Market participants continued to monitor developments related to the devastating advance of the coronavirus pandemic. The outbreak has spawned a grim global economic outlook, the collapse of crude oil values, and hefty base oil price decreases, with Paulsboro, Avista Oil, Kleen Performance Products, Phillips 66 and Petro-Canada joining other producers in lowering posted prices this week.

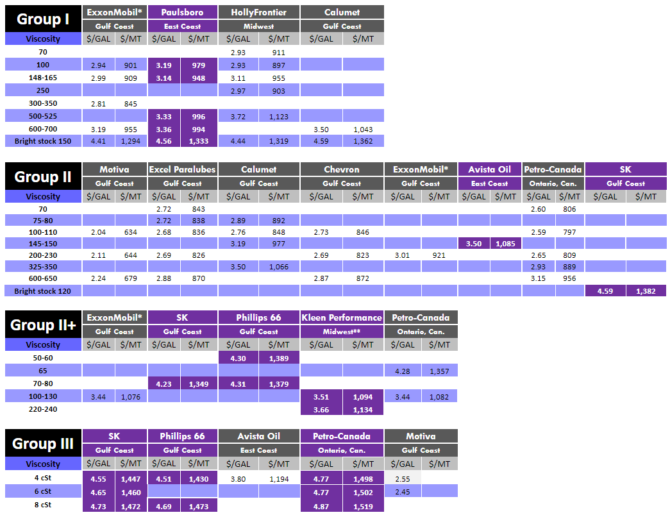

Paulsboro will be marking down its API Group I prices by 60 cents per gallon, effective April 1.

Avista Oil decreased its Group II cut by 40 cents/gal, effective March 30.

Kleen Performance Products reduced its Group II+ postings by 60 cents/gallon, with the decrease having been implemented on March 26.

Phillips 66 communicated a 40 cents/gal decrease for its Group II+/III Ultra-S® base oils that the company markets in North America, with an effective date of March 26.

Petro-Canada will also decrease its postings for all three of its Group III base oil grades by 40 cents/gal, effective April 1. No other products will be affected at this time, as the producer had already adjusted down prices earlier this month.

SK Americas had also announced a 40 cents/gal markdown on its Group II+/III cuts, and a 60 cents/gal decrease on its Group II bright stock last week, which will become effective on April 1 and be reflected in the Price Table below this week.

A majority of base oil producers have reduced posted prices by 60 cents/gal since March 24, with the exception of Chevron, who lowered its Group II 100R grade by 58 cents/gal and its other grades by 60 cents/gal, and a handful of Group II/II+/III suppliers, whose prices have been marked down by 40 cents/gal. This was the second round of markdowns since the beginning of March.

Naphthenic producers also completed a series of decreases during that timeframe, driven mostly by the sharp drop in crude oil and feedstock prices and market fundamentals.

A few suppliers maintained that demand was still fairly steady, considering the market upheaval caused by the virus outbreak and the self-isolation measures that have led to a reduction in manufacturing activity and the use of means of transport.

However, others acknowledged that the current market situation and dim prospects had caused base stock buyers to retreat, or commit to only small quantities, while sales of finished lubricants has dwindled as well.

Demand for automotive lubricants has fallen in part due to the temporary suspension of operations at several automotive plants. Auto makers such as Tesla, Ford and General Motors have also pledged to switch production to manufacturing much needed medical equipment such as ventilators.

There was also increased talk about refiners trimming operating rates as gasoline and fuel demand has declined and market economics have stepped into negative territory, which could result in reduced base oil output.

Naphthenic base oil refiner Ergon extended the current turnaround at its Vicksburg, Mississippi, unit for a month in response to the coronavirus epidemic. The planned turnaround started on March 5 and was originally scheduled to last 26 days, but the restart has been delayed “due to the implementation of best practices to manage the impact of the coronavirus,” the company said in a press release.

While this extension would likely result in tight supply of products, the company said it was working to minimize supply disruptions during this planned maintenance period, and as the company rebuilds its pre-turnaround inventory positions.

The coronavirus pandemic also continued to cause mayhem in crude oil markets. West Texas Intermediate futures collapsed to below $20 per barrel on Monday, hovering close to their lowest levels in 18 years, as the industry is dealing with the largest demand drop in history.

Analysts predicted that crude consumption could fall by as much as a quarter next month as a result of the lockdowns prompted by the pandemic. WTI and Brent have lost more than half their value in March, MartketWatch.com reported.

The stock market did not fare any better, with the Dow Jones Industrial Average registering the worst first quarter in 124 years.

U.S. oil futures edged slightly higher on Tuesday, with some support coming from news about a recovery in Chinese manufacturing levels and President Donald Trump communicating with Russia about the fight against the coronavirus pandemic and about stabilizing the crude market.

On Tuesday, March 31, WTI futures settled at $20.48 per barrel on the CME/Nymex, and had closed at $24.01/bbl on March 24. (CME Group closed its Chicago trading floor as a precaution on March 13; all products continue to trade on CME Globex).

Brent futures for May delivery were reported at $22.74/bbl on the CME on March 31, from $27.15/bbl on March 24.

Light Louisiana Sweet was trading at $20.05/bbl on March 30 and had closed at $24.55/bbl on March 25, according to OilMonster.com. Wholesale spot prices from the Energy Information Administration were not available at the time of writing.

Low sulfur vacuum gas oil and high sulfur VGO were trading at WTI plus $0.25/bbl (or $20.73/bbl) on Tuesday, March 31, and were trading at WTI plus $0.50/bbl ($24.99/bbl) on March 25. Two weeks ago, on March 17, VGO prices were hovering at $29.95/bbl, according to OPIS PetroChemWire assessments.

Lubes’n’Greases Publications shall not be liable for commercial decisions based on the contents of this report.

Historic and current base oil pricing data are available for purchase in Excel format.