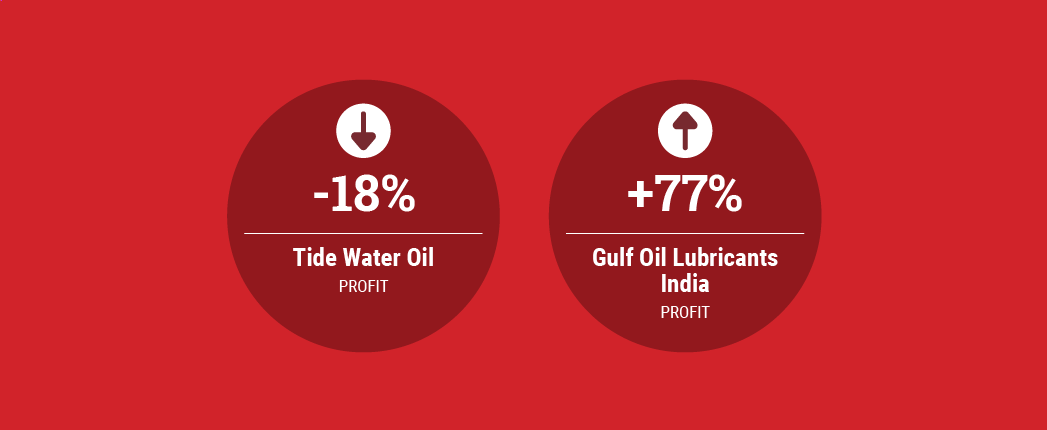

For the quarter ending June 30, Tide Water Oil reported a decrease in profit, while Gulf Oil Lubricants India, Maximus International, Continental Petroleums and Lanka IOC all reported higher profits, compared to the same period in 2020.

Tide Water Oil

Tide Water Oil reported standalone profit of Rs 12.2 crore for the quarter, down 18% from Rs 14.8 crore a year earlier and 44% below its Rs 21.7 crore mark in the same period in 2019.

The manufacturer and distributor of Veedol-branded lubricant said revenue from operations increased 31% to Rs 215.2 crore, up from Rs 164.8 crore but 27% below the Rs 295.7 mark in the same period in 2019

Total expenses for the quarter were up 39% at 209.2 crore, compared with Rs 150.1 crore, but were below by 22% the Rs 269.4 crore mark in the same period in 2019.

Tide Water Oil said in its filing that the government-imposed nationwide lockdown and restrictions due to the COVID-19 pandemic had some impact on the company’s production and sales. “However, the company’s operations have gradually come back to pre-COVID level,” it stated.

Gulf Oil Lubricants India

Gulf Oil Lubricants India Ltd., a Hinduja group company, reported net profit of Rs 30.4 crore for the quarter ending June 30, improving 77% from Rs 17.2 crore in the same period last year, but down 38% from Rs 48.7 crore in the same quarter in 2019.

Total income for the quarter grew 69% to Rs 428.2 crore, up from Rs 254.1 crore. This was only 5% below Rs 449 crore total income in the same period in 2019.

The Mumbai-based company said revenue from operations for the quarter grew 73% to Rs 417.4 crore, up from Rs 241.2 crore, and was 5% shy of Rs 440.7 crore in the same quarter in 2019.

“With the rapid spread of second wave of COVID-19 hitting the country very hard during April and May, market conditions – especially in retail – deteriorated sharply, but this time around, the business-to-business segment has been less impacted as most industries continued to function in the state level lockdowns announced from time to time in a phased manner,” Managing Director and CEO Ravi Chawla said in the company’s earnings news release. “This enabled the company to garner volumes from its B2B segments to deliver good year-over-year growth.

“With the second wave subsiding from June onwards, markets started opening up, which led to demand conditions across the segments significantly improving, and we are seeing robust volumes now,” he said. “The company is focusing on continuing its market leading growth journey and is geared up to face the challenges of unprecedented rise in input costs with a series of price interventions already taken to move towards restoring margins in coming quarters.”

Maximus International

Maximus International Ltd. reported consolidated net profit of Rs 1.1 crore for the quarter, up 57% from Rs 0.7 crore for the same quarter last year. This also improved by 120% from Rs 0.5 crore in the same period in 2019.

The Indian company, based in Vadodara, Gujarat, said consolidated revenue from operations increased 55% to Rs 18.7 crore, compared with Rs 12.1 crore. This was 228% higher than Rs 5.7 crore in the same quarter in 2019.

The lubes and base oils trader said in a regulatory filing that other income for the quarter rose to Rs 1 crore, up 400% from Rs 0.2 crore. That was an increase of 233% from Rs 0.3 crore in the same period in 2019.

Total expenses for the quarter reached Rs 18.5 crore, up 63% from 11.4 crore and up 244% from Rs 5.4 crore in the same period in 2019

Continental Petroleums

Continental Petroleums Ltd., a lubricant and grease seller based in Jaipur, India, reported net profit of Rs 0.85 crore for the quarter, jumping 233% from Rs 0.25 crore in the same period last year and up 270% from Rs 0.23 crore in the same period in 2019.

Total income – including revenue from operations and other operating income – rose 189% to Rs 29.5 crore, improving from Rs 10.2 crore, and surpassing by 80% the Rs 16.4 crore total income mark for the same quarter in 2019.

Total expenses for the quarter skyrocketed 189% to Rs 28.3 crore, up from Rs 9.8 crore and 76% higher than Rs 16.1 crore in the same period in 2019.

Lanka IOC

Lanka IOC PLC reported a net profit of 273.1 million Sri Lankan rupees (U.S. $1.4 million) for the quarter ending June 30, rebounding from a net loss of Rs 795.5 million in the same period in 2020 and improving from a net loss of Rs 239.2 million in the same quarter in 2019.

Revenue for the quarter reached Rs 16.9 billion, improving 58% from Rs 10.7 billion, though 8% below Rs 18.4 billion in the same period in 2019.

In its interim financial statement to the Colombo Stock Exchange, Lanka IOC reported an operating profit of Rs 78.2 million for the quarter, rebounding from an operating loss of Rs 1.2 billion operating loss and improving on an operating loss of Rs 280.1 million in the same period in 2019.

Lanka IOC is a subsidiary of India’s public sector utility Indian Oil Corp.