The COVID-19 pandemic has been a transformational event for the global economy and the lubricants industry. As our industry begins to establish some new operational norms, we must also embrace a new reality that is shaped by an energy transition and sustainability commitments. This overview of the entire lubricants industry examines the potential outcomes and opportunities of these changes.

The depth and duration of the 2020 pandemic and lockdowns are influencing all potential recovery scenarios. As we go to print, many uncertainties continue to cloud the picture for oil markets and economic growth in the short term. However, 2019 offers some guideposts that help us develop a plausible outlook for the future.

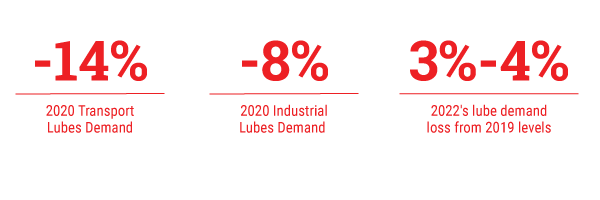

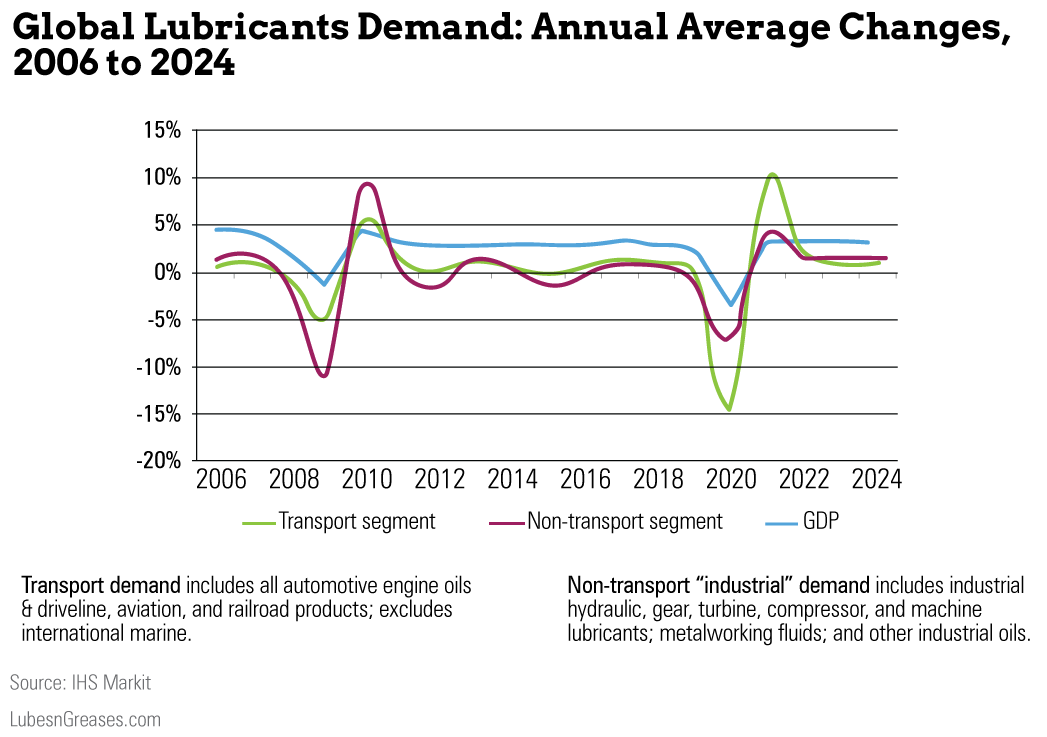

According to the latest IHS Markit macro-economic and industry recovery scenario, global lubricants demand for 2020 will be down by 14% for transport sector products and 8% for non-transport industrial products. As it recovers gradually over the next two years, average global demand will still be down 3% to 4% relative to where it started in 2019.

