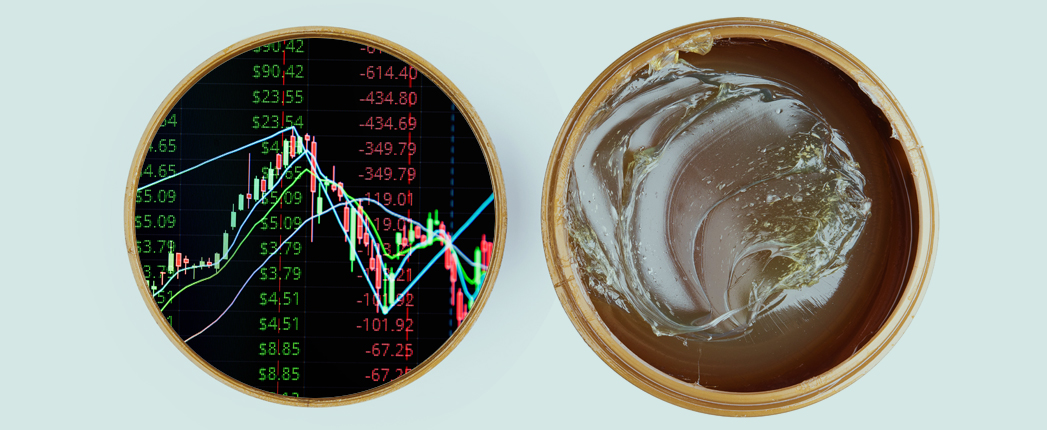

Derivatives marketplace CME Group last week announced it would begin trading futures contracts for lithium hydroxide on May 3, pending regulatory reviews. Lithium hydroxide is a key metal for electric vehicle batteries and is also the most common of several key ingredients that can be used to make soaps that are mixed with oil to thicken greases.

The market will be called Lithium Hydroxide CIF CJK (Fastmarkets) futures.

Lithium demand from the burgeoning electric vehicles industry has caused moderate disruption for grease producers, driving up costs for a key ingredient. The impact of EVs also drove CME’s action.

“Demand for key battery metals like lithium and cobalt continues to accelerate as economies invest in lower carbon alternatives for the transportation sector,” said Young-Jin Chang, managing director and global head of metals at CME. He added that “the new Lithium futures will provide our customers with another tool for managing the price risks associated with the manufacturing of electric vehicles.”

Futures contracts are designed to provide stability, protecting buyers and sellers from price fluctuations. This could benefit grease manufacturers by boosting their confidence in setting prices and covering their costs. It also has the potential to benefit large grease buyers – such as automotive manufacturers and the military – by enabling them to more clearly project future grease costs. A published price for lithium hydroxide could also play a role in grease supply contracts.

Lithium futures will be listed by and subject to the rules of COMEX. Lithium futures will be financially-settled based on the lithium hydroxide assessment published by Fastmarkets, which reflects the cost, insurance and freight spot price in China, Japan and South Korea, where the majority of battery manufacturing capacity is concentrated today.

A futures trade is a contract to sell that commodity at a fixed price at a specific point of time in the future. Futures contracts are traded on exchanges where prices are settled on a daily basis until the end of the contract. Clearing houses guarantee the transactions, drastically lowering the probability of default.

Lithium hydroxide has long been used by grease producers as a thickener and is found in around 70% of lubricating greases. while the growing e-mobility megatrend has increasingly seen it siphoned away for battery production in recent years.

Prices for lithium hydroxide rose in recent years thanks to steep demand for lithium-ion batteries in electronic devices and electric vehicles, though producers saw a reprieve at the end of 2019 due to a significant increase in supply volumes. For more coverage of electric vehicles and their impact on lubricants, subscribe to Lubes’n’Greases’ Electric Vehicles InSite.