Afton Chemical posted decreased operating profit for the fourth quarter and full year 2021 along with increased sales, while Valvoline saw an increase in sales and mixed results in operating income for its two segments for its fiscal quarter ending Dec. 31.

Afton Chemical

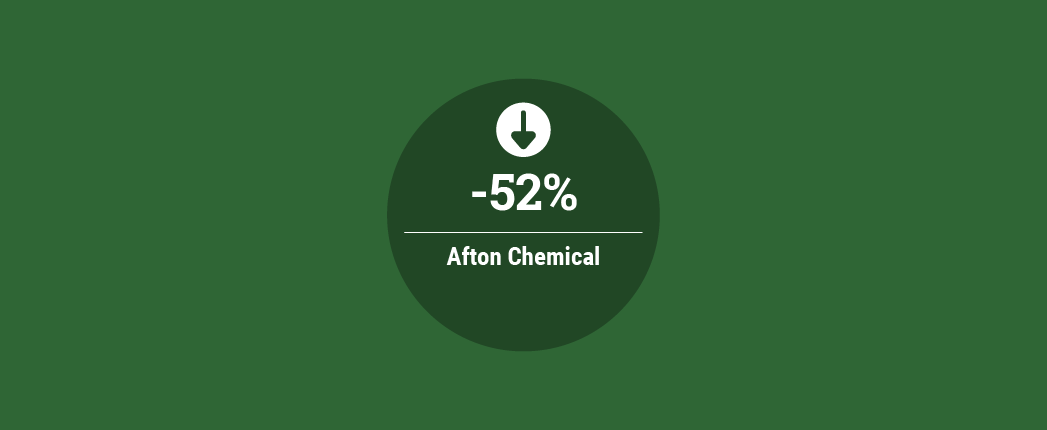

NewMarket Corp.’s Afton Chemicals petroleum additives business reported operating profit of $40.7 million for the fourth quarter ending Dec. 31, down 49% from the same period in the previous year. For the full year, operating profit was down 16%, from $333.2 million in 2020 to $281.1 million in 2021. The decrease was mainly due to higher raw material and operating costs, partially offset by increased selling prices, the company stated in its financial report.

Sales for the segment climbed 9% to $573.4 million for the fourth quarter. It also posted a 15% increase in sales for the full year to $2.3 billion.

Richmond, Virginia-based NewMarket reported net income of $17.2 million for the quarter, or $1.65 per share, down 74% from $66.9 million, or $6.12 per share. Net income for 2021 totaled $190.9 million, or $17.71 per share, a 42% drop.

“While we have made some progress in adjusting our selling prices to offset the effects of the higher costs, we have not been able to adjust sufficiently to offset the cost increases,” the company said in its earnings news release. “We continue to see a lag between when price increases go into effect and when we begin to see margin recovery. This lag will continue until we see a period where raw material prices stabilize. We have also seen significant increases in many elements of our operating costs such as utilities, logistics, insurance, and third-party manufacturing services. In addition, the worldwide supply chain disruptions continue to negatively impact our business.”

Valvoline

Operating income for Valvoline’s Retail Services segment increased 45% to $81 million for its first quarter, which ended Dec. 31, while its other segment, Global Products posted a 20% drop in operating income to $70 million.

Retail Services’ sales grew 36% to $346 million. Global Products sales totaled $512 million, a 28% climb. The segment’s lubricant sales also rose 13% to 43.1 million gallons.

The quarter ending Dec. 31 is the first quarter of Lexington, Kentucky headquartered Valvoline’s fiscal year.

“Topline growth in both segments was impressive with a 36% increase in sales for Retail Services and a 28% increase in sales for Global Products, highlighting a strong start to the fiscal year and a reflection of the health of both businesses,” Valvoline CEO Sam Mitchell said in the company’s financial release. “We continue to be pleased with strong demand in Global Products, as we navigate short-term supply-chain challenges. Retail Services topline performance remains strong as our algorithm of same-store sales growth and unit additions continues to deliver. We do expect our same-store sales to moderate as we compare against strong comps in the prior year.”

In May of 2021, Valvoline announced it would restructure its business model for the third fiscal quarter of this year, renaming its Quick Lubes segment to Retail Services and consolidating its Core North America and International segments into Global Products. Retail Services comprises Valvoline’s oil change stores in the United States and Canada, while Global Products focuses on sales of lubricants and other maintenance products through channels other than quick lubes.