Countries with early and effective lockdowns such as China and some European Union countries are expected to recover closer to pre-pandemic levels by 2022. Countries with prolonged lockdowns and recurring virus impacts are not likely to return to 2019 levels due to greater permanent demand destruction across industries, businesses and the consumer sector, plus the advancement of market efficiency trends.

Despite the downturn in oil market pricing, international oil companies remain committed to ambitious emissions reduction targets. Pressure from financial institutions, investor groups and citizens to move to a low-carbon world will continue. The clear skies that appeared over some of the most polluted cities in the world during the pandemic have highlighted the potential benefits of clamping down on emissions. Over the coming decades, we are anticipating evolutionary change in automotive and industrial technology, efficiencies and environmental policies that will bring new opportunities to participants across the lubricants industry.

As we look toward 2050, IHS Markit forecasts that total transport sector demand will remain essentially flat. Consumer demand will decline due to the impact of synthetic lubricants and greater efficiencies. Growth of light-duty hybrid and battery electric vehicles will be offset by commercial transport sector growth. On the other hand, non-transport industrial sector demand will grow by 13%, led by developing economies.

The net effect will be a dramatic rebalancing of the industry’s average portfolio of products, weighted toward commercial and industrial sectors. Although hard to imagine currently, these forces even now are driving strategic thinking and structural changes among lubricant marketers and additive suppliers.

Reaching Peak Earnings

Let us not forget that 20 years ago our industry went through a phase of significant global consolidation of oil companies, lubricant marketers and additive suppliers that ushered in almost two decades of relatively constant and strong earnings growth. New value was driven by a lower cost structure and the growth of premium and synthetic products that original equipment manufacturers required to meet fuel economy and emissions standards. As with today, overall volume was essentially flat as growth in emerging markets was offset by declines in mature markets. Yet the pace of value growth as measured by the industry-wide gross margin averaged about 3% annually.

More recently and just prior to COVID-19, the industry had been restructuring and consolidating as margin and operating cost pressures presented headwinds for reinvestment in future technologies and efficiencies. The growth of industry-wide gross margin has moderated, and the trajectory for the next five years is flat. Pre-pandemic trends reflected industry maturity as more players entered the market and commoditization extended across the entire supply chain.

The impact of 2020 demand destruction and the extended recovery cycle has amplified the fact that the industry reached another period of peak earnings last year. This sets the stage for companies with financial strength to act as consolidators, drive efficiencies to take down costs, and build a platform to generate future earnings growth by participating in the coming energy transformation.

Getting Past the Crash

With the collapse of demand during the first half of 2020 and no clear picture of when or to what extent it might recover, the priorities of lubricant marketers and additive suppliers are two-fold:

- How do we manage our supply chains to move from crisis or contingency back to just-in-time operating efficiencies?

- How will we protect and maintain the health and safety of our employees and business stakeholders?

At the onset of COVID-19, it became clear that the supply chain needed to change to provide the flexibility and speed to navigate new market conditions. This starts with the delivery of base oil and additives to manufacturing facilities and continues through the warehousing and logistics that support distributors and end-use customers.

The availability of raw materials is a balancing act between sales volatility and optimizing production and stock levels. Those moving base oils, additives and finished products across country boundaries face a variety of new and different restrictions. Potential challenges for operations include product allocations and production caps and the ability to respond to formulation changes.

As financial pressures mount, additive suppliers and lubricant marketers will seek opportunities to decrease costs by consolidating plant operations, moving to third-party relationships and generally shortening their global supply chains.

The industry commitment to the health and safety of employees and key stakeholders has also been paramount. Compared to some other industries, such as retail sales or hospitality, the lubricant and additive industries are well prepared to deal with a pandemic. Generally, the organizational culture is accustomed to managing chemical risk, and it is a short step to managing medical risk.

