Some base oil suppliers continued to observe a steady stream of orders, while others have started to see signs of softening demand. This situation was not completely surprising as blenders had built inventories to manufacture lubricants and other finished products ahead of the summer driving season. Their base oil needs were likely to start declining once the season got into full swing, with the Memorial Day weekend in late May already bringing increased driving activity. Both producers and consumers were also expected to stockpile base oils in preparation for the hurricane season, which runs from June 1 until November 30 in the Atlantic Basin.

This year’s hurricane season was forecast to be very active and participants were anticipated to store extra base oil barrels in case of production disruptions due to severe weather along the U.S. Gulf Coast, where several base oil plants are located. Producers were also expected to be ready to implement storm preparedness programs to avoid power failures and output outages.

Many economic and trade uncertainties continued to affect market activity and clouded demand projections in the short and long term. The OECD (Organization for Economic Co-operation and Development) lowered its growth forecast for the U.S. this week, as it warned that President Donald Trump’s trade war will impair major economies, according to an article in the Financial Times. “The global economy as a whole is heading into its weakest period of growth since the Covid-19 pandemic, but the slowdown will hit the U.S. particularly hard,” the report said. The organization predicted that U.S. growth would fall to 1.6 per cent this year–down from 2.8 per cent in 2024–and also trimmed its growth forecasts for China, France, India, Japan, South Africa and the UK.

Despite the ongoing tariff upheaval, base oil prices were generally stable, supported by fairly balanced supply and demand fundamentals in most segments, although the heavy-viscosity grades have started to lengthen. Crude oil futures have been on a downward trek since early April, exerting downward pressure on base oils and prompting one paraffinic supplier and most naphthenic producers to announce price decreases in May. However, crude futures reversed course early this week and traded at three-week highs on ongoing geopolitical tensions between Russia and Ukraine, and between the U.S. and Iran.

Downstream, lubricant manufacturers were facing customer pressure to reduce pricing, but production costs have increased in recent weeks, particularly for those blenders who import additives and components, although it appears that the announced additive increases have been postponed or rescinded. Most base oil prices remained on firm ground, granting little relief. Lubricant suppliers were also dealing with competitive movements among sellers.

Group I

Most API Group I grades were on the tight side, not only in North America, but in other regions as well on the back of permanent plant shutdowns and turnarounds. The most sought-after and tightest grade continued to be bright stock, with prices remaining on firm ground. Most Group I suppliers were seeing steady demand and balanced inventories, although there were reports that one supplier may have some surplus available and that it was likely to be offered for spot export business.

Additionally, a number of recent and imminent plant turnarounds were expected to exacerbate the snug conditions affecting the heavy-viscosity Group I grades.

Calumet will be starting a turnaround at its Group I/Group II unit in Shreveport, Louisiana, this month. The turnaround will only affect the Group I heavy grades. The company completed maintenance on the lighter viscosity base oil lines last March.

American Refining Group was also heard to be preparing for a turnaround at its Group I plant in Bradford, Pennsylvania, according to sources.

Ergon was heard to be rebuilding inventories following a turnaround at its Group I/Group II unit from the end of March until mid May. The producer expected no supply interruptions for current ratable customers as the company had built inventories ahead of the shutdown.

Buying interest from Mexico was also steady, but prices were heard to have inched up as availability in the U.S. had been more limited than expected over the last few weeks. Buyers had hoped to see prices drop due to sliding crude prices and the possibility that demand would start to decline in the U.S. after most spring lubricant production has been completed.

Group II

There were expectations that downward pressure would be building on Group II grades as Chevron’s turnaround in Pascagoula, Mississippi, has been completed and more product was anticipated to hit the market. Chevron had announced a 35 cents per gallon posted price decrease in mid- May, thought to have been triggered by lower crude oil prices and an increased production yield at the Pascagoula plant following a catalyst change. The company was heard to have restarted its unit in late May and was rebuilding inventories.

At the same time, there were other maintenance programs being completed and a plant was running at reduced rates, curbing Group II spot supplies.

Motiva scheduled a three-week turnaround at its hydrocracker in May, which was expected to be completed by the first week of June. The shutdown was anticipated to affect mainly the Group II 220N grade.

Excel Paralubes was heard to be running its Lake Charles, Louisiana, plant at reduced rates since late last year reportedly due to technical issues related to Group III production at the facility, but contractual obligations continued to be met. Sources indicated that the producer had abstained from offering spot volumes in May and might not be able to supply spot cargoes in June, depending on whether it can build enough stocks ahead of the hurricane season. The production issues were not expected to be resolved until the plant’s scheduled turnaround in October, according to sources. Chevron, Motiva and Excel Paralubes did not comment on the status of their operations.

Back on March 31, Ergon had started a seven-week turnaround at its Group I/Group II base oil unit in Newell, West Virginia, to complete maintenance and implement several reliability improvements. The plant was heard to have been restarted as planned in the second half of May.

Most rerefining units were also running well, following the recent restart of one plant, and additional rerefined products were therefore expected to become available over the next few weeks.

Given that Group II high-viscosity grades were expected to start lengthening as plants return to production, a couple of producers have begun to look for export opportunities to help curb surplus supply. There were discussions of heavy-grade cargoes moving to India, with an 8,000-10,000-metric-ton parcel mentioned for possible shipment from the U.S. Gulf to West Coast India in late May. However, demand in India may subside in the coming months as the monsoon season starts in June, with the heavy rains sometimes disrupting manufacturing, logistics and transportation.

Additionally, a 1,500-ton lot was also expected to be shipped from Houston, Texas, to Le Havre, France, in early June.

Group III

As described over the last few weeks, a global tightening of Group III base oils supported generally firm prices on the back of plant turnarounds in North America, Asia and the Middle East. In the U.S., domestic Group III production was also heard to have been reduced as producers who can also manufacture Group II grades had favored Group II output. Tight fundamentals and firm prices in Europe have also drawn more Group III cargoes to that region, partly reducing volumes moving to the U.S.

A supplier reported a balanced to tight supply-demand situation and attributed it mostly to all the Group III turnarounds in this period, “coupled with the regular seasonality uptick in the spring.” It also reported an increase in new business, likely due to competitors’ temporary shortfalls because of turnarounds and/or import delays.

The restart of production at Petro-Canada’s Group III plant in Mississauga, Canada, in early May following a turnaround that began in April was expected to allow for additional product to enter the supply system. The company had built contingency inventory to avoid any supply impacts to customers. The Group II unit at the same location continued to operate during the Group III turnaround.

In South Korea, SK Enmove started a partial two-month turnaround at its Group III plant in Ulsan in May, but the shutdown was not expected to have a significant impact on supplies because of uninterrupted production on the facility’s other trains, company sources said.

In the Middle East, Adnoc started a two to three-week turnaround at its Group II/Group III plant in Ruwais, Abu Dhabi, United Arab Emirates, in early May.

Bapco was heard to have scheduled a 10-week turnaround at its Group III facilities in Sitra, Bahrain, which was originally scheduled to start in late March or early April, but was reportedly postponed to late May or early June.

Naphthenics

Naphthenic base oil prices were mostly steady, following price decreases implemented on a majority of grades in mid-May. The adjustments were said to have been driven by falling crude oil and feedstock prices and growing supplies of the heavier grades. The light grades remained fairly tight given robust demand from the transformer oil and process oils segments.

Further tightening of spot supplies was anticipated in the second half of the year as Ergon Refining Inc. will be embarking on a turnaround and was likely to start building inventories to cover requirements during the outage.

Ergon has scheduled a planned maintenance event at its naphthenic refinery in Vicksburg, Mississippi, beginning September 1. In a press release, the company explained that various operating units of the ERI refinery will be down for approximately six weeks as several reliability improvements will be implemented. No supply interruptions were expected for Ergon’s current ratable customers, as product inventory levels were anticipated to be sufficient to support sales during the planned outage.

Crude Oil and Diesel

Crude oil futures had been on a downward trend for most of the previous week, but edged up earlier in the week as ongoing geopolitical tensions fueled concerns over tighter global supply. On Monday, Russia and Ukraine held their second round of peace talks following a sharp escalation in hostilities the previous day, although the discussions yielded no significant progress, Trading Economics.com reported. A wildfire in Alberta, Canada, has forced the temporary shutdown of some oil and gas production, further fanning concerns about a reduction in oil supplies. Meanwhile, OPEC+ agreed to production increases in July at the same level as the previous two months.

On June 3, West Texas Intermediate July 2025 futures settled on the Nymex at $63.41 per barrel, compared with $60.89/bbl on May 27.

Brent futures for August 2025 delivery were trading on the ICE at $65.40/bbl on June 3, from $64.17/bbl for July futures on May 27.

Louisiana Light Sweet crude wholesale spot prices

hovered at $65.94/bbl on June 2, compared to $65.39/bbl on May 23, according to the U.S. Energy Information Administration. (There was no trading on May 26 due to the Memorial Day holiday).

Low-sulfur diesel wholesale spot prices were $2.06 per gallon at New York Harbor, $2.00/gal on the Gulf Coast and $2.15/gal in Los Angeles on June 2, compared with $2.11/gal, $2.05/gal and $2.19/gal, respectively, on May 23, according to the EIA.

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

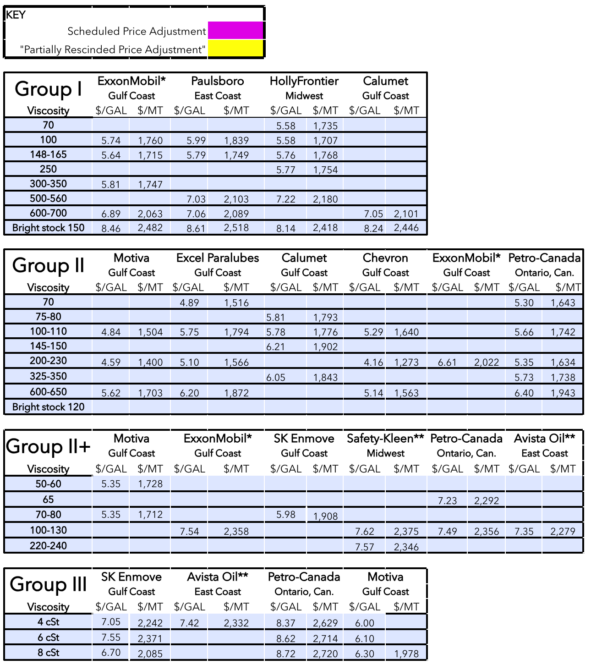

Posted Paraffinic Base Oil Prices

June 4, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.