November Cooldown

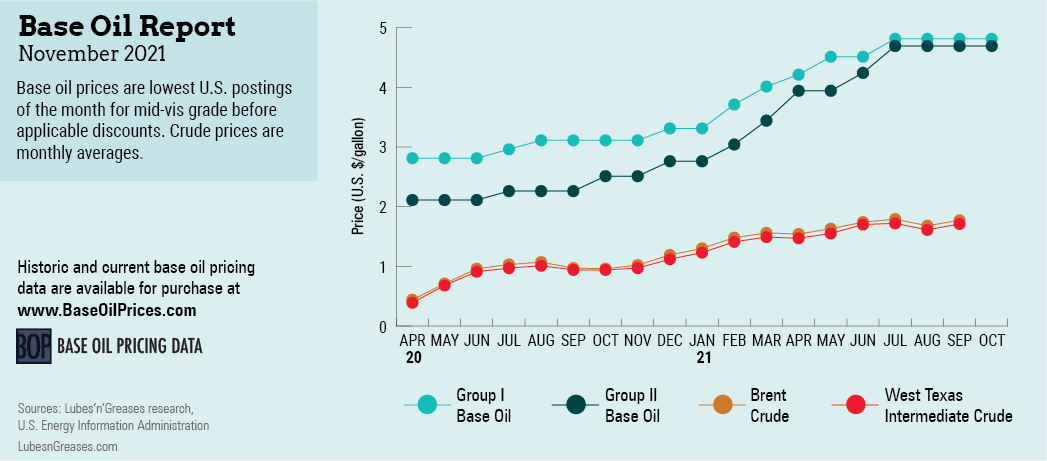

The naphthenic base oil segment in the United States was where most of the upward price action took place in September and October; postings on the paraffinic side were generally stable. Paraffinic spot values softened slightly on improved supply and weakening demand, but they stabilized in early October as crude oil prices jumped to multi-year highs.

Naphthenic producers Cross Oil, Calumet, Ergon and San Joaquin Refining communicated increases of 25 cents per gallon, which went into effect between September 21 and October 1. Suppliers explained that the markups had been necessary to offset increases in crude oil, natural gas and transportation.

Supply in the naphthenic segment had been strained since the last quarter of 2020, and this situation was compounded by unplanned outages and maintenance programs this year. Pale oil suppliers did not expect to achieve a balanced supply and demand position until early 2022.

Cross Oil completed a minor turnaround at its Smackover, Arkansas, naphthenic base oil plant that involved a catalyst change in September. This shutdown exacerbated the already snug supply situation. Despite the fact that a majority of the remaining naphthenic plants were running well in October, inventories were still fairly low as the market entered a busy turnaround period.

Ergon scheduled a planned 16-day maintenance event at its naphthenic refinery in Vicksburg, Mississippi, beginning October 23. No supply interruptions were expected for Ergon’s ratable customers, as product inventory levels were sufficient to support sales during the outage.

Calumet scheduled a one- to two-week turnaround at its Princeton, Louisiana, plant in early November.

Further ahead, San Joaquin Refining planned to start a three-week maintenance shutdown at its refinery in Bakersfield, California, on February

1, 2022.

Both the naphthenic and the paraffinic sectors were still dealing with the aftermath of Hurricane Ida in late August and Tropical Storm Nicholas in mid-September. While most base oil plants in the storms’ paths were spared and suffered minor damage, there were still logistical issues, like railcar rerouting and reduced terminal operations, that disrupted shipments in and out of several plants in Texas, Louisiana, Mississippi and other states.

Most paraffinic producers reported very little spot availability, although it appeared that supply of lighter grades was lengthening faster than for heavy-viscosity cuts. The API Group I heavy-viscosity grades and bright stock were still fairly tight, but an influx of products from Europe and the Baltic relieved some of the pressure.

Group II supplies were snug as well, but buyers did not appear as anxious about being able to acquire all the product they needed as they were earlier in the year. Producers worked on catching up on a backlog of orders, but conditions were more manageable.

The improved Group I and Group II supply levels resulted in downward adjustments of spot prices, which ranged from a few pennies to 20 cents per gallon, depending on the grade. Some of the extra availability of the light grades was earmarked to move to Mexico and India.

The Group III segment displayed strained conditions and spot prices remained firm. Even though increased volumes were being shipped to the U.S. from the Middle East and South Korea, there did not appear to be enough to cover all requirements. However, the situation seemed to improve as other regions saw swelling supplies.

Softer base oil consumption in Asia, coupled with increased output, translated into increased availability of export cargoes and downward pressure on spot pricing, although the speed and extent of the decreases slowed down compared to August when most base oil grades underwent significant drops.

The base oil cuts that experienced the largest decreases in Asian markets were those that had reached sky-high levels in the first half of the year when strained supply and healthy demand had catapulted prices to historic highs.

One of these grades was Group I bright stock, which continued to enjoy considerable buying interest but became more readily available as Group I plants returned to full production following turnarounds and reduced operating rates. The heavy grades within the Group I and Group II segments also saw pronounced downward price adjustments since late July for the same reasons. Demand for heavy-viscosity grades also weakens in the winter months as lubricant manufacturers switch to lighter formulations.

All in all, global base stock markets were leaning toward more balanced conditions as they entered November, but some pockets remained very tight while others showed a lengthening of supplies. A need to lower inventories before December 31 and more muted activity around the holidays traditionally prompt suppliers to make attractive offers, imparting a softening effect on base oil fundamentals.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com