Ready for a Change

The first quarter of the year was certainly a challenge. Base oil producers dealt with unexpected output disruptions and lean inventories, while buyers struggled with rising prices and difficulties in fulfilling their requirements, as many were placed on allocation and extra product was difficult to source. By the start of the second quarter, market participants were ready for a change.

The extremely tight balance was the result of steady demand coupled with low supply levels, which were exacerbated by several planned turnarounds at paraffinic and naphthenic plants.

The scheduled shutdowns followed unexpected outages in mid-February—the result of extreme winter temperatures and ensuing power and water supply outages in swaths of the United States. Two major API Group I and Group II producers, ExxonMobil and Motiva, were forced to declare force majeure and place customers on allocation. The suppliers restarted their plants by late March, but allocations remained in place for a few additional weeks.

Calumet’s and HollyFrontier’s base oil plants had been undergoing routine turnarounds at the time of the storm. They also suffered setbacks due to the severe weather, forcing extended shutdowns and further limiting domestic supply of Group I and II grades. By early April, both producers had restarted operations and were ramping up output, but spot availability was not expected to improve until May.

All of these difficulties were taking place at a time when many consumers start to pad inventories to cover potential base oil supply disruptions during the hurricane season, which in the Atlantic basin runs from June 1 to November 30.

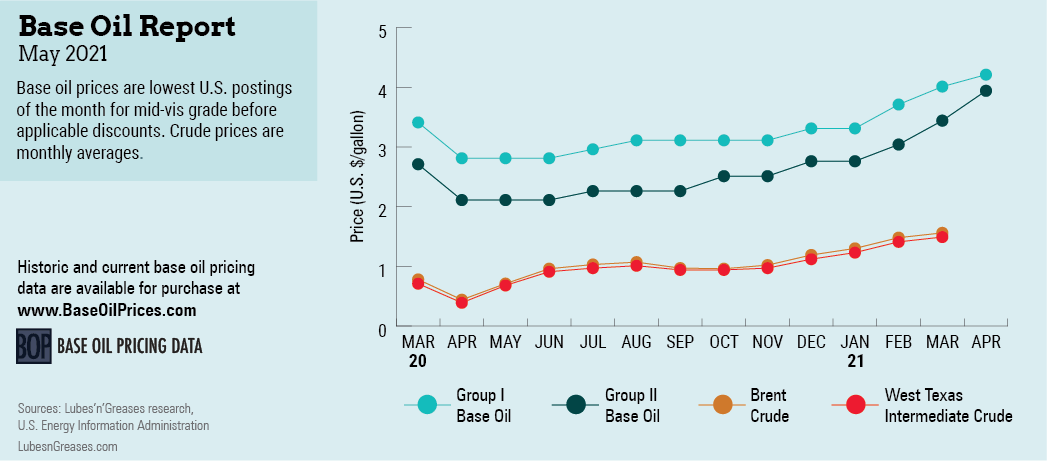

The critically strained conditions, together with steep crude oil and feedstock prices, prompted producers to increase prices in March and early April. On the paraffinic front, suppliers implemented posted price increases ranging from 20 to 55 cents per gallon, with implementation dates interspersed between March 19 and April 1. Most naphthenic producers also raised prices by 20 cents in late March and early April.

With COVID-19 vaccination campaigns underway and prospects of heightened activity anticipated in automotive, industrial and aviation segments, fuel and lubricant consumption is likely to increase as the year wears on. Refinery and base oil production rates are also expected to improve, hopefully ushering in a more balanced supply and demand scenario and a stabilization of pricing.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com.