In effect since the start of the year, the International Marine Organization’s 2020 international convention was implemented to reduce air pollution from ships. Increased use of compliant fuels has directly impacted the types of marine cylinder oils used on sea-going vessels, industry sources told Lubes’n’Greases. But problems observed in ship engines indicate that the industry needs to keep working to create the right oils for the job.

Under IMO’s regulation, ocean-going vessels operating most anywhere—except for emission control areas that line coasts of the Baltic, North and Caribbean seas, as well as the coasts of Canada and the United States—have three paths to compliance: to employ scrubbers that capture sulfur emissions, to burn fuel oil with maximum 0.5% sulfur or to burn liquefied natural gas, which emits almost no sulfur. Sulfur emissions have been targeted because they are harmful to human health and cause acid rain.

Because a large number of ships now use very low-sulfur fuel oils, there has been a shift away from the use of base number 70 and BN 100 cylinder oils, according to Ronald Brand, Chevron Oronite’s marine product line specialist.

“The majority of the vessels, which are running on 0.5% sulfur fuels, have transitioned to BN 40 marine cylinder oils. In general, we have seen a strong increase of BN 40 products demand and a decrease of BN 70 products,” Brand said in emailed comments in September.

Roman Miroshinichenko, head of St. Petersburg, Russia-based Gazpromneft Marine Lubricants, confirmed this shift, explaining that “75% of our company’s total sales of cylinder oils in the first quarter of 2020 were products for engines that use low-sulfur or very low-sulfur fuel oils, compared to the same period last year when 79% of cylinder oil sales were oils for engines that use high-sulfur fuels [with up to 3.5 percent sulfur].”

|

“The majority of the vessels, which are running on 0.5% sulfur fuels, have transitioned to BN 40 marine cylinder oils. In general, we have seen a strong increase of BN 40 products demand and a decrease of BN 70 products.”

– Ronald Brand, Chevron Oronite

|

The transition to low-sulfur fuels has been relatively smooth, with a limited number of vessels detained for breaching the rule and using banned fuel, according to Caroline Huot, who was global head of lubricants for Singapore-based marine fuel and lubricant distributor Cockett Marine Oil at the time of the interview. She is now senior vice president with shipping company Delta Corp.

However, because compliance with IMO 2020 has been so commonplace, supply issues have emerged. “The demand for BN 40 [cylinder] oil increased dramatically in the fourth quarter of 2019 and in 2020, creating availability issues in certain geographies,” Huot explained. This included ports in the Caribbean, Central and South America, most of Africa, the Indian and South Pacific Oceans, and some smaller ports in the Middle East.

Multiple factors contributed to the supply problems, she continued. While BN 40 cylinder oil manufacturers slowly rolled out their new products at the end of 2019, some oil majors were trying to dispose of existing stocks of BN 55–70 products in places like East and West Africa before replenishing with lower-base number oils. With bulk storage already in use for the higher-base number oils, there was no place to store BN 40 products in some ports.

Low BN Goes Bump?

In addition to some supply challenges, both Brand and Huot stated that low-base number oils have caused some unexpected hardware issues. A lubricant’s base number measures its ability to neutralize acidic byproducts of combustion, which are caused by the sulfur in the fuel oil.

For example, “A BN of 70 for a typical slow-speed engine cylinder oil means that a quantity of acid equivalent to 70 milligrams of potassium hydroxide is required to neutralize the alkaline additives present in one gram of this oil,” according to a white paper from Chevron.

During combustion, sulfur in fuels is oxidized to sulfur dioxide and sulfur trioxide. Some of these molecules combine with water during combustion to form acids that are extremely corrosive to engine components. To prevent corrosion, formulators employ agents that neutralize the acids, like oil-soluble bases such as calcium salts.

However, using oils with a base number that is too high could lead to deposits in the engine and other equipment, such as the turbocharger, Brand explained. The deposits can cause wear or scuffing in the engine or fouling of the turbocharger. “Therefore the OEMs’ desire is to have a marine cylinder oil with the right amount of BN to neutralize the acids but with enough cleaning capacity to keep the engine clean,” he said.

Despite the lower levels of sulfur in fuels, ship operators and lube formulators have confirmed the emergence of problems such as liner wear with BN 40 oils, most likely stemming from the oxidized sulfur. “We observed operational issues onboard such as feed rate adjustments, calcium deposits on the piston crown and liner wear,” Huot said. “With the growing number of vessels using BN 40 cylinder oil in combination with very low-sulfur fuels, concerns began to emerge for various parts of the industry, including lubricant suppliers, ship operators and original equipment manufacturers.”

Huot conceded that although BN 40 cylinder oil has been recommended by engine manufacturers, “it was not a silver bullet, but rather the best compromise available.”

Meanwhile, MAN Energy Solutions, a German marine engine designer, published in May new lubricant guidelines recommending a higher performing BN 40 cylinder oil for their latest engine designs. The guidelines divide oil performance into two categories. Category II cylinder oils, which are being recommended, have “excellent overall performance with a special focus on cleaning ability,” MAN stated in its service letter. “The first cylinder oils to go through the Cat. II [testing] process have been the 100 and 140 BN oils, and the aim is that the other lubricant grades will follow, such as the 40 BN oil.” Until such product is widely available, the advice from the OEM is to alternate between BN 40 and BN 100 oils.

However, in a webinar hosted by Riviera Maritime Media in July, Kjeld Aabo, director of new technologies and two-stroke promotion for MAN, said that alternating between low and higher BN oils “calls for a lot of work onboard, and that’s not the solution. The solution is to come forward with a BN 40” cylinder oil that is better suited for use with very low-sulfur fuels.

MAN also published a service letter withdrawing their approvals for the majority of low-BN cylinder oils such as BN 25 and BN 15.

Searching for Solutions

In a white paper, Lubrizol claims that “in the new, low-sulfur era, the traditional lubricant indicator of base number … will be only part of the equation. New refinery processes and fuel blend stocks used to produce VLSFOs, as well as the expected incompatibility between these fuels, could lead to engine condition challenges that can only be tackled effectively with new lubricant additive chemistries.”

During the Riviera webinar, Ian Bown, technical manager of marine diesel engine oils for Lubrizol, concurred. “Historically, the capability to neutralize the acid was really the index that we used for how a lubricant was selected; we selected on base number. Today and into the future, we’ve got to consider how we decouple acid neutralization from piston cleanliness. As we’ve seen, the focus has shifted more toward piston cleanliness and ring pack cleanliness, but we’ve got to remember that we’ve got to maintain some acid neutralization.”

Detergents have traditionally been an important tool used in marine oil additive packages to neutralize acid, reduce deposits and prevent corrosion, and they still are. However, detergents alone have fallen short of adequately protecting marine engines running on very low-sulfur fuel oil, the additive maker said.

Fortunately, new chemistries have begun to emerge that can help address the problems seen on the seas. In its white paper, Lubrizol stated that it has developed and tested a new additive package formulated with “dispersant chemistry that is new to the marine lubricant sector.” The chemistry is specifically intended for use in low-BN cylinder oils to improve piston cleanliness with reduced deposit formation in piston ring grooves and piston lands.

Scrubbing Away the Problem

In part due to the engine problems associated with VLSFO, the use of exhaust scrubbers is an attractive option for many ship operators.

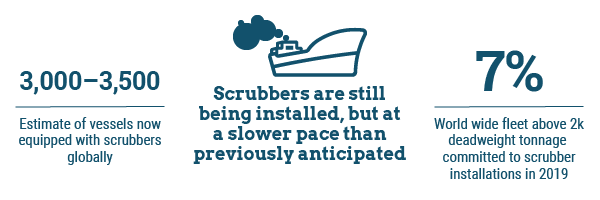

“We estimate that between 3,000 and 3,500 vessels are now equipped with scrubbers, representing about 15% to 20% of the global bunker fuel demand,” Brand said. “Ships with scrubbers are still running on high-sulfur fuels, therefore using BN 100 to BN 140 marine cylinder lubes.” He added that the scrubbers are quite often installed on bigger vessels with two-stroke engines and more power.

Scrubbers are still being installed, but at a slower pace than previously anticipated. “This is mainly due to the current very small price difference between high-sulfur fuel and very low-sulfur fuels,” said Brand.

Huot observed that many ship owners have decided whether or not to install scrubbers mostly based on calculations of how quickly the cost of installation would be made up, considering the price difference between high- and low-sulfur fuels.

“In 2019, about 7% of the worldwide fleet above 2,000 deadweight tonnage was committed to scrubber installation. Delays in installation at shipyards and the first known issues in terms of maintenance costs, as well as a ban on open-loop scrubbers, which are cheaper, has slowed down the adoption of scrubbers,” Huot said.

She added that scrubbers made more financial sense in the fourth quarter of 2019 than they do now. “With the crash of oil prices in the beginning of 2020, combined with the hike in tankers’ freight rates for oil storage, scrubber payback became quite unattractive, and a number of shipping companies—in particular tankers—cancelled their scrubber options,” she said.

“The uptake of scrubbers may not be as high in the coming year as previously expected,” Brand observed. “For the longer term, it will depend on the economics—such as fuel prices and global seaborne trade—as to whether installing scrubbers is financially attractive for shipping companies.”

Gazpromneft’s Miroshnichenko said shipping companies are still considering installing scrubbers in order “to be able to use other types of fuels, and we are ready to supply [cylinder] oils for high-sulfur fuel engines, too.”

Brand concluded that future trends in marine lubricant formulations will heavily depend on the types of fuels that ships are required to use.

Boris Kamchev is a staff writer with Lubes’n’Greases. Contact him at Boris@LubesnGreases.com.