While conditions in the base oils market were stable to slightly softer, the most unsettling factor came from the crude oil side, as futures suddenly skyrocketed late last week on news that Israel and Iran had exchanged airstrikes. The steeper oil prices started to erode base oil margins and placed upward pressure on values. However, futures later fell as the attacks spared key energy infrastructure. Aside from keeping a close eye on crude prices, refiners were also monitoring base oil consumption levels because some segments have started to slow down, following an uptick during the runup to the summer driving season.

On Friday, June 13, oil futures posted the largest single-day gain since the Ukraine war started in 2022, jumping by as much as 13% in a single day. By Monday, however, West Texas Intermediate futures had given up much of the gains and were down by about $2.75 per barrel, to trade at $70.25/bbl as energy facilities had not been affected by the Israel-Iran conflict. Nevertheless, analysts worried about potential oil supply disruptions due to the turbulence near the Strait of Hormuz, a shipping route for global oil cargoes.

Crude values were falling for most of the previous weeks, exerting downward pressure on base oil prices. Posted prices were maintained for the most part, although one paraffinic producer lowered prices in mid-May and a majority of naphthenic suppliers also decreased prices in the first half of that month.

There were also reports that buyers had requested temporary value allowances (TVAs) on base oils because some manufacturers were hit by cost increases – some due to tariffs on imported raw materials and components and higher freight rates amid thinning margins – but it appears that no TVAs have been granted so far.

“My impression is that base oil supply has been sufficient and finished lubes are still under some pressure, though maybe not as much as a month or two ago,” a source commented. If crude prices continue to firm, base oil producers will be more reluctant to lower prices, even if demand slows down.

Group I

Ongoing tight conditions of some Group I cuts continued to support prices, despite a slight slowdown in demand from a few downstream segments, especially those related to industrial output. Bright stock was still in short supply and as a result prices were firm.

The snug supply and demand balance in the United States largely reflected fundamentals in other regions, where API Group I supplies have tightened on the back of permanent plant closures and maintenance shutdowns. This has attracted U.S. cargoes to fill supply gaps in Europe and as far away as India, which typically imports mostly U.S. Group II grades. There have been plant Group I turnarounds in Southeast Asia, Japan, China and the Middle East, while a couple of U.S. plants have also undergo shutdowns. However, as plants resume production, supplies were expected to lengthen, lifting some of the pressure on pricing.

Calumet will be completing a turnaround at its Group I/Group II unit in Shreveport, Louisiana, this month. The turnaround will only affect the Group I heavy grades. The company performed maintenance on the lighter viscosity base oil lines last March.

American Refining Group was also heard to have planned a turnaround at its Group I plant in Bradford, Pennsylvania, this month, according to sources.

Ergon was heard to be rebuilding inventories following a turnaround at its Group I/Group II unit that lasted from the end of March until mid-May. The producer had also built inventories ahead of the shutdown to continue supplying its ratable customers.

Buying interest for U.S. base oils from Mexico was steady, especially for the light grades, despite the fact that import prices for U.S. products have edged up given limited spot availability. Nevertheless, there was still hesitation on the part of some buyers because they expected prices to decline, once summer demand has been met in the U.S. and surplus volumes start to build.

Export movements to Brazil have been less robust than last year, partly because the local producer has been able to meet a larger portion of domestic requirements, and a large lubricant blending plant had been forced to halt production following a fire in February, which had freed up some base oil barrels that were snatched up by other blenders. Buying appetite has started to pick up, however, as stocks are being drawn down, with prices of the light grades moving up more significantly than other grades on healthy demand.

Group II

Recent and ongoing turnarounds have strained Group II spot supplies, but as plants resume production, more product was expected to be reintroduced into the market. Even so, additional barrels seemed to be quickly absorbed, with those becoming available after the restart of Chevron’s plant in Pascagoula, Mississippi, following a turnaround, heard to have been placed already and this had helped stabilize pricing. The tightest grades were the Group II 100N and 220N cuts, but there were also very few spot volumes of the 600N.

Motiva was expected to restart its plant late last week and begin building inventories, following a three-week turnaround at its Port Arthur, Texas, hydrocracker that began in late May. The shutdown was anticipated to affect mainly the Group II 220N grade.

Excel Paralubes was heard to continue running its Lake Charles, Louisiana, plant at reduced rates, but contractual obligations are being fulfilled. The supplier was heard to be building inventories ahead of the hurricane season and had restricted its spot sales. The production issues were not expected to be resolved until the plant’s scheduled turnaround in October, according to sources. Chevron, Motiva and Excel Paralubes did not comment on the status of their operations.

Ergon completed a seven-week turnaround at its Group I/Group II base oil unit in Newell, West Virginia, and restarted its plant on schedule in the second half of May.

Rerefiners had also brought additional product to the domestic market following a series of brief turnarounds at several facilities, with “prices holding up well,” according to a source. A one-month turnaround at Safety-Kleen’s rerefining unit had been expected to curb availability of some of its rerefined products, but the plant was heard to be running now, while another rerefiner was understood to be completing maintenance in June. Most rerefiners were reportedly offering limited supplies into the spot market.

Aside from fairly steady domestic demand, there has been buying interest from Brazil and Mexico as blenders have exhausted existing inventories, with the lighter grades very much sought after. Export prices have edged up because of the snug supply situation in the U.S., which had left little product for shipment to Latin America and other destinations like India.

