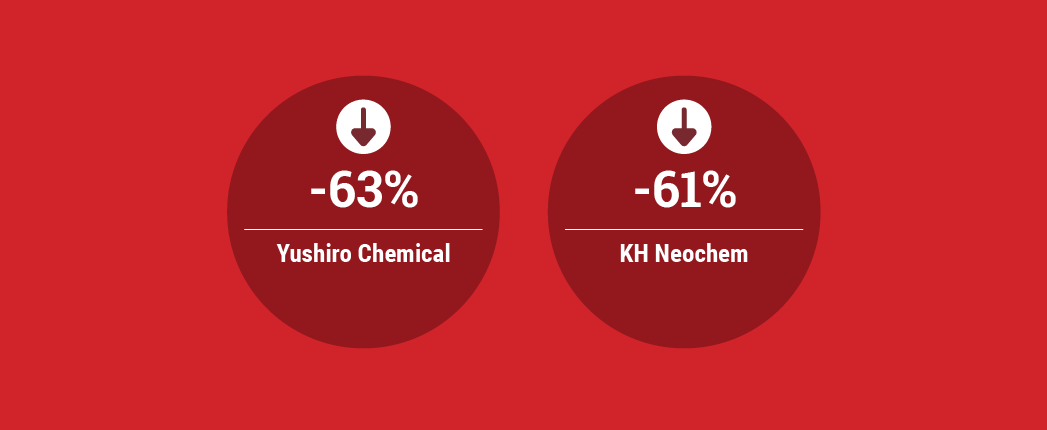

The impacts of soaring raw material prices and lockdowns due to the COVID-19 pandemic hindered second-quarter profits for Japan’s Yushiro Chemical and KH Neochem’s performance materials segment. Yushiro said this was despite revised sale prices, while KH Neochem noted rising logistics costs as another key factor.

Elsewhere in Asia-Pacific, profits fell more than 35% for South Korea’s GS Caltex’s base oil and lubricant business.

Yushiro Chemical

Yushiro Chemical, whose fiscal year ends in March, reported operating income of 196 million Japanese yen ($1.5 million) for the quarter ending June 30 – the first quarter of its fiscal year that started April 1 – a 63% drop from ¥527 million in the same period in 2021.

Sales increased 15% to ¥10.2 billion in the quarter, improving from ¥8.9 billion. The company attributed this increase to general production recovery, although Yushiro noted that production volume at automobile manufacturers – which are major customers – was lower than originally planned due to COVID-related lockdowns and the shortage of semiconductors in China.

Profit for each of Yushiro’s regional business segments is based on operating income.

Within it’s the company’s domestic Japan market, Yushiro reported a 99 million operating loss in the quarter, compared with ¥62 million segment profit in the same period in 2021. Although sales increased because of sales price revisions, domestic losses expanded because soaring raw material prices exceeded the of sales price revisions, the company said.

In the Americas, segment profit declined 14% to ¥244 million, although its QualiChem subsidiary in North America increased its operating profit by 15% to ¥171 million. Sales increased 35% to ¥3.7 billion, the company said, due to strong sales at QualiChem and in Brazil.

In China, segment profit fell 58% to ¥47 million, while sales increased 13% to ¥1.3 billion. Although the country’s automobile production remained firm and sales increased, profits fell because of a rise in the cost of sales, due to soaring raw material prices.

In Southeast Asia and India, segment profit fell 38% to ¥107 million, while sales increased 17% to ¥1.3 billion, with customers’ operating rates showing a recovery trend.

KH Neochem

Japanese specialty chemical producer KH Neochem reported that operating profit for its performance materials segment fell 61% to ¥900 million for the second quarter, compared with ¥2.3 billion yen for the same period last year.

Net sales for the segment decreased to ¥8.4 billion, down 21% from ¥10.6 billion.

The company’s specialties are oxo reactions for production of alcohols and esters. Yushiro sells derivatives, such as 2-ethylhexanoic acid and isononanoic acid, for use as raw materials in lubricants. The company also manufactures fatty acids, esters and feedstocks for refrigeration compressor lubricants.

Sales of air conditioners in China decreased slightly year on year in the first half of the year, the company noted, due to a slump in the real estate market there, the lockdown due to COVID-19 and soaring raw material prices. Although sales volume decreased in the first half of the year due to the Fukushima prefecture offshore earthquake in Japan in March and the extension of large-scale periodic maintenance – among other factors – sales prices remained high in response to soaring raw material prices and rising logistic costs, KH Neochem said in its earnings report.

The company said a project to increase production capacity for refrigeration lubricants raw materials at its Chiba plant is in the engineering, procurement and construction phase.

GS Caltex

GS Caltex reported operating profit of 102.5 billion South Korean won (U.S. $77.2 million) for its base oil and lubricant business in the second quarter, a 36% drop from ₩159.2 billion in the same period last year. Revenue for the quarter increased 37% to ₩557.9 billion, improving from ₩405.8 billion.

The 50-50 joint venture of GS and Chevron has the capacity to produce 1.3 million metric tons per year of API Group II and Group III base oil at its plant in Yeosu and 9,000 b/d of finished lubricants at its blending plant in Incheon.