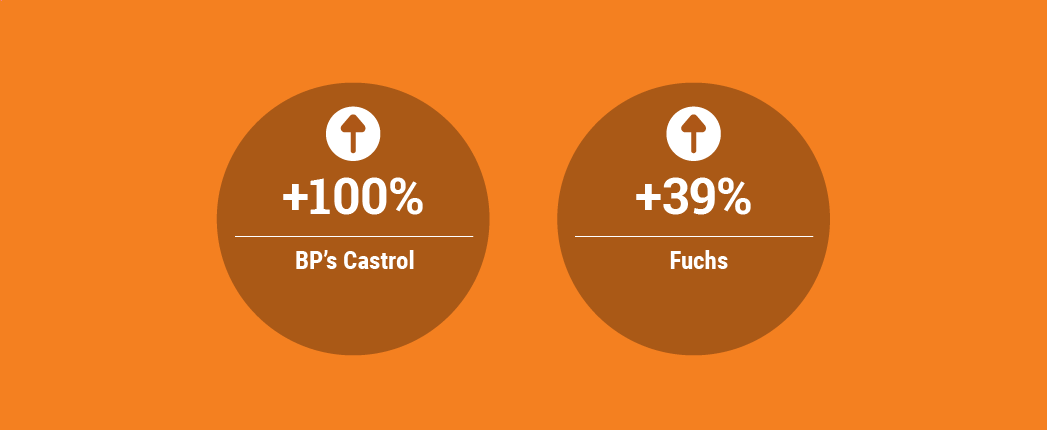

The first quarter of 2021 was bullish for two of the world’s largest lubricant suppliers, BP’s Castrol unit and Fuchs Petrolub SE. Castrol doubled its underlying replacement cost profit before interest and tax, compared to the same period of 2020, while German independent blender Fuchs reported strong increases in profits and sales.

BP

London-based BP reported an underlying replacement cost profit of $334 million for its Castrol lubricants business before interest and tax for the first quarter, up 100% from $167 million in the same period in 2020.

“Castrol is already demonstrating strong recovery in first quarter 2021, with high volume delivery,” BP said in its earnings news release. Volumes, revenues and growth markets earnings were all materially higher than in 2020’s first quarter.

Fuchs

Mannheim, Germany-based Fuchs reported €71 million (U.S $85.6 million) in earnings after tax for the quarter ending March 31, improving by 39% from €51 million in the year-earlier period. Sales revenue for the company increased 13% to €697 in the first quarter, up from €616 million.

Revenue for Europe, the Middle East and Africa edged up 5% to €419 million. Revenue in Asia-Pacific jumped 46% to €213 million. In North and South America, the company’s revenue was up 1% at €111 million.

Although the company had expected a good start in the new fiscal year, the first quarter exceeded its expectations, according to Fuchs Petrolub’s chairman of the executive board, Stefan Fuchs. “This positive development was driven by China, which generated record quarterly sales revenues and significantly contributed to the Asia-Pacific region doubling its earnings compared to the previous year,” he said in the company’s earnings news release.

“[Europe, Middle East and Africa] and North and South America also developed extremely positively with an earnings growth of 14% and 33% respectively – especially given that, in contrast to earnings in the Asia-Pacific region, their prior-year quarters were not yet impacted by the COVID-19 pandemic.” He said that while the company is optimistic about the coming months, caution was necessary due to a variety of factors.

“However, the current shortages and noticeable price increases of raw materials and packaging materials will weigh on costs and margins of the financial year,” Fuchs said. “The high quarterly sales revenues are therefore at least partly the result of early purchases by our customers in view of the already announced, necessary selling price increases.”