A Snapshot of Base Oil Capacity

Our print subscribers will have found the 2020 Global Guide to Base Oil Refining delivered alongside this issue, with data on 165 mineral base oil plants masterfully compiled by managing editor Michele Persaud.

Data for the map was compiled in the spring and includes plants with capacity of 800 barrels per day or greater. It is a snapshot in time of a global industry poised on the edge of change due to effects of the covid-19 pandemic.

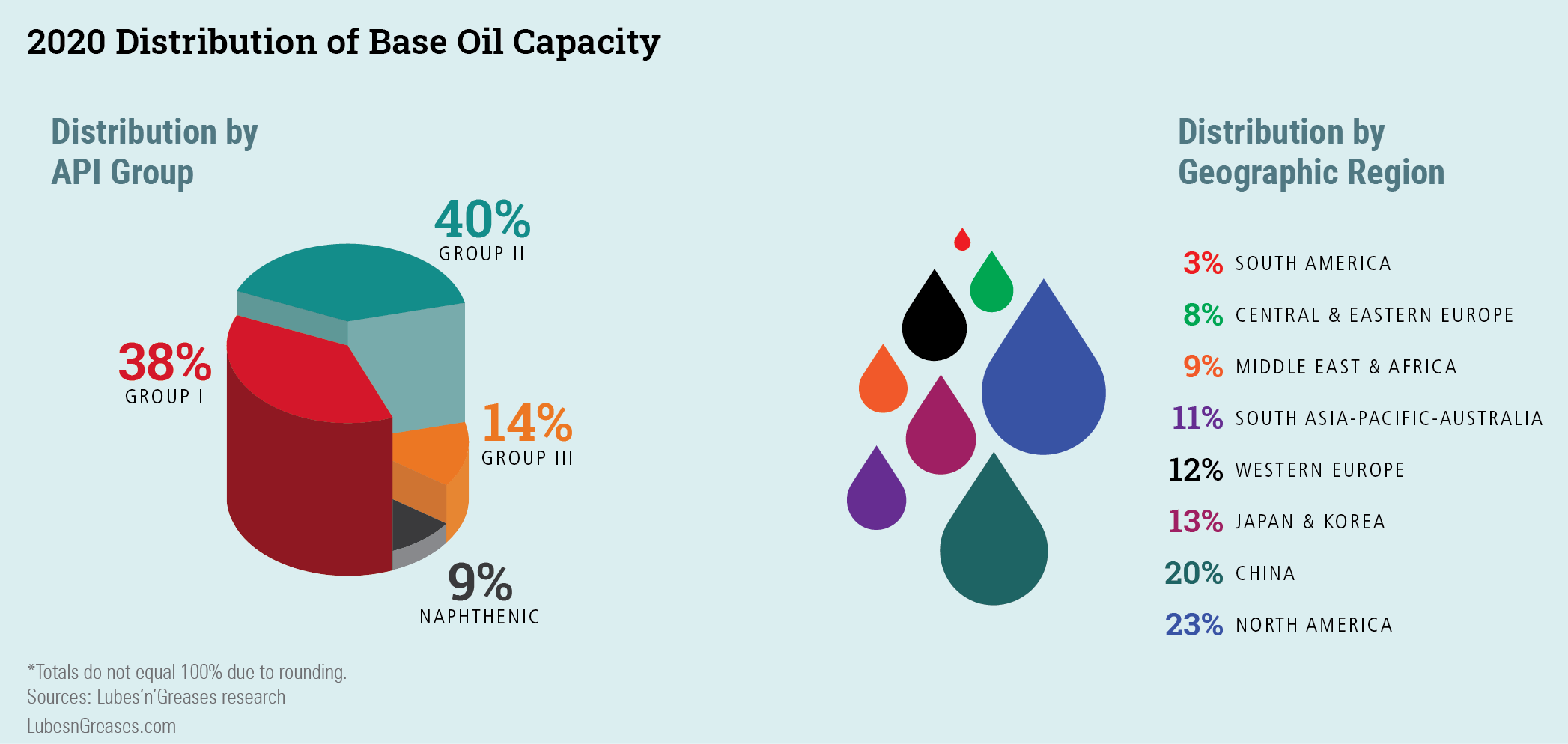

Despite what most insiders agree is an oversupplied market, total global mineral base oil production capacity increased from 1,124,235 b/d in 2019 to 1,189,835 b/d (60.5 million tons per year) in 2020. The 65,600 b/d increase adds just under 6% in only a year.

The spread by API group held steady with Group II keeping the lead it gained last year. Regional distribution is also unchanged.

The LyondellBasell plant in Houston, with capacity of 1,000 b/d API Group II and 3,600 b/d naphthenics, dropped off the map this year. A contract allowing Calumet to market naphthenic base oils from the plant expired last year, and Lyondell decided to shut down the facilities with no specific restart date mentioned.

Avista Oil’s rebuilt 1,300 b/d API Group I rerefinery in Kalundborg, Denmark, is back on the map and expected to be operational in the second half of this year.

But the real news is how lubricant demand, dragged to the floor by the covid-19 pandemic, will affect the base oil landscape through the rest of this year and beyond.

During a webinar on June 9, Ian Moncrieff, vice president of energy with Kline Management Consulting, noted that producers have attempted to deal with the immediate effects of the crisis in multiple ways, including by enacting selective shutdowns. “What the covid-19 pandemic has done is really raise a fundamental question in our minds about how many of these temporary shutdowns will become permanent, because we do have an oversupply of capacity on the market.”

“We may have reached peak demand for lubricants in 2019,” he said. Kline predicts a 15% decline in global lubricant demand this year.

The global base oil capacity utilization rate had already dropped from 84% in 2010 to 78% in 2019, according to Kline. Assuming that base oil demand will decline at the same rate as lube demand, this year’s average utilization rate could be just 67%. “The lower your capacity utilization, the lower your profitability,” Moncrieff reminded listeners.

About 10 Group I plants have shut down over the past several months, he said, not including rerefiners. Moncrieff pointed to ExxonMobil’s 13,500 b/d Group I facility in Singapore as one plant that may or may not start up again. A number of others, including the 7,700 b/d Group I Tupras plant in Turkey, have announced that they will reopen, according to Kline.

Ultimately, Kline expects around 25,000 b/d of Group I and naphthenic capacity to shut down this year, “but another 70,000 b/d or more of excess capacity should be idled, even if demand returns to 2019 levels,” said Moncrieff.

“There is no need for new capacity under almost any circumstances for the next several years, and if lubricant demand actually declines, [no new capacity is needed] as far out as I can see,” he concluded.

It’s likely that next year’s map will look different, though it’s difficult to predict which players will disappear from the count. If you’d like additional copies of the 2020 Guide, you can order them at www.LubesnGreases.com/base-stock-guides.

Caitlin Jacobs is managing editor of Lubes’n’Greases magazine. Contact her at Caitlin@LubesnGreases.com.