Need to Know

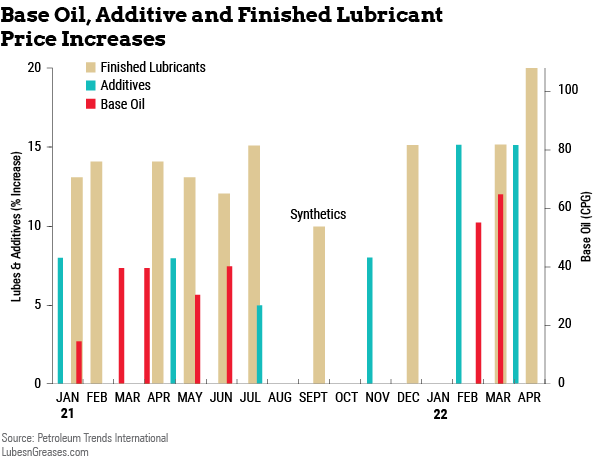

While many of the price increases in 2021 and 2022 are up to 15% and higher—well above the 4%-6% seen many years prior—three majors recently announced increases of up to 25%. Chevron had an increase of up to 25%, which took effect on March 28, while ExxonMobil and SOPUS each had one of up to 25%, taking effect on March 15.

The reasons for the unprecedented magnitude of the recent price increases are the substantial hikes in costs at all levels of the supply chain. These costs include base oils, additives, packaging, transportation, labor and others. Of particular note is the escalating cost of lubricant additives. While the industry may see one to two lubricant additive price increases in any given year, there were four last year. In 2022 there have already been two announced by Afton and Infineum and one by Lubrizol. In addition to this being uncharacteristic in terms of two increases being grouped so close together, the percentage of the increases is more than double those seen in years past. But, as with lubricants, the price increases for additives are also driven by substantially high costs.

With base oil accounting for close to 40% of the material in many additive packages and roughly 30% of its cost, you can be sure the multiple recent increases in base oil prices have driven additive prices up, too. But, in addition to higher base oil costs, the cost of many of the basic chemicals that feed lubricant additive production have also ramped up. Examples of these costs are seen in the price of ethylene and propylene, which have increased more than 35% over prices from the year prior to the pandemic. Similarly, the price of butane, sodium hydroxide, maleic anhydride and other chemicals ramped up. Looking further downstream, the costs to produce many of these key raw materials increased due to the escalating price of crude oil and the monumental increases in supply chain costs for all basic chemicals.

In addition to higher costs driving up prices for materials at every link in the lubricant supply chain, prices have also been pushed up by imbalances in supply and demand—the most notable being the demand for additives outstripping available supply.

For various reasons, supply of lubricant additives fell significantly short of demand in 2021. This affected some lubricant additive manufacturers much more than others. Although many predicted it would catch up in 2022, it still hasn’t, and supply of some additives—particularly certain types of automotive lubricants—remains very tight. In fact, beyond allocations deeper than most have seen in their careers, supply of some products completely dried up at various times over the past year and a half.

With that as a backdrop, there is little wonder why some of the leading lubricant distributors characterize the period we are in as one of playing defense. Rather than proactively seeking out new customers and growing business organically, they are spending an inordinate amount of time managing and implementing price increases, scrambling to secure product for existing customers and explaining the reasons for allocations as well as delayed and canceled orders. In short, they say they are doing far more apologizing and explaining to simply retain and service existing accounts than they are to gain new business and grow.

According to many distributors, while their customers certainly don’t like seeing the rapid fire of price increases, they generally understand the justifications. The reason they do is because they are also experiencing skyrocketing increases in the costs of goods, freight and other expenses in their class of trade. They too understand the economic cycle we are in.

But while they understand the price increases, they are less understanding and accepting of the explanations for allocations and products that they have been using for years being “out of stock.” This is particularly the case when the competition has product available and their supplier doesn’t. Although short supply is an industry-wide issue, some brands continue to struggle more than others, and the disruptions in business and brand switching this creates will long be remembered.

But in the process of working through these challenging times, we are witnessing an important dynamic that can help move marketers from a defensive posture to a proactive one that puts them on a path to organic growth after market prices settle down and we move out of this economic cycle. That dynamic speaks to the value of secure and reliable supply lines. While the price and performance of lubricants will always be important selection criteria for buyers, a marketer’s ability to demonstrate it can consistently deliver products when and where needed will be a decidedly powerful point of differentiation as the business environment improves and marketers move from defense to offense.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com