Unparalleled

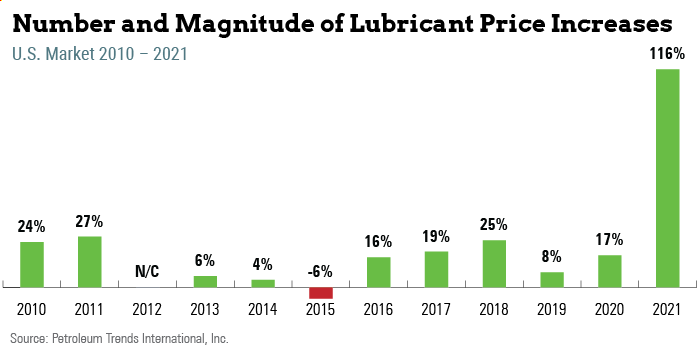

While lubricant prices have experienced ups and some downs over the years, the events of 2021 have made this year one for the record books. With two months left on the calendar, lubricant prices have increased six times —seven when the most recent increase for synthetic lubricants is included. This contrasts sharply with an average of two annual price increases from 2010 to 2020. Prior decades were similar for annual price adjustments.

The magnitude of the 2021 adjustments has also been remarkable. Where price increase announcements have ranged from 6%-8% over the past 10 years—and a few percentage points lower in prior decades—the six increases announced this year averaged 14%. When taken together, the increases moved the price of lubricants up by nearly 116%, and the seventh increase pushed the price of synthetics up by about 140%. The next highest annual increase came in 2011 when lubricant prices escalated by 27%.

What caused the unprecedented number and magnitude of price increases in 2021, and will the increases hold?

The pandemic’s impact on business in 2020 was by far the most significant factor responsible for lighting the fuse on the lubricant price rocket that took off in 2021.

The most pronounced impact the pandemic had on the lubricants business was a precipitous drop in demand caused by lockdowns. By mid-2020, demand in some product segments was down by nearly 30%, and competition for business was intense. Because of this, many lubricant manufacturers and marketers had to pull back the price increases they announced at the beginning of the year and absorb the higher base oil prices ushered in at the beginning of the year.

Refinery production (including base oils) was significantly reduced in 2020, as oil companies adjusted capacity utilization in response to the historic declines in global demand for fuel. Likewise, lubricant additive manufacturers also dialed back production to adjust to lower demand.

With that, we entered 2021 with lubricant manufacturers and blenders struggling with compressed margins and disappointing sales, very tight supply of base oil and additives, logistical nightmares in supply chains, higher operating costs, and a high level of uncertainty about what the future would bring as the economy recovered from COVID. Then a record-setting winter storm hit the U.S. Gulf Coast region in February, further disrupting supply of base oil and additives and adding more damaging waves to the perfect storm of supply and demand imbalance and supply chain interruptions.

This was not a good position for the industry to be in as business returned to normal and constraints on pent-up demand for lubricants and fuel eased. As lubricant and fuel demand ramped up in 2021, crude oil and VGO prices increased accordingly, and base oil and additive supply struggled to catch up to demand. The higher prices for VGO and the supply-demand imbalances resulted in a barrage of price increases for base oil and three increases for additives from December 2020 to October 2021. In addition, the gap between supply and demand gave rise to a shortfall in PCMO, HDEO and driveline additives. This resulted in deep allocations placed on those lubricants.

Each of the seven lubricant price increases in 2021 are the direct result of short supply and the higher cost of raw material and other inputs.

The price of Group II base oil increased by nearly $2 per gallon, and Group III by just over $3.10 since January. While blenders typically see one additive increase a year at about 6%, there have been three since December 2020. When taken together, they moved the price of additives up by nearly 20%. Adding to these price burdens, the cost of resins used to produce bottles, pails, caps and other containers, steel for drums, corrugated pallets, and other packaging materials increased by 15%-20% in 2021. Transportation costs also jumped by 30%-35% from pre-pandemic levels, and labor costs escalated. Further, the costs of getting urgent loads for inbound raw materials or outbound shipments to customers increased in 2021 because of severe supply chain shortages.

So the reasons for the remarkable number and magnitude of lubricant price increases in 2021 are tied to continually rising costs born from the pandemic. Based on what marketers are saying, customers understand the pricing dynamic and supply shortfall. Although the number of lubricant price increases in 2021 is unsettling, customers are aware that the entire industry is under enormous pressure. Meanwhile, lubricant demand has bounced back and in some cases is doing better than expected as customers look to build lubricant inventory as much as possible before prices increase further.

But will the increases hold?

At least for the short term, many in the industry believe they will. This is because supply of additives, particularly PCMO and gear oils remain tight and are expected to remain that way into the first quarter of 2022. Further, most anticipate that the supply of 4-centistoke Group III will remain tight into the first quarter of 2022, and although loosening a bit, supply of bright stock will continue to be tight. As a result, demand will continue to outpace supply. In addition, most people I speak with believe that we are in a severely inflated market and that transportation, labor, insurance and other costs will continue to rise.

But if there is anything we learned over the past two years, it’s to expect the unexpected.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com