Vertex Energy’s black oil segment, which includes its rerefineries and used oil collection business, reported increases in gross profit, income from operations and revenues for the quarter ending March 31, compared to the same quarter last year.

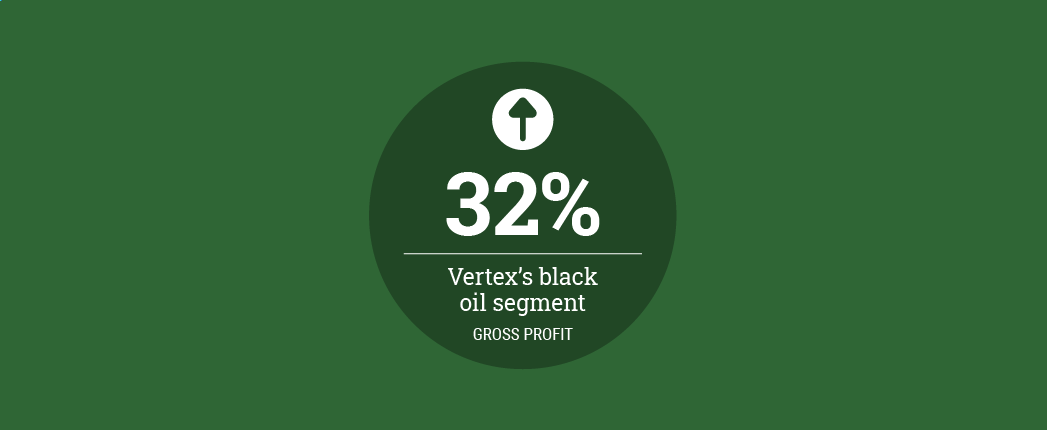

In a filing with the U.S. Securities and Exchange Commission, the Houston-based company said that its black oil segment’s gross profit increased 32% to $11.2 million for the first quarter, compared with $8.5 million in the same quarter last year. The segment’s income from operations jumped 61% to $4.5 million because of “improvements in commodity prices, which resulted in improved margins as well as reductions in operating expenses through our various facilities as well as by diligent management of our street collections and pricing,” Vertex stated in the filing.

The black oil segment’s revenue comes primarily from the products of Vertex’s rerefineries and sales of used motor oil purchased from generators, like oil change shops and garages and a network of collectors.

Segment revenues for the quarter increased 9% to $32.2 million. For the quarter, the company reported base oil revenues of $9.1 million, a 23% increase. Revenue in the quarter from oil collection services jumped 33% to $1.6 million.

Vertex operates a rerefinery in Columbus, Ohio, that can produce 1,100 barrels per day of API Group II base stocks and a refinery in Marrero, Louisiana, that produces vacuum gas oil.

The black oil segment’s volume decreased 7% during the first quarter, compared to the same period last year. “This decrease was largely due to continued impacts of the shelter-in-place orders in the locations in which we collect used motor oil as a result of the COVID-19 pandemic, which directly impacted the generation of used oil, which caused a reduction in volumes,” the company said. The Heartland facility experienced lower demand for finished products in the three months ended March 31, the company noted.

Vertex’s recovery division includes the business operations of Vertex Recovery Management.

The company said a key initiative continues to be a focus on growing its own volumes of collected material and displacing the third-party oil processed in its facilities. “We started to see improvements in our collection volumes at the end of the period,” the company added.

On May 26, Vertex announced an agreement to acquire the Mobile refinery in Mobile, Alabama, and related logistics assets for $75 million from Equilon Enterprises – which does business as Shell Oil Products U.S. – Shell Oil Co. and Shell Chemical LP, subsidiaries of Royal Dutch Shell. In the news release’s asset overview section, Vertex noted that the refinery has the option to run as a stand-alone refinery and is also capable of producing base oils and chemicals feedstock.