While there have been few changes on the demand side, supply could be affected by refinery decisions regarding fuels production versus base oils, as crude oil and feedstock prices have edged up. With base stock margins losing ground, there could be more incentive for producers to stream feedstocks into the distillates stream. However, upcoming turnarounds and prospects of increased base oil demand in the coming months, together with softening crude values this week may provide enough motivation for refiners to keep production at current levels. Participants were also keeping an eye on an arctic winter storm sweeping the U.S. Gulf Coast, where many refineries are located.

The storm brought freezing conditions and heavy snow to parts of Texas, Louisiana and Mississippi in the early part of the week, causing icy roads to be closed and flights to be cancelled. The frigid weather was also anticipated to affect refinery operations, with run rates likely to have been reduced and extra operators placed on stand-by at some units ahead of the below-freezing temperatures. Refiners are better prepared for extreme weather events after experiencing similar storms in recent years, which had caused extensive power outages, frozen pipelines, and damaged equipment.

Base stock demand in the domestic market was steady, allowing producers to keep balanced inventories for most grades. API Group I cuts were on the tight side because of structural deficits and healthy demand from several sectors, as well as from the export market. Bright stock, in particular, continued to enjoy the limelight as availability was strained and prices remained firm.

Most Group II cuts were also available, but 100N and heavy grades seemed to be on the snug side for some suppliers, supporting stable pricing. While demand for these grades was not expected to take off significantly until late February or March, upcoming turnarounds and ongoing tight pockets because of unplanned outages late last year could lead to further supply curtailments.

For the time being, suppliers appeared eager to find a home for their surplus volumes and continued to look for export opportunities. There were still many uncertainties surrounding the impact that the newly-inaugurated president’s policies might have on international trade. The president said he planned to impose a 25% tariff on products from Canada and Mexico, starting on Feb. 1, and that he “may” also impose a universal tariff on all imports, adding that “essentially all countries take advantage of the U.S.,” the New York Times reported.

Demand from avid U.S. base oil importing countries such as Mexico and Brazil, which had secured significant volumes throughout 2024, has failed to show much strength so far in January, but was expected to improve as buyers deplete inventories, and U.S. suppliers show more willingness to lower offer levels. More competitive pricing may also attract additional buying interest from India, where some U.S. Group II cargoes were expected to be delivered this month.

There were reports that export price ideas for the Group I and Group II cuts had moved down by 3 to 5 cents per gallon from the previous week to attract buyers and compete with domestic prices at different destinations as local currencies have weakened against the dollar. However, there was some hesitation about offering deeper discounts because of rising crude oil and feedstock prices and expectations that the domestic market in the U.S. would start to see improved consumption in the coming weeks. Traditional receivers of U.S. base oil barrels such as European countries have shown subdued buying interest because of sluggish lubricant demand and a wide gap in bid and offer levels.

A couple of upcoming plant turnarounds in the U.S. could also restrict spot availability. The producers were expected to build inventories to cover contract commitments during the outages, but spot barrels might be limited.

Chevron was reported to have scheduled a three-week turnaround at its Pascagoula, Mississippi, Group II plant, starting in March 2025. The turnaround may lead to a tightening of spot Group II supplies, but contractual obligations were likely to be fully met, sources speculated. The producer does not disclose details about its plant operations.

Calumet will also be completing a two-week maintenance program on one of its units in Shreveport, Louisiana, in the second half of February. The Shreveport refinery produces Group I and Group II base oils. The producer has assured customers that it plans to have ample inventory to cover orders during maintenance.

Group III grades were plentiful in the U.S., but there could be some tightening in the coming weeks because of reduced domestic production and upcoming turnarounds at Group III plants in Asia. According to sources, South Korean producer GS Caltex was preparing for a turnaround at its Group II/III plant in Yeosu and has started to build inventories to cover term commitments during the outage. The turnaround was anticipated to start in early March and be completed by mid April, likely tightening spot availability in the first quarter.