Group III

Spot prices for Group III base oils were exposed to upward pressure given strained supplies, especially of the 4 cSt grade, which is more widely used than the 6 cSt and 8 cSt. The higher Group III prices lured cargoes into the U.S. that had previously been more likely to move to Europe because of more attractive prices in that region.

Slightly reduced import volumes, coupled with curtailed production in the U.S. at plants that produce both Group II and Group III base oils have led to the snug supply and demand ratio.

Some buyers and sellers were also padding inventories ahead of the peak hurricane period in August and September, when the largest number of storms are typically seen along the U.S. Gulf Coast.

In North America, Group III supplies had improved following the restart of Petro-Canada’s Group III plant in Mississauga, Canada, in early May after the producer completed a turnaround. The Group II unit at the same location continued to operate during the Group III maintenance program. However, ongoing turnarounds in other parts of the world have resulted in curbed Group III availability.

In South Korea, SK Enmove started a partial two-month turnaround at its Group III plant in Ulsan in May, although the shutdown was not expected to have a significant impact on supplies because of uninterrupted production on the facility’s other trains, company sources said.

In the Middle East, Adnoc started a two to three-week turnaround at its Group II/Group III plant in Ruwais, Abu Dhabi, United Arab Emirates, in early May that was expected to have been completed.

Bapco was heard to have originally scheduled a turnaround at its Group III facilities in Sitra, Bahrain, in late March or early April, but was reportedly postponed to early June. No updates could be obtained by the publishing deadline.

Naphthenic Base Oils

There were a few pockets of lingering tight supply in this segment following turnarounds earlier in the year, together with robust demand over the last several weeks. This was particularly the case for the light grades, but the heavier grades had captured more moderate requirements and appeared more readily available. These grades see increased demand ahead of the summer driving season because they go into applications such as rubber and tire manufacturing, and tariff-related disruptions in the automotive industry have affected consumption this year.

Naphthenic base oil prices stabilized after a widespread 20-cents-per-gallon price decrease on a majority of grades in mid-May, with the exception of one refiner who did not adjust the pale 60 cut. The decreases were mostly triggered by falling crude oil prices, which tend to have a more direct and immediate impact on naphthenic cuts than on paraffinic oils.

There might be some tightening of availability in the second half of the year as Ergon Refining Inc. has planned a turnaround and was likely to start building inventories to cover contract requirements during the outage.

Ergon has scheduled a maintenance program at its naphthenic refinery in Vicksburg, Mississippi, beginning Sep. 1. Various operating units of the ERI refinery will be down for approximately six weeks as several reliability improvements will be implemented. No supply interruptions were expected for Ergon’s current ratable customers, as product inventory levels were anticipated to be sufficient to support sales during the planned shutdown, company sources said.

Crude Oil and Diesel

Crude oil futures continued to climb on Tuesday afternoon, following a dip in Monday’s trading session and the biggest intraday surge in three years last Friday. What analysts had feared following news of the Israeli-Iranian exchange of airstrikes was a major supply disruption in the Middle East, which has not materialized.

As the Israel-Iran war rages on, analysts are speculating whether Israel could target Iran’s oil energy infrastructure after its strikes on the South Pars gas field. So far, Iranian oil exports did not seem to have been impacted by the Israeli missile strikes, and ship movements have not been affected in the Strait of Hormuz either.

On June 17, West Texas Intermediate July 2025 futures settled on the Nymex at $74.84 per barrel, compared to $64.98/bbl on June 10.

Brent futures for August 2025 delivery were trading on the ICE at $76.40/bbl on June 17, from $66.87/bbl on June 10.

Louisiana Light Sweet crude wholesale spot prices were hovering at $75.63/bbl on June 16, compared to $68.74/bbl on June 9, according to the U.S. Energy Information Administration.

Low-sulfur diesel wholesale spot prices were at $2.40 per gallon at New York Harbor, $2.31/gal on the Gulf Coast and $2.46/gal in Los Angeles on June 16, compared to $2.15/gal, $2.09/gal and $2.19/gal, respectively, on June 9, according to the EIA.

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

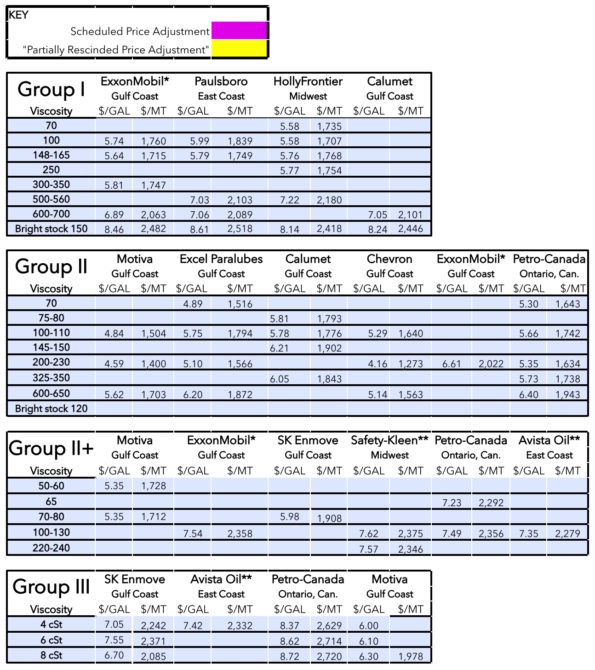

Posted Paraffinic Base Oil Prices

June 18, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner