction of the marketplace and pending advancement in lubricant technology, including work on PC-12, the next proposed heavy-duty engine oil category.

Emissions Standards Drive Technology

In recent decades, emissions standards and regulations have focused OEM efforts on improving engine efficiency and fuel economy, which in turn help reduce greenhouse gas emissions and particulate levels.

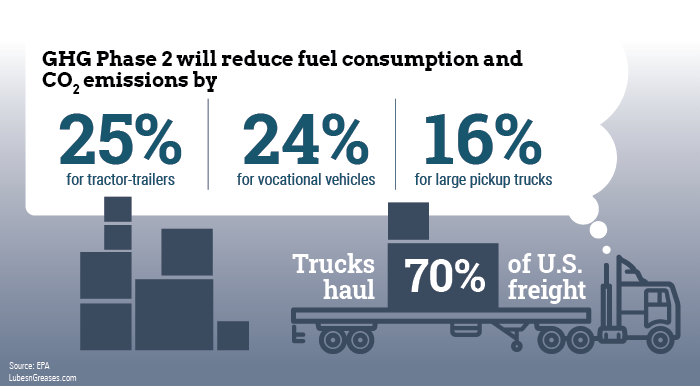

For example, the second phase of the U.S. Environmental Protection Agency and the National Highway Traffic Safety Administration’s joint Greenhouse Gas Emissions and Fuel Efficiency Standards for Medium- and Heavy-duty Engines and Vehicles becomes effective starting with model year 2021 vehicles, phasing in through 2027. Each phase requires larger gains in fuel economy and greater emissions reductions.

By 2027, the EPA says this initiative will lower fuel consumption and CO2 emissions by 25% for tractor-trailers, 24% for vocational vehicles such as buses and construction vehicles, and 16% for large pickup trucks and vans over the lifetime of the vehicles.

The next set of EPA regulations, called the Cleaner Trucks Initiative, focuses on reducing nitrous oxide emissions. An Advance Notice of Proposed Rule was issued on Jan. 6, 2020. The pandemic has delayed the next step, the Notice of Proposed Rulemaking, which is expected this quarter.

In the ANPR, the EPA said it was considering adding a laboratory test cycle to evaluate emissions control in low-speed or low-load operation, which is not evaluated in current test cycles. It also proposes longer mileage requirements for useful life standards and emissions warranty. The proposals are similar to work being done by the California Air Resources Board.

The changes in engine architecture pushed forward by these regulations mean that modern engines require lubricants that are more durable to help prevent wear, primarily due to the higher operating temperatures. Extreme temperatures stress conventional lubricants, limiting performance and swelling costs due to increased downtime and additional oil changes. Relatively new engine operations, such as stop-start technology, can also mean additional burdens for an engine oil.

To tackle the challenges posed by new engine technology and a focus on engine efficiency, recent oil standards have offered more resistance to oxidation, as well as improved aeration control and shear stability. These changes forged the path to API CK-4 and FA-4.

Introduced in December 2016, API CK-4 and FA-4 are the culmination of one of the biggest specification overhauls in history for heavy-duty diesel engine oils. Following five years of work after the Engine Manufacturers Association’s official request, the new category delivered engine oils compatible with modern engine technology that can deliver better fuel economy and significantly reduce carbon emissions.

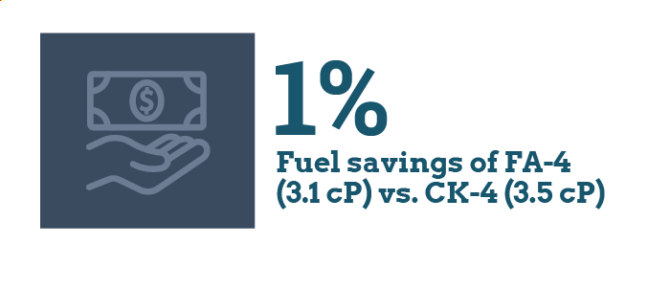

Formulated for the newest engines—model years 2017 and later—API FA-4 engine oils are designed with a high-temperature, high-shear viscosity between 2.9 and 3.2 centipoise, compared to 3.5 cP or higher for their API CK-4 counterparts. With typical kinematic viscosity of SAE 10W-30, engine protection and durability is maintained with API FA-4 engine oils while improving fuel consumption and lowering exhaust emissions.

It’s accepted that lubricants meeting modern standards provide contemporary engine technology with enhanced protection and improved fuel economy, as well as the potential to safely extend oil drain intervals. This not only ensures that equipment can be operational for longer between oil drains but also reduces scheduled maintenance costs, resulting in a direct and positive impact on the company’s bottom line.

In fact, according to industry research, API FA-4 engine oils provide additional fuel savings over CK-4 oils of the same grade: up to 1% when comparing an SAE XW-30 with 3.5 cP HTHS viscosity to an XW-30 with 3.1 cP HTHS. Most importantly, the benefits to operators are complemented by the benefits to the environment.

Slow but Steady

The passenger car industry tends to set the pace of change with the heavy-duty market following hot on its tail. The move toward hyper-efficient engines—with no cost to performance—has made lower-viscosity oils commonplace in the light-duty market. The combination of legislation and emissions standards alongside the demand for greater fuel efficiency to enhance the fleet’s bottom line is currently directing the heavy-duty market down a very similar path.

However, acceptance of API FA-4 has been slow. Industry trend data has shown multi-grade oils will continue to dominate the heavy-duty segment, representing over 95% of the commercial market’s demand. SAE 15W-40 will continue to be the most widely used grade, but its share has started to decline. SAE 10W-30 is now the fastest growing viscosity grade, having more than tripled in demand since 2010.

From the data, it’s clear that SAE 10W-30 API FA-4 oils will be slowly accepted, with demand steadily increasing as we enter into the next decade. This is due to three main reasons.

First, the pace of change over the past 30 years has resulted in a superior quality of oil in the field, the performance of which is still being heralded and benefitted from.

Second, API FA-4 was developed specifically for engines made from 2017 onward, meaning not every truck in the fleet would have an OEM recommendation for an API FA-4 oil. If we consider that a truck may be used as part of the core fleet for about five years, building a customer base among fleet owners will therefore take time. Added to this, API FA-4 oils are not specified for use in all heavy-duty vehicles. Traditionally, both fleets and workshops are hesitant to stock two engine oils due to the risk of contamination or misapplication.

And finally, conversion to a new fluid is a process that requires time, as seen with the adoption of SAE 10W-30 oils. It took nearly 15 years for most OEMs to start factory filling with the thinner oil. Navistar stepped out in 1998 and Volvo followed a decade later, but it was not standard practice until 2013.

Although these challenges are currently slowing the adoption of API FA-4 engine oils, their use is expected to gain pace over the coming decade as new trucks enter the market and older vehicles are gradually phased out. Detroit Diesel, which holds about a third of the North American market, was the first to use FA-4 as factory fill beginning with its 2017 model years and even approved the oils for use in some of its 2010 engines. More OEMs will likely begin using it as factory fill, and as it becomes more common, this will also help to address workshop concerns around having to stock two different engine oils.

As older trucks are phased out, and as more OEMs test the waters with API FA-4 oils in the field and have data to back up performance claims, use of FA-4 oils will increase.

The real-world tests of an API FA-4 lubricant should demonstrate two things. First, the drive to improve the technical performance of heavy-duty engine oils is benefiting the bottom line of industry players as well as satisfying emissions standards and environmental expectations. Second, lower-viscosity oils are not being pursued at any expense, but indeed, the focus on viscosity brings with it myriad benefits, including increased fuel economy and extreme temperature reliability.

The Path Ahead

Depite the fact that API CK-4 and FA-4 came into effect less than five years ago, PC-12 is already on the horizon. Although there has been no official announcement to date, the EMA held a meeting in December indicating its intention to submit a written request to the American Petroleum Institute to begin the development process.

There is a long way to go, but what do we know, and what does this starting point tell us?

PC-12 will be developed based on what is expected in Phase 3 of the EPA and NHTSA joint greenhouse gas emissions standards. This next phase will provide justification for the development of a new engine oil category timetabled for around 2027.

While announcements have yet to be made, it is safe to say that we can expect inclusion of even lower viscosity grades such as SAE 5W-30 as we continue the trend toward lower viscosity. We can also expect a review of all current engine tests for life expectancy and redundancy. All of this will be taken into consideration while continuing to improve performance characteristics of the engine oil.

The heavy-duty engine oil industry has been in a period of transition for several years, moving toward lower-viscosity lubricants and keeping up with technological advancement of engine architecture. The roadmap to lower-viscosity engine oils and further improvements is marked out, and although it may seem distant, it will be here sooner than we all think.

Darryl Purificati is OEM technical liaison with Petro-Canada Lubricants, a HollyFrontier brand. Contact him at Darryl.Purificati@hollyfrontier.com.