Unboxing July

July turned out to be another busy month for base oil market participants, which is a far cry from years past when the summer months would typically usher in softer consumption levels along with muted pricing activity.

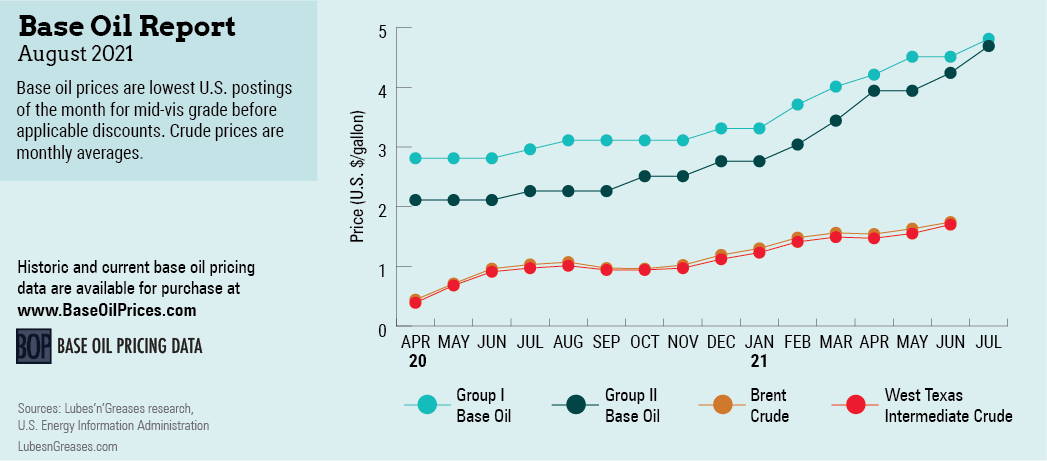

Demand remained unusually healthy throughout June and during the first half of July, supporting somewhat surprising increase initiatives. Chevron, ExxonMobil and Avista Oil introduced a price increase in mid-June—the sixth round of markups since the beginning of the year—and were quickly followed by a majority of base oil producers. The initiatives were driven by persistent supply tightness, healthy demand, rising spot prices and firm crude oil and feedstock values.

The paraffinic base oil increases ranged from 15 to 55 cents per gallon, depending on the grade and whether the supplier had participated in all the previous rounds of price hikes.

Shortly after paraffinic producers raised their prices, naphthenic producers followed suit, announcing increases of their own, with Cross Oil being the first to raise prices by 30 cents per gallon in early July. The company explained that the increase was driven by the steeper cost of crude oil as well as in-bound transportation. Other naphthenic producers—including Calumet, Ergon and San Joaquin Refining—introduced similar price adjustments.

The snug supply situation in the naphthenic segment was compounded by an unplanned outage and force majeure declaration at the Valero refinery in Three Rivers, Texas, following a fire there on June 6. The damage to the fuels unit forced the Valero refinery complex to shut down, and a restart was not expected until mid- to late July.

A majority of domestic suppliers focused on meeting contractual obligations and were left with little to no availability for spot and export business. Many customers have remained on allocation since February, when a freezing winter storm disrupted production in large swaths of the United States, particularly the Gulf Coast region. Ergon lifted the force majeure on Group I and II supplies from its Newell, West Virginia, refinery on July 7 as the unit was restarted following a fire on May 29.

Supply of the heavy grades in both the Group I and II categories was especially scant beyond those barrels allotted to contract shipments. Bright stock continued to be the belle of the ball as many buyers were intent on finding supplies. However, they remained elusive. A majority of players have also been unable to build emergency stocks ahead of the hurricane season, which started on June 1.

At the same time, a slight oversupply of light viscosity grades in Asia prompted suppliers to look for takers beyond the region, and a number of light-grade parcels were shipped from South Korea to Brownsville, Texas. From there, they were likely to then move on to Mexico—where consumers use base oils for fuel blending—and other Latin American destinations.

The base stock supply shortages and climbing prices in the United States prompted manufacturers of lubricants, greases, additives and other products to communicate price increases between 5% and 19% for implementation in late July and August. These followed a series of similar initiatives during the previous months.

A shortage of certain base oils and additives also triggered reduced production rates or brief shutdowns at blending facilities and forced manufacturers to place customers on allocation.

Base oil shortages were also reported in Europe and Asia, where prices have skyrocketed since the last quarter of 2020. However, the availability of a number of grades had started to improve by July as plant turnarounds were completed and a more balanced supply-demand scenario was starting to emerge.

Spot prices in Asia stabilized, although a number of grades were still exposed to upward pressure due to strained supply levels. In Europe, prices in general were hovering at all-time highs, and availability of most grades was still extremely limited.

Just like a box received in the mail may reveal an unexpected gift, what may occur in the next few months in base oil segments remains a bit of a mystery. Since the start of the coronavirus pandemic, the market has displayed atypical patterns, and it may be some time before a more familiar and reliable environment is reestablished.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com