Picture a refinery and you probably think of the endless industrial landscape of the Texas Gulf Coast, not the rolling hills and pine forests of Anatolia. But down an orange-dirt track near the town of Osmaneli in Turkey is the freshly minted Tayras waste oil rerefinery. The plant is Turkey’s first rerefinery and the first plant of any kind to produce API Group II base oil in the country.

In Turkey, a country that according to the national statistics bureau recovers only 12% of its municipal waste yet imports 11.4 million metric tons of trash from its European Union neighbors, the opening of such a plant is a significant event. It also could signal the start of a gradual upward trend in recycling in general.

“Turkey offers significant opportunities to make advanced technology investments in the recycling sector. And we are going to be a pilot, a part of this,” Tayras Chairman Mehmet Afsin told Lubes’n’Greases during a visit to the site in November.

The view outward from the plant is a bonus for workers, but the selection of the site in 2016 was motivated by practicality. Turkey is 783,562 square kilometers, roughly twice the size of California, and easy access to as many parts of the country as possible was a key factor.

“We didn’t pick this spot because we found it very beautiful. We considered the collectability of the raw material and the logistics in Turkey. For six months, our friends in logistics only worked on the country’s state railways, sea routes and roads and found the best common point, and that’s here, Osmaneli-Bilecik,” Afsin said.

The Tayras rerefinery is located near a highway, allowing easy access to supplies of waste oil feedstock from the capital, Ankara, in the east, the industrial port areas of Izmit and Gebze in the north and the country’s most populous city, Istanbul, just beyond. It also has its own single-track railway spur that the company intends to be the main delivery route for finished products.

Technology Selection

The initial discussions for building the plant began in early 2009, and it took another two years of research into the project’s feasibility before solid plans were made. The company then spent several years examining the technology and operations of plants around Europe and the United States, contacting producers including Avista in Denmark and Puraglobe in Germany for guidance.

One of the company’s consultants was involved in developing the technology used by Avista. Another is president of GEIR, the rerefining branch of the Union of the European Lubricants Industry, or UEIL.

The decision was made to produce Group II based on the prevailing market conditions in Turkey, based on the country’s growing demand for that grade.

“In the past, we did not have smart phones. Today, nobody uses any old-fashioned phone; everyone outside has smart phones. Group I base oils are like this. Of course there is a large, established sector that uses it, but the model and opportunity is moving toward upgrade to Group II+ base oil,” Afsin said.

By 2018, two years after site selection, the environmental impact assessment began.

Technology was sourced from a number of providers, and equipment was manufactured by a combination of local and overseas companies, said Aydin Ozbey, Tayras’ general manager and former head of the waste oil collection program at Petder, the country’s oil industry association.

Operations

Currently, trucks deliver waste oil by road, but the intention is for cargos to arrive by train beginning next year when construction of the railway spur is complete.

The site’s process manager, Ertugrul Kilic, explained the stages of refining. The waste oil is tested in the onsite lab straight away. Shipments that contain more than 20 parts per million of polychlorinated biphenyl or 10,000 ppm of chlorine—levels that are more stringent than officially mandated—are rejected and sent for proper waste treatment. PCBs are carcinogenic and must be treated as hazardous waste.

It is then unloaded into reception and screening tanks from where treatment begins—pre-treatment, distillation and then hydrotreatment at 125 bar (12,500 kilopascals), the highest pressure of any hydrotreaters at rerefineries around the world, said Ozbey, a calculated risk to enhance quality. The plant could, if given the ideal waste oil feedstock, produce an API Group III base oil.

Commissioning was scheduled for completion in early December with certification by the Turkish Standards Agency at the end of that month. Start-up is planned for February.

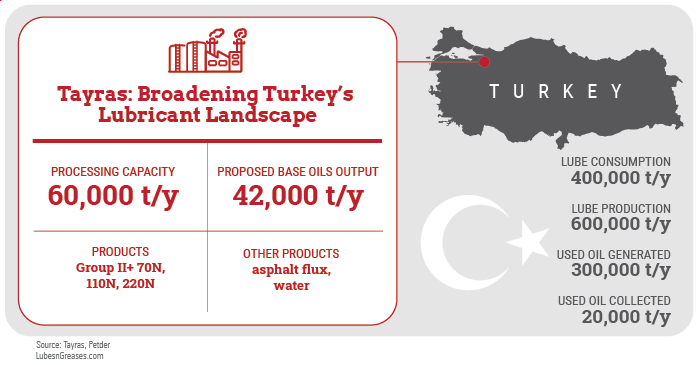

The plant produces three grades of Group II oil—70 neutral, 110N and 220N, marketed as Group II+ oils called Tidrabase. It also produces a few other byproducts, chiefly an asphalt flux, which can be used by asphalt producers as a viscosity modifier. The flux also contains much of the additives and metal particles extracted from the waste oil, which adds stability to the end-use applications.

Another product is a low-hydrocarbon-number fuel in the naphtha range used in the burners and steam boilers. Apart from ash, the plant’s only other output is irrigation water from the refinery process.

Feedstock Collection

Industry consultancy Kline & Co. estimates that about 50% of used motor oil is rerefined in Europe. This amount falls to between 10% and 15% in North America. In Turkey, it is estimated by Petder to be as little as 7%, despite a law mandating collection.

Turkey produces about 300,000 t/y of waste oil, including automotive and industrial, of which 20,000 is collected for free by Petder, the only licensed collector at this point. According to the Petder website, the collected oil is regenerated into usable products or incinerated. The remaining 280,000 tons is either uncollected or sold illegally at 1,200-2,000 lira (U.S. $150-255) per ton, depending on whether it is used motor oil or industrial oil, and resold as substandard lubricants such as molding oil and monograde motor oil, which is also used as a cheap diesel substitute. Coach buses are a staple mode of intercity transport in Turkey, and news of them combusting due to use of this dodgy fuel is all too common.

It is easy to see why workshops are tempted to sell used oil rather than have it properly collected. In order to secure a steady supply of feedstock, Tayras intends to pay a premium through a network it established in advance, which should also help keep a lid on bootlegging.

The plant has capacity to process 60,000 tons per year of waste oil and will output 42,000 t/y of base oil.

Market Impact

There is an easy case to be made for rerefining waste oil back into base oil from an environmental and sustainability standpoint. It is part of the consensus that hydrocarbons extraction should be scaled back to reduce carbon emissions and for the global economy to operate more sustainably.

But in countries such as Turkey that rely on imports of hydrocarbon products, rerefining becomes a matter of supply security and greater economic autonomy. This also applies to other resources such as plastics and metals.

“Used oil is a strategic feedstock, not waste,” Afsin said. “Due to COVID-19, all countries are trying to reduce dependence on imports and are trying to survive on their own production.”

Waste oil can be rerefined again and again. This offers an opportunity to draw back on imports, which would be beneficial given that the Turkish lira lost about a quarter of its value against the dollar this year over worries about the government’s economic and foreign policies.

Consumption of Group II grades is around 55,000 t/y, and while Tayras’ projected output could meet some part of that demand, there is no substantial market for Group II outside of major multinational companies operating in the country, according to one Istanbul base oil trader who asked not to be named.

The entrance to the new Tayras rerefinery in northwestern Turkey, the country’s first domestic source of API Group II base oils. © Tayras

“It can easily find itself a place in the market, but only in the second league of players—certainly not majors,” he said.

Recycled Group II is unlikely to replace imported virgin material, but it could make a dent in Group I sales and reduce smaller players’ formulation costs, he speculated.

The country’s lone base oil producer until now has been Tupras in Izmir, from which sporadically trickles virgin Group I oil, mostly used in industrial applications by the sizeable domestic manufacturing sector. Imported material from producers in the Mediterranean and Middle East satisfies the rest of the country’s base oil demand, which is about 375,000 t/y.

The plant’s impact on the domestic base oil market will become clear when it is operating at full tilt and the aftershocks of the COVID-19 pandemic fade. But its effects on the Turkish rerefining and waste management sector will be substantial.

Turkey’s waste oil sector is yet to mature, said Ozbey, and that applies across the board, requiring significant investment. This leaves plenty of room for growth, like the lone tree within the confines of the site left standing during construction.

Simon Johns is an editor with Lubes’n’Greases. Contact him at Simon@LubesnGreases.com.