A majority of base oil grades have attained more balanced supply and demand conditions, supporting stable pricing, but a few cuts have started to lengthen, and this was exerting downward pressure on spot export indications. Suppliers are comfortably able to meet contractual obligations while keeping extra availability on hand in case of weather-related output disruptions during the height of the hurricane season. Blenders are keeping a close eye on immediate product needs, which are driven by somewhat subdued activity in lubricant segments, without losing sight of macroeconomic developments.

There has been market attention focused on ongoing geopolitical tensions and their effects on crude oil prices. Futures had climbed last week as United States President Donald Trump threatened to impose secondary sanctions on Russian oil exports, with oil values ending more than 6% higher. However, prices fell at the start of the week after OPEC+ said that it would move ahead with another larger output increase in September. Refiners were also keeping a keen eye on fuel prices as they might favor fuel output over base oils if demand and margins are more favorable.

Some U.S. market participants expressed concern about the imposition of tariffs on a number of imports as President Trump reached preliminary pacts with some nations but was unable to attain agreements with several others, driving him to impose hefty tariffs on partners such as Canada. However, base oils imported from Canada were not expected to be subject to tariffs as long as they comply with the U.S.-Mexico-Canada Agreement, which was still in effect. Similarly, base oil imports from South Korea were expected to be exempt from the new tariffs beginning this month because they fall under the energy products classification, which was established as a duty-free category back in April. Nevertheless, market participants said that the situation was fluid.

Lubricant manufacturers could see tariffs on some inputs such as additives from Europe and other origins, but the rules were still unclear and further details were expected to emerge in the coming weeks. Blenders have been dealing with competitive situations as major suppliers have been able to offer more significant discounts to attract buyers, while production costs have generally increased over the last few months, despite stable posted base oil prices, and this has squeezed margins.

Group I

Some grades within the API Group I segment have started to show more comfortable positions in terms of availability than last month as plants were running well and demand has been steady but has not exceeded supplies. The heavier grades and bright stock were still deemed fairly tight, with spot prices hovering at firm levels as spot export volumes were limited. At least one producer was heard to be rebuilding inventories after maintenance work at its plant and was unable to offer spot volumes.

Group I buying interest from Mexico, Latin America and other regions was still noted, but numbers appeared difficult to work and there were fewer reports of transactions having been concluded over the last couple of weeks. Demand from Europe has dwindled as markets were quiet during the summer holiday period.

U.S. suppliers continued to prioritize contract shipments to Mexico but faced ongoing railcar transportation disruptions and delays at the border. Economic uncertainties and ongoing tensions with the United States as Mexico has not yet reached a fresh trade agreement with the U.S. chilled buying activity.

Brazilian buying appetite for imports remained dull because buyers were able to cover most product needs through domestic base oils and these were available at competitive prices since the main producer adjusted its prices down in July. Most buying activities involved Group II cargoes as prices for these high-performance base stocks were considered competitive against Group I grades. At the same time, expectations of lengthening supplies in the U.S. could open up attractive import opportunities to Brazilian market participants later in the year.

Group II

Group II base oil prices have come under pressure because of growing supplies as most plants were running at top rates, with the exception of the Excel Paralubes’ Group II unit in Lake Charles, Louisiana, which has been running below peak capacity for most of the year.

The Group II 100N grade was described as tight and prices were therefore somewhat sheltered from price pressure. The 200N and 600N were more available, but suppliers did not seem anxious to place additional barrels as they preferred to hold extra volumes to cover potential output disruptions during the peak hurricane months. That being said, there were reports of export offers of Group II grades as producers sought to maintain current inventory levels and avoid oversupply conditions.

A rerefiner has not offered Group II/Group III spot supplies over the last month but was anticipated to return to the trade table later this month.

Excel Paralubes has planned a turnaround and catalyst change in October, which should help resolve the plant’s current production problems, sources said. Both Chevron and Motiva have recently completed maintenance programs at their plants and the units were running well, with inventories starting to build, according to sources. None of the producers commented on the status of their operations.

Group III

With regional turnarounds having been completed and plants returning to production, additional product was expected to be offered worldwide. The U.S. limited Group III production and most of its product needs are met through imports from Asia, the Middle East and Canada. Turnarounds at several facilities over the previous months had restrained spot availability, but that situation has changed, with several import cargoes expected to arrive in the U.S. over the next few weeks.

Prices for volumes moving under contract were reported as stable, but the additional availability has started to exert pressure on Group III spot prices. Last month, the 4 cSt experienced some downward adjustments, but as the 6 cSt and 8 cSt grades became more abundant, spot prices for these grades were also expected to be exposed to downward pressure, according to sources.

Uncertainties over tariffs and the U.S. economy were dampening activity in the automotive industry, which draws significant volumes of Group III grades.

Naphthenics

Supply and demand have shown few changes over the last few weeks, and conditions were described as mostly balanced, although there has been some lengthening of the heavy grades due to sluggish demand from the rubber and tire industry. The lighter grades continued to display steady consumption levels and this segment was therefore tighter. Most buyers seemed to have ample inventories to keep operations running and were keeping extra barrels on hand as a precaution due to recent railcar transportation disruptions.

With crude oil futures hovering within a fairly narrow range over the last two weeks and early August prices at lower levels than the July average, there was very moderate pressure on refiners to adjust base oil prices.

Ergon started to build inventories ahead of a turnaround at its naphthenic base oils plant in September, restricting spot supplies. The producer scheduled a six-week maintenance program at its refinery in Vicksburg, Mississippi, beginning Sept. 1. Various operating units of the ERI refinery will be down, as several reliability improvements are implemented. No supply interruptions were expected for Ergon’s current ratable customers, as product inventory levels were anticipated to be sufficient to support sales during the planned shutdown, company sources said.

Crude Oil and Diesel

Crude oil futures slipped at the start of the week as OPEC+ announced plans to increase crude production in September. However, by mid-week, futures inched up as U.S. crude stocks fell and President Trump threatened to impose fresh sanctions on Russian oil exports and countries that buy oil from Russia.

According to the American Petroleum Institute, U.S. crude oil inventories declined by 4.2 million barrels for the week ending Aug. 1.

- West Texas Intermediate September 2025 futures settled on the Nymex at $65.16 per barrel on August 5, down from $69.21/bbl for front-month futures on July 29.

- Brent futures for October 2025 delivery were trading on the ICE at $68.75/bbl on Aug. 5, down from $72.19/bbl on July 29.

- Louisiana Light Sweet crude wholesale spot prices were hovering at $69.31/bbl on Aug. 4, down from $68.81/bbl on July 28, according to the U.S. Energy Information Administration.

- Low-sulfur diesel wholesale spot prices were $2.36 per gallon at New York Harbor, $2.23/gal on the Gulf Coast and $2.40/gal in Los Angeles on Aug. 4, compared to $2.48/gal, $2.35/gal and $2.49/gal, respectively, on July 28, according to the EIA.

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

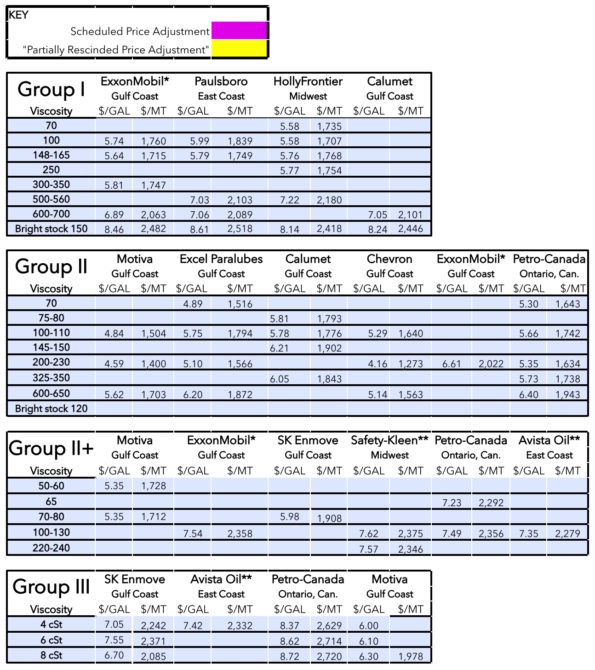

Posted Paraffinic Base Oil Prices: August 6, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner