Industrial lubricant giant Houghton International acquired metalworking fluids manufacturer Wallover Oil for an undisclosed amount, part of an aggressive strategy to double Houghtons size in five years.

The acquisition includes four manufacturing facilities and three distribution warehouses from Strongsville, Ohio-headquartered Wallover, an independent lubricants manufacturer that has operated since 1863.

Jeewat Bijlani, president of Houghton Americas and global strategic business, said that the acquisition expands the offering of metalworking fluids for a variety of applications. This includes Wallovers electrical discharge machining fluids and stainless steel cold rolling oils.

Wallovers customer base and product portfolio supplements Houghtons market presence, bringing strong incremental revenue and cross-selling opportunities between the two companies immediately in the United States and Canada, and in the future, in Europe, the Middle East, Africa and Asia, Bijlani explained.

Houghton International was acquired by Gulf Oil International, part of Indias Hinduja Group, from equity firm AEA Investors for $1 billion in 2012. Since then, Houghton has made numerous acquisitions and investments in the metalworking fluids and industrial lubricants segments.

In the last two years, Houghton has acquired Manchester, United Kingdom-based Braemar UK; Envirotek Management Services of Greenville, South Carolina; and Henkel AG & Co.s North American Steel Mill business, Bijlani mentioned. In March, Houghton also bought out its partner in the grease joint venture Houghton Japan, Kyodo Yushi.

Houghtons CEO, Mike Shannon, told local Philadelphia newspaper Philly.com that this most recent acquisition is part of Houghtons strategy to increase sales, from $855 million in 2015 to $1.7 billion by 2020.

George Morvey, industry manager for Parsippany, N.J.-based consultancy Kline & Co.s Energy Practice, said that Houghtons acquisition of Wallover Oil will solidify its position as the main supplier of metalworking fluids in the Americas, followed by Quaker Chemical and Fuchs Petrolub SE.

Demand for metalworking fluids in North America, most notably in the transportation equipment manufacturing industry, is quite strong as of late given the robust vehicle production and sales figures the industry has enjoyed, and expectations are these gains will continue in the near term, Morvey stated. This announcement proves that even in a low- to no-growth volumetric market like the United States, there are still plenty of opportunities for lubricant suppliers to grow their businesses and strengthen their positions with customers and end users.

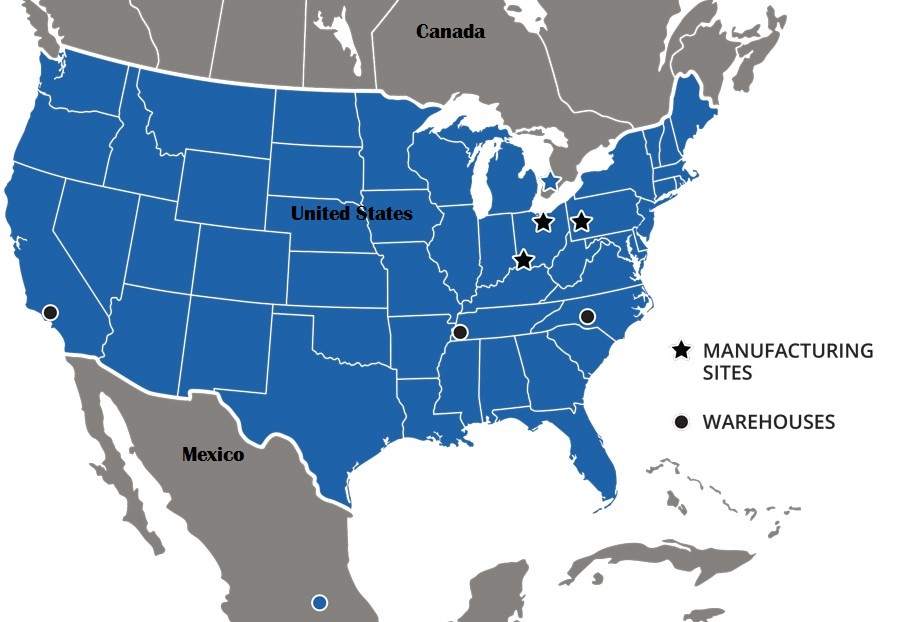

Wallovers manufacturing sites are in the Ohio cities of Strongsville, East Liverpool and Hamilton, and in Harrow, Ontario, Canada. The three distribution warehouses are in Los Angeles, Memphis, Tennessee and Charlotte, North Carolina.

Houghton International was founded in 1865 and manufactures specialty chemicals, oils and lubricants in addition to metalworking fluids, for applications in industries such as automotive, aerospace, mining, machinery and offshore, among others. Headquartered in Valley Forge, Pennsylvania, Houghton operates research and development sites and manufacturing facilities in 33 countries.

Image: Wallover Oil