The latest research results suggest that fleet operators are ignoring recommended oil change intervals and instead opting for more familiar or traditional servicing – a trend which is potentially impacting their bottom line.

According to data from industry consultants MacKay & Company, carriers and fleets, both on- and off-highway, may be un-necessarily replacing their engine oils – meaning more trips to the service bay and less time spent on the road.

“By more closely following the published intervals suggested by oil and engine manufacturers, operators may be able to realize significant cost savings,” says analyst Brian VanCamp.

“We’re seeing a pattern of disconnect between recommended and real-world feedback with regard to oil change intervals. In some cases, these are almost half of what conservative published figures are,” he says. “We believe the majority of fleet operators are doing this almost out of habit and that their related service spend could be greater than actually necessary.”

Since the early 2000s, changes to emission standards and fuel economy have driven rapid adoption of new engine designs which, in turn, have fueled requirements for more advanced lubricants, including oils.

Yet despite these newer technologies offering greater performance and efficiencies, real-world data collected by MacKay suggests that end-users appear to be sticking to old habits and potentially switching out their oils prematurely.

The Illinois-based market research firm publishes annual reports that focus on four key market segments: construction equipment, agriculture equipment, light duty trucks, and medium- and heavy-duty trucks. Unlike other consultancies, MacKay collects data directly from end users, fleet operators, and service companies to capture a direct representation of the aftermarket.

Its recently published DataMac Lube report surveyed thousands of medium-duty (Class 6 & 7) and heavy-duty (Class 8) fleets from both on- and off-highway vocations. One of the primary data points collected is the miles to replacement for primary fluids. Studying these figures highlighted the anomaly with oil change intervals.

Fleets are certainly becoming more conscious of ROI, cost of ownership, and cost per mile, says VanCamp. However, results collected by the report over the past five years have shown that the idea of extended oil drain intervals still hasn’t caught on.

“Regardless of the class or vocation, none of the fleet respondents seem to be changing interval mileage at a particularly fast pace,” he says. “On average, the medium-duty fleet miles between oil changes have increased by 7%, far outpacing the heavy-duty mileage change of only 1%.”

The common base line suggested by manufacturers for Class 8 diesel trucks is a 25,000-mile oil drain interval. For a long-haul fleet doing 100,000 miles a year, that’s already four times a year when the truck isn’t making money.

According to the Fleet Maintenance Oil Study sponsored by Shell in 2017, 83% of fleets surveyed were still operating in the 12,000-22,000 mile range.

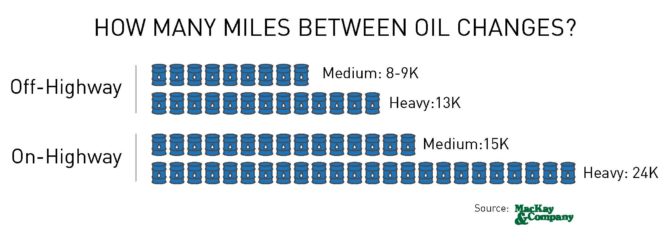

Based on the latest round of survey results collected by MacKay & Company, on-highway fleets send their medium-duty units for an oil change every 15,000 miles and heavy-duty at just above 24,000. Off-highway fleets visit the shop in the 8,000-9,000 mile range, with their heavy-duty equivalents going in every 13,000 miles.

“The age of the vehicle and engine technology play major roles in the options for approved oil types. We anticipate the intervals to become longer as older vehicles are retired and replaced,” adds VanCamp. “However, fleets do not necessarily have to rely on new technology for extended drain intervals if they take advantage of oil analysis programs currently offered by lubricant suppliers or engine manufacturers.”

“Realistically, the new industry standard could be saving them money,” he adds. “The bigger the fleet size, the bigger the potential savings. That said, small and medium sized fleets rely heavily on managing their costs per mile and would benefit greatly by realigning their oil change service intervals.”

Direct market insight, such as the service habits of end-users, is just one example of how MacKay & Company’s DataMac subscribers can benefit from an in-depth understanding of this highly competitive industry and realize the benefits of having access to direct, timely, and actionable market data.

To keep up with the latest trends and access invaluable data for you and your business, find out more about DataMac Lube by visiting www.mackayco.com or reach us via email at mackay@mackayco.com.