Many companies had contingency plans in place after the SARS epidemic in Asia in 2003. Implementing these plans has resulted in employees working from home as much as possible, avoiding commuting and making new or greater use of internet connectivity. Sales visits have effectively stopped, saving travel and hotel costs as sales and customer personnel learn new virtual communication techniques.

Order processing can also be handled remotely with appropriate safeguards around IT systems. Where employees need to attend work in person, such as a research facility or manufacturing plant, high attention is paid to social distancing, minimizing access and movement on site, coordinating shift operations and improving hygiene and cleaning practices. Of course, we ask ourselves how long these operations and the associated costs can be sustained financially—hopefully long enough!

What’s new, what’s the same?

The COVID-19 pandemic has accelerated several trends that were already in place. The internet has found greater value as a business-to-business tool and a facilitator for virtual meetings. There will be more flexibility in working practices with less physical travel to a work location or other premises. Remote monitoring and ordering systems have found greater value, as they help avoid physical contact. Digitalization will continue.

Air quality and the environment have benefitted from the lack of transport, along with lower power generation and industrial activity. Political and societal pressure to maintain progress in this area will continue. Lifestyles and values may change as people reflect on their lockdown period.

Whilst progress toward vehicle electrification continues, market constraints of charging infrastructure, battery technology and consumer acceptance remain. Whether developing the infrastructure and providing financial incentives for electric vehicles is a priority for governments with increasing debt is an open question. Progress toward more hybrid vehicles and cleaner burning fuels like liquefied petroleum gas will continue.

Commercial vehicles are less impacted by electrification; however, fuel economy and emissions will remain key lubricant drivers.

Cost Reduction Opportunities

With sales volumes and revenues dropping precipitously in the face of a global pandemic, companies of all shapes and sizes are searching for ways to reduce costs.

• Reducing in-house costs, such as closing offices and creating leaner workforces

• Shuttering inefficient plants and consolidating production

• Outsourcing to create a variable cost base in lubricants production or bringing production in-house with shorter raw material supply chains

• Expanding digital and transparent customer interfaces

• Accelerating internet sales and purchasing interfaces

• Monitoring the supply chain to mitigate demand volatility and maintain supply security

• Involving multiple stakeholders in new lubricant developments as budgets and projects are critically assessed

• Partnering with large logistics companies to bridge supply chain gaps

The decrease in miles driven is likely to continue as health concerns remain around gatherings of people in work and leisure environments, which will also promote greater use of digital services. Light- and heavy-duty vehicle and industrial lubricant usage will recover as trade and deliveries pick up more quickly than personal mobility.

Whilst marine-driven trade will slowly improve, industry analysts suggest air travel and leisure cruises will take many years to recover as people are wary of spending long periods in an enclosed space close to fellow travelers.

OEMs committed to greater electrification are expected to continue investments in those areas, while research and development on conventional internal combustion engines and lubricant specifications is likely to be slowed. Automakers that are less committed to full battery electric vehicles are likely to focus more on optimization of existing powertrains, including hybrids. The drive for greater fuel efficiency and lower emissions is set to continue, but with a more critical eye toward the most significant benefits.

What will the industry look like in the coming decades? It will be stronger. It will be more efficient, and it will be more profitable. There will be fewer players that only sell lubricants, only make base oil or only make lubricant additives. There will be lots of new products based on new technologies and some that extend the application of old technologies. Beyond lubricants, businesses will offer a mix of products and services that offer the benefits customers need to operate well and at the lowest cost. The authors dare to dream and hope of the day coming soon when we put 2020 well behind us and start this new journey.

Suzan M. Jagger, vice president of oil markets and downstream consulting with IHS Markit, has partnered with multinational clients across the energy industry for more than 25 years. Contact her at Suzan.Jagger@IHSMarkit.com.

Philip Reeve is a chemist with 40 years of experience in the global lubricants and additives industry. He’s held positions at Afton, Infineum and ExxonMobil and is now a director of ADLU Consultancy. Contact him at philipreeve@adlu-consultancy.com.