Reports also circulated that SK Enmove would be completing a partial turnaround at its Ulsan, South Korea, Group III plant for two months, starting in May, which should partly curtail Group III availability in the region. SK Enmove is one of the top importers of Group III base oils in the U.S. No direct producer confirmation about the turnaround could be obtained by the publishing deadline.

On the naphthenic front, business was described as steady, particularly for the light-viscosity grades as demand from the transformer market remained robust. Consumption of the high-viscosity grades has declined on the back of reduced demand from the tire and rubber industries. But this trend should be reversed in the spring, ahead of the driving season in the U.S. Naphthenic prices stayed stable given the fairly balanced supply/demand conditions and firm crude oil and feedstock prices.

Meanwhile, lubricant and finished products manufacturers continued to face high production costs and unrelenting pressure as competition among suppliers has not let up given reduced demand in several downstream segments. Some lubricant suppliers were heard to be hoping to increase prices, but others preferred to protect market share by offering discounts into select accounts.

Crude and Diesel Prices

Crude oil futures fell on Tuesday after the U.S. president called for an increase in oil output, raising concerns about additional barrels coming to an already oversupplied market. Weak economic activity and reduced fuel demand in countries such as China – the world’s top crude importer – weighed heavily on oil demand and was expected to exert pressure on prices throughout the year.

On January 21, West Texas Intermediate March 2025 futures settled on the Nymex at $75.83 per barrel, compared to $77.50 for February futures on January 14 and $74.25/bbl on January 7.

Brent futures for March 2025 delivery were trading on the ICE at $79.64/bbl on January 21, from $79.83/bbl on January 14.

Louisiana Light Sweet crude wholesale spot prices were hovering at $80.26/bbl on January 17, from $82.07/bbl on January 13, according to the U.S. Energy Information Administration. (There was no trading on January 20 due to a federal holiday in the U.S.)

Low sulfur diesel wholesale spot prices were at $2.63/gal at New York Harbor, $2.52/gal on the Gulf Coast and $2.67/gal in Los Angeles on January 17, compared to $2.53/gal, $2.45/gal and $2.58/gal, respectively, on January 13, according to the EIA.

Contact Gabriela Wheeler directly at gabriela@lubesngreases.com

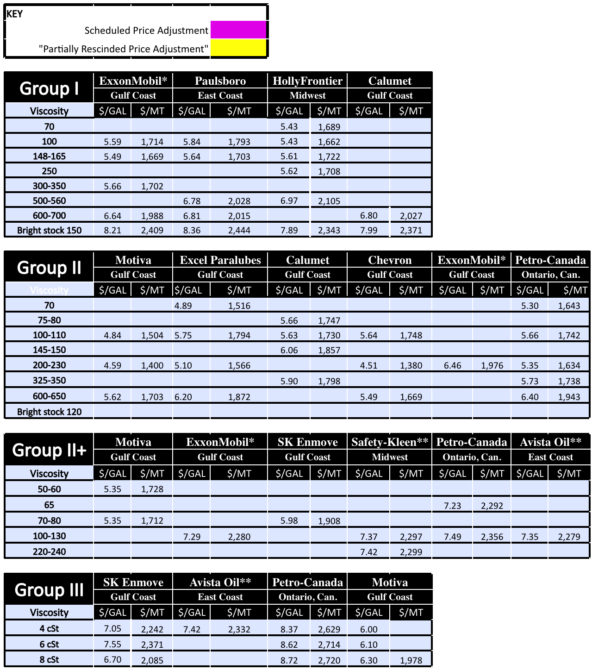

Posted paraffinic base oil prices: January 22, 2025 (FOB basis, USD/gallon and USD/metric ton)

Lubes’n’Greases Publications shall not be liable for commercial decisions based on this report.

Archived reports are here. Historic and current base oil pricing spreadsheets available to buy here.

*ExxonMobil prices obtained indirectly.

**Rerefiner