The base oils market seems to have slipped into a summer slumber, with demand described as steady, but not particularly vigorous as the height of the lubricant production cycle has ended and forward orders were not expected to improve much. Additional stocks have been secured by both producers and consumers to cover requirements during potentially disruptive storms as the peak of the hurricane season along the United States Gulf Coast approached.

Despite the fact that the hurricane season runs from June until November, most of the severe weather occurs between August and September, and the National Oceanic and Atmospheric Administration forecast between 13 and 19 named storms in 2025. Six to 10 of them could become hurricanes, and three to five of those could become major hurricanes.

A storm of a different kind that was also brewing was the tariff squabble between U.S. president Donald Trump and several trade partners, with many countries hoping to reach an agreement by the August 1 deadline. On Tuesday, president Trump announced that the U.S. had agreed to a trade deal with Japan that would lower the “reciprocal” tariffs from 25% to 15%. Japan, along with Mexico and South Korea, is one of the largest exporters of cars and automotive parts to the U.S. Recently imposed trade barriers such as steep duties on steel and copper had already resulted in disruptions to many domestic automakers’ supply chain and plant operations, and were anticipated to pose a challenge moving forward.

Base oil posted prices were largely stable, and there had been talk about potential price increases when crude oil prices had jumped in mid-June, but discussions waned when oil prices retreated. With base oil demand not expected to pick up significantly in the coming weeks and suppliers starting to worry about growing inventories, prices were anticipated to be exposed to downward pressure. However, some participants expected suppliers to wait and ensure no supply disruptions take place during the hurricane season–which lasts until November 30–before considering price revisions, particularly given that “refineries’ overall performance has been lackluster” and margins have not been robust, according to sources.

Group I

The API Group I segment was the tightest of all base oil segments as demand remained fairly steady and supply has started to improve, but was not expected to be sufficient to meet many extra requirements in the short term. However, as most plant maintenance programs have been completed, more product was expected to make its way into the market.

Similar conditions were observed in other regions as well due to permanent Group I closures in recent years and a heavy turnaround schedule in the previous months. There have been inquiries to move U.S. Group I products to Europe, the Middle East and India, but spot export supplies were not sizeable.

U.S. suppliers had to make sure they continued to meet contract commitments and previously agreed shipments to Mexico. Base oil movements have been plagued by railcar transportation issues and delays at the border. Economic uncertainties and ongoing tensions with the U.S. due to Trump’s tariff policies also seemed to get in the way of export transactions.

Buying interest from Brazil for Group I and Group II imports remained lackluster as buyers had plentiful inventories and preferred to secure domestic supplies of Group I grades, which were offered at competitive prices and were not exposed to currency fluctuations and long lead times. Several cargoes had moved to Brazil from Argentina in the previous weeks, but this supply seemed to have dried up. Given a lack of domestic Group III grades, there were ongoing discussions for Group III imports, with some players expecting Asian cargoes to meet part of this demand. However, Group III availability in Asia has been fairly tight given plant turnarounds, and many of the spot cargoes that became available moved to other regions such as Europe or the U.S.

Group II

The Group II segment was largely balanced, and most grades were readily available, with spot prices for the mid-viscosity cut experiencing downward pressure as supplies were more abundant. Demand was not anticipated to change substantially in the coming weeks since blenders were fairly conservative in terms of purchased volumes as it has been challenging to offset production costs, and they preferred to avoid carrying extra inventories. At the same time, many have bolstered their stocks during the hurricane season.

With the exception of the Excel Paralubes plant in Louisiana, which has been running below peak capacity for most of the year, Group II units have not experienced any shutdowns, following a number of turnarounds in the first half of 2025. Both Chevron and Motiva completed maintenance programs at their plants and the units were running well, with inventories starting to build, according to sources. This was not expected to be a problem, as producers prefer to keep extra barrels in case of potential supply disruptions caused by severe storms along the U.S. Gulf.

Excel Paralubes has planned a turnaround and catalyst change in October, which should help resolve the plant’s current production problems, sources said. None of the producers commented on the status of their operations.

Spot rerefined base oil cargoes were limited, with one rerefiner reporting healthy demand and tight supplies. A second rerefiner also reported a sold-out inventory position in June/July and expected similar fundamentals in August. Rerefiner Avista may have a short turnaround at its Peachtree City, Georgia, plant in September, which could limit supply from the producer.

Group III

Group III grades were generally snug, but additional import cargoes were expected to arrive this month and the next, relieving any tight pockets. Importers hoped to keep enough inventory in storage in the U.S. to cover requirements, should a hurricane impact production and transportation. Additionally, ongoing geopolitical tensions in the Middle East also continued to fan concerns about possible supply and shipping disruptions, along with the threat of potential tariffs on imported goods.

Maintenance programs at several Group II+/Group III plants, including Petro-Canada’s unit in Canada, SK Enmove’s in South Korea, and Adnoc’s in the United Arab Emirates have been completed and plants have returned to production, allowing for additional cargoes to enter the supply system.

Group III production at domestic plants was heard to have been trimmed in favor of Group II output, as that segment of the market had tightened and spot prices had moved up over the previous months.

Naphthenics

Naphthenic base oil prices were reported as steady, with fairly balanced supply and demand conditions offering support to current price ideas. Buyers and sellers kept a close eye on crude oil values as these have a direct impact on margins, and abrupt fluctuations could lead to base oil price changes, but oil prices were generally trading within a narrow range, assuaging some of these concerns.

The light grades enjoyed healthier demand levels than the mid- and heavy-viscosity grades. The heavy grades, which are used in the tire and rubber segment, have seen less of an uptick during the summer driving season than in previous years, which some attributed to reduced activity and production disruptions in the automotive segment. Demand from Europe has so far been fairly robust, but that market has entered the summer holiday period and requirements may weaken as a result.

Ergon has started to build inventories ahead of a turnaround at its naphthenic base oils plant in September, and this may limit spot supplies. The producer has scheduled a six-week maintenance program at its refinery in Vicksburg, Mississippi, beginning Sep. 1. Various operating units of the ERI refinery will be down for approximately six weeks as several reliability improvements will be implemented. No supply interruptions were expected for Ergon’s current ratable customers, as product inventory levels were anticipated to be sufficient to support sales during the planned shutdown, company sources said.

Crude

Crude oil futures declined for a second session on July 22 amid concerns that pending U.S. trade deals may not be finalized by the Aug. 1 deadline, potentially slowing economic growth and energy demand.

- West Texas Intermediate September 2025 futures settled at $65.31 per barrel on the Nymex, down from $66.52 on July 15.

- Brent September 2025 futures traded at $68.47 per barrel on the ICE, up slightly from $68.40.

- Louisiana Light Sweet crude spot prices $70.99 per barrel on July 21, compared to $70.89 on July 14, according to the U.S. EIA.

- Low-sulfur diesel spot prices on July 21 were $2.54 per gallon at New York Harbor, $2.44 on the Gulf Coast and $2.63 in Los Angeles. On July 14, prices were $2.40, $2.31 and $2.63 per gallon, respectively, according to the EIA.

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

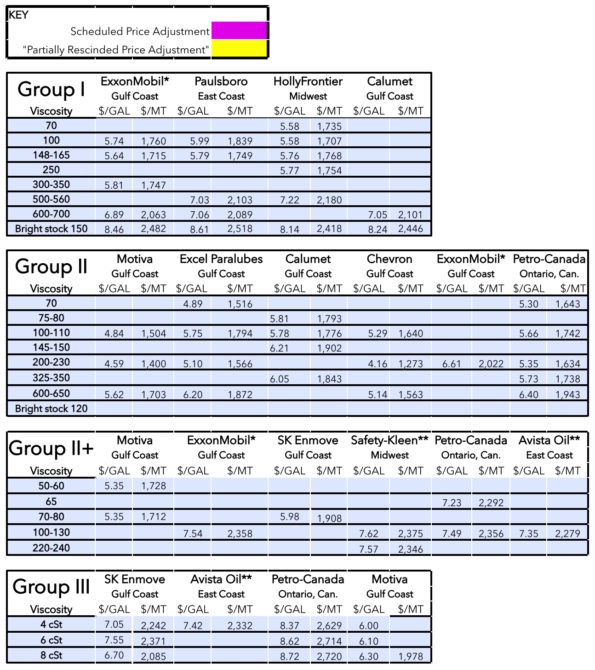

Posted Paraffinic Base Oil Prices

July 23, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner