Awareness of the advantages of low-viscosity heavy-duty engine oils can help to narrow the gap between what fleet owners and operators want and what original equipment manufacturers are currently specifying.

In 2016, the American Petroleum Institute provided its latest guidance on heavy-duty engine oils with the introduction of the CK-4 and FA-4 performance categories. The new lubricants were designed to meet the changing hardware needs of original equipment manufacturers and to deliver fuel economy gains that could help to lower the overall cost to operate fleets throughout North America. The category offered backward compatibility through CK-4, which led to a smooth transition to the new performance category.

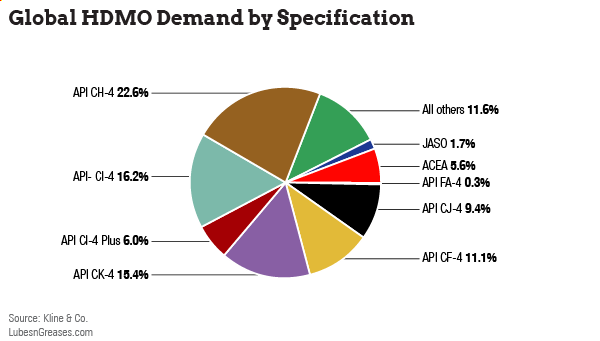

But when it came to the adoption of FA-4 oils, the road was not so smooth. According to data collected by Kline & Co.’s LubesNet database, oils certified under API FA-4 still cover only about 1% of the market in North America, despite having the proven ability to achieve up to 2% greater fuel economy when compared to the more traditional 15W-40 lubricants.

Initially, fleet owners and operators did not adopt FA-4 oils because their fleets were made up of older trucks that were not compatible with the latest lubricant technology. Similarly, OEMs were hesitant about using the new technology: Some had durability concerns. Meanwhile, others determined that CK-4 oils would meet their needs to achieve greenhouse gas emissions targets.

As older vehicles started to come off the road, more fleet operators and owners began investigating the long-term advantages to using lower-viscosity oils in their vehicles to improve fuel economy and overall maintenance costs.

The challenge before the industry today is how to bridge the disconnect between what OEMs are filling trucks with at the factory level and the viscosity grades fleet owners and operators are using on the road. Because of this, further education on the advantages of low-viscosity heavy-duty oils is essential. This article will examine why the gap exists and what may eventually cause OEMs as well as fleet owners and operators to align around the use of FA-4 oils in their heavy-duty vehicles.

Overcoming the Natural Reluctance

Historically, the North American commercial vehicle market has been slow to adopt changes in oil viscosity. The transition from monograde 40W to multigrade 15W-40 is a clear example, despite the many end-user advantages of a multigrade oil.

We are now seeing history repeat itself with the slow adoption of FA-4 oils in the market. Why has the market been dragging its feet? The slow adoption has been fueled by fleet owners’ and operators’ confusion regarding the value that can be attained from FA-4 oils. This value, which includes substantial fuel economy gains of up to 2%, is offset by the varied levels of support of FA-4 adoption by OEMs.

OEMs that have introduced FA-4 as their factory fill fluid have managed to deliver value to their customers. This is value that OEMs that have not introduced FA-4 could realize with their customer base.

Rising Costs May Spur Adoption

Fuel, labor, overhead and other costs are rising as the world begins to return to normal after the COVID-19 pandemic caused market conditions to fluctuate dramatically. Each of those factors is putting pressure on fleet owners and operators to seek efficiencies and cost reductions in other areas of the business. Shifting to lower-viscosity oils can help them to pursue those goals.

Adopting FA-4 engine oils at the factory fill level can provide competitive advantages for OEMs. © Lubrizol

A joint report from the North American Council for Freight Efficiency and Carbon War Room revealed just how much money fleet owners and operators can save: “Class 8 over-the-road fleets can realistically expect fuel savings in the range of 0.5% to 1.5% by switching from 15W-40 to 5W/10W-30 CK-4 engine oil.”

Shifting to FA-4- lubricants where applicable can bring even further benefits. “The savings from switching to the fuel-efficient FA-4 variant can be expected to add a further 0.4% to 0.7% of increased fuel efficiency,” the report stated.

Once wider FA-4 adoption takes hold, fleets will start to see the positive impacts of FA-4 with improved fuel economy, cleaner engines and easier starting. This will then translate into other benefits for fleets and OEMs alike. Furthermore, if OEMs do not adapt to these changing market conditions, they may find themselves losing customers who are seeking the benefits of FA-4 oils.

A Meeting of the Minds

More heavy-duty trucks will become FA-4 eligible as older vehicles are necessarily phased out of the market during the coming years. This will put more fleet managers and operators in the position to streamline the lubricants they keep in their shop for routine maintenance. What’s more, those shop oils will increasingly be lower-viscosity products, like FA-4, and the advantages of lower-viscosity oils for fuel efficiency will become increasingly important as diesel prices remain elevated.

Though concerns remain about the long-term durability and wear protection of lower-viscosity oils, real-world evid ence is increasingly showing that those concerns may be unfounded. In fact, properly formulated FA-4 lubricants with the right additive packages will become more desirable, as they meet the same durability performance as CK-4 lubricants but are formulated to reduce emissions and improve fuel economy. For OEMs that recognize this trend early and make the move to recommend FA-4 solutions from the factory, the competitive advantage will be significant.

As the gap between what fleet owners and operators want and what OEMs are specifying narrows, the demand for low-viscosity lubricants, like FA-4, will increase. When that happens, the industry can move toward a brighter new future.

Greg Matheson is a commercial lubricants product manager for the Lubrizol Corporation. Since he was hired by Lubrizol in 2015, Matheson has worked as an OEM account manager, managing Lubrizol’s business with the heavy-duty truck and engine builder OEMs in North America. In his current role, he is responsible for a wide variety of API CK-4 and FA-4 additive products in North America and globally for Lubrizol. Before joining Lubrizol, he spent nearly 10 years in the trucking industry working for Travel Centers of America.