Afton Chemical recorded higher operating profit in the fourth quarter, but weaker full-year results, while Valvoline posted increases in sales and operating income for its fiscal quarter ending Dec. 31.

Afton Chemical

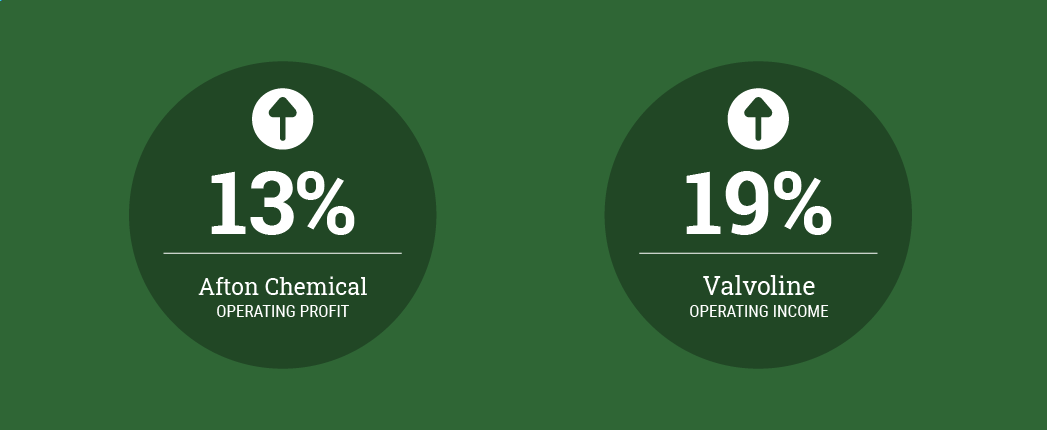

NewMarket Corp.’s Afton Chemical petroleum additives segment reported operating profit of $84.3 million for the fourth quarter ending Dec. 31, up 13% from $73.6 million in 2019’s fourth quarter. For the full year, operating profit was $333.2 million, down 7.2% from $359.2 million in 2020. The decrease was mainly due to changes in selling prices, lower shipments and higher conversion costs, partially offset by lower costs for raw materials, selling, administrative and general activities. Conversion costs refer to direct labor and overhead expenses incurred when transforming raw materials into finished products.

Sales for the segment edged down 1.2% to $525.2 million in the fourth quarter.

For the full year, the petroleum additives segment’s sales were down 9% at $2 billion. The company attributed the full-year decrease in sales to lower shipments and decreased selling prices.

NewMarket said business rebounded during the second half of 2020, but began to flag again late in the year. “During the second quarter of 2020, government and business shutdowns in North America and Europe led to a precipitous drop in vehicle miles driven and auto production, with gasoline consumption in the United States dropping to its lowest point in over 50 years,” the company explained. “With less travel and fewer miles driven, combined with automobile plant closures, global demand for our products declined substantially, except in our Asia-Pacific region where demand remained relatively stable throughout the year.”

Global production of automobiles began to recover as restrictions eased and economies reopened, leading to steady improvement in miles driven in most countries, including the United States. “Late in the fourth quarter, renewed restrictions on travel and work in certain countries had a negative effect on our business,” NewMarket stated. “The pace and stability of improvement in demand for our products will continue to depend heavily on economic recovery and the rate at which government restrictions are lifted and remain lifted.”

Richmond, Virginia-based NewMarket reported net income of $66.9 million, or $6.12 per share, for the fourth quarter, down 34% from $50.1 million, or $4.48 per share, during the same period of 2019.

For 2020, the company posted net income of $270.6 million per share, or $24.64 per share, down 6% from $254.3 million, or $22.73 per share in 2019.

Valvoline

Valvoline’s three operating segments – Core North America, quick lubes and international – combined for operating income of $124 million for its first quarter, which ended Dec. 31, up 19% from the same period in 2019.

The Lexington, Kentucky-based company generated $653 million in sales, up 8% from $607 million. Quick lubes accounted for $254 million in sales, or 39% of total sales, followed by the Core North America segment’s 235 million in sales – 36%. International contributed $164 million