Electrification of the global vehicle parc is coming, but will it swoop in like a blizzard or creep in at a glacial pace? The answer is somewhere in between, experts agreed at recent industry meetings. In the meantime, advances in traditional lubricants, including those for hybrid engines, will continue to be important to achieving sustainability goals.

In a presentation during the ICIS Middle East & Africa Base Oils & Lubricants virtual conference in October, Adam Banks, e-mobility marketing manager for Afton Chemical, contended that vehicles powered by internal combustion engines will be overcome by electric options, calling e-mobility a “global megatrend.”

Joan Evans, industry liaison manager, Americas, for Infineum, expressed a similar opinion. “Electrification is a long-term direction for transportation propulsion,” she asserted in a presentation given during the Independent Lubricant Manufacturers Association’s virtual annual meeting later that month.

However, the rate of electric vehicle adoption will vary for different modes of transportation, as some modes present more technical and practical challenges than others.

“Small engines have already moved to electric options; motorcycles are electrified. As the engine size increases, the pace of change is impacted due to complexity,” Evans explained. “Hybridization is the current technology being employed in passenger cars due to lower technical hurdles and economics. Heavy-duty has freight weight and long-haul charging challenges. And shipping, which may move to natural gas next, will be the last to electrify.”

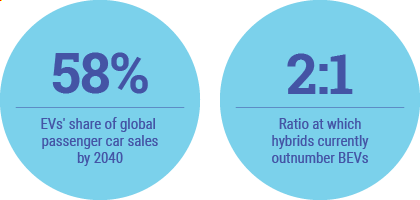

Despite these challenges, hybrids and battery EVs are considered the two endgame technologies, according to Evans. “We see today that full hybrids outnumber BEVs two to one. But as early as 2026, we expect to see rapid growth and a shift to more of a 50-50 split between BEVs and full hybrids.”

Looking forward, there will be an increase in EVs’ share of new passenger car sales in all markets and regions. By 2040, Evans said EVs are predicted to make up about 58% of global passenger car sales. Parts of Europe and China are set to phase out ICE vehicles before other regions, driven by strong government regulations and incentives. As analysts continue to revise their prediction models, the trend accelerates. The car parcs in some regions are expected to be made up of 30%-50% EVs in 20 years.

The ever-increasing global concern with climate change and sustainability will be another factor in chilling ICE technology. Evans explained that several “major movers” have made public commitments to achieve certain sustainability goals, many of which include phasing out ICE fleets in favor of electrified transportation options. For example, in the United States, Amazon bought 100,000 electric delivery vans as part of its sustainability efforts, and retailer Walmart followed suit by placing an order for 45 electric semitrailers, one of the largest orders that EV maker Tesla has received.

Pandemic Slows Progress?

While EVs have been making great strides in the three hotspots of North America, Europe and Asia, the onslaught of the COVID-19 pandemic has presented a sizeable roadblock. According to Evans, this is suggested by the growing interest in the used car market, which currently consists mostly of ICE vehicles. And as more people have moved away from cities, drivers may place more value on cars with traditional powertrains and longer ranges.

Additionally, “as [OEM] spending slowed, we saw some resource allocation away from BEVs,” she said.

The pandemic also forced several automakers to suspend or greatly reduce production of new vehicles, including EVs, while worldwide lockdowns were in effect. Ford Motor Co., like many other manufacturers, announced in mid-March that it would halt all of its North American production in order to thoroughly clean and disinfect all worksites. About a week later, the automaker also suspended production at several other sites around the globe and didn’t resume in North America until May 18, according to a press release. Lucid delayed the launch of its electric luxury Air sedan, and in the U.K., iconic sportscar company Aston Martin shelved its EV development altogether.

However, it is possible that these may prove to be short-term factors, as the industry has already seen production and R&D return closer to pre-pandemic levels. In fact, Kevin Kelly, senior manager of product and brand communications for GM, said the pandemic has not been much of a setback for the automaker. “We’ve remained committed to an all-electric future, and our teams have continued working on our EV programs through the pandemic.”

“The pandemic certainly slowed things down in our whole industry,” said Evans, “but the trend is still moving toward electrification.”

There are other notable factors that may slow the rate at which ICE vehicles are phased out, one of which has to do with how long consumers drive the ICE vehicles that they currently own. The average age of the car parc in the U.S. is just shy of 12 years, and it is nearly 11 years in Europe. Assuming that trend continues, it will take some time for new ICE vehicles being sold now and in the next few years to be replaced by electric options. “There will be a decline in the internal combustion engine production, but the parc replacement [rate] is only about 4% a year,” said Evans.

Banks pointed to other widely known factors that have slowed the rate of EV adoption, such as a lack of adequate charging infrastructure, as pointed out by ACEA in its second annual sector report, the higher cost of EVs, the potential lack of availability of materials used to make EV batteries and insufficient battery range. Yet advances in battery range and materials have been rapid lately, with major manufacturers boasting ever-longer distances and reduced reliance on materials from often conflict-stricken parts of the world.

Lube Evolution

Some industry experts have predicted that new developments in ICE technology will slow as soon as next year. “While the timing is uncertain, the direction is clear,” said Evans. “The demand for energy will increase. There will be limited new specs for internal combustion engine lubricants because the OEM hardware changes will decrease over time. We see sustainability becoming more important as a product attribute, and consumer buying practices will evolve.”

What does this mean for the lubricants industry? Evans answered, “Ultimately—we don’t know when—as vehicle sales of the internal combustion engine fall, the volume of engine oil required will drop.”

According to Banks, this drop in demand, in addition to other factors, will require lubricant manufacturers to change up their product portfolios, focusing more on hybrid-specific engine oils, as well as specialty greases, battery coolants and transmission fluids for full EVs. Many marketers, such as Valvoline, Pennzoil and Motul, have already launched hybrid engine oils.

Evans stated that some of the challenges associated with developing hybrid and EV lubes include managing the repetitive cold-duty cycle of plug-in hybrids, meeting traditional transmission lubrication requirements in addition to e-specific requirements such as dielectric stability, and adequately cooling electric motors.

There are also issues of compatibility. E-fluids must be compatible with more exposed copper and the various coatings, plastics and sealants used in EVs. In addition, these lubes must ensure that there are no electrical shortages or current leaks, while also preventing static charge.

Banks added to the list of challenges, stating that most e-fluids are fill-for-life and must be able to maintain their performance properties even when the fluid has aged.

For now, though, “combustion engine innovations are still very much part of the drive to reduce emissions of greenhouse gasses. We need to realize all possible further efficiencies. New [ICE] lubricants are key enablers,” explained Evans.

For example, gasoline particulate filters might be required to meet new emissions regulations, which may call for the development of even lower-ash oils. Lower-viscosity fluids will also be needed to reduce drag and decrease energy loss, while still doing their core job of dissipating heat and lubricating parts.

OEMs Push EVs

While legislation and purchase incentives in countries around the world have been largely credited with the growing popularity of EVs, original equipment manufacturers should receive their fair share of the credit.

“There’s been a lot of news coverage about OEMs making decisions on their future R&D budgets. While there are new [ICE technology] developments announced from Mazda, Nissan, Toyota and others, the bulk of the OEM resources are shifting toward electrification,” said Evans.

For example, Volkswagen announced that its very last ICE design is expected to debut in 2026, and the company plans to cease producing ICEs altogether by 2040. It is going all-in on its modular electric drive matrix platform across its myriad sub-brands.

Similarly, Daimler announced in 2019 that it had no major ICE platforms in its research & development queue, and Evans speculated that the company’s timing would be similar to VW’s in order to comply with the terms set forth by the Paris Accord.

General Motors is fostering an ambitious goal to sell 1 million EVs per year in its two largest markets, North America and China, by 2025. In October, the automaker also announced a $2 billion investment to transition its Spring Hill, Tennessee, location into an EV manufacturing plant. The Cadillac Lyriq will be the first EV produced there.

So, vehicle manufacturers are clearly developing and producing EVs, but are consumers buying them? According to GM’s Kelly, the answer is yes. “We have sold more than 14,000 Chevrolet Bolt EVs in the U.S. through the third quarter of this year,” he told Lubes’n’Greases. The Bolt is GM’s best-selling electric model and can travel up to 259 miles on a full charge, as per the EPA-estimated range.

Aside from the Bolt, GM has partnerships in China that produce a handful of models exclusively for that market.

Furthermore, Kelly affirmed that GM has plans to introduce 20 new EV models in the near future. The company has already unveiled its new Cadillac Lyriq and GMC Hummer EV models, which are set to hit the market in the next couple of years.

For now, ICE vehicles are generally more affordable than comparable electric models. According to Kelly, the base manufacturer’s suggested retail price for the Bolt is $36,620. One of its ICE counterparts, the Chevrolet Cruze, starts at $17,995. Buyers in California can claim up to $6,250 in tax and purchase incentives, bringing the price within a more comfortable range.

Evans predicted that “we can expect price parity with the internal combustion engine and BEVs in some regions as early as 2022. In the long-term outlook, complexities of the plug-in hybrids and the lower cost of batteries will cause the BEVs to win out.”

Sydney Moore is assistant editor for Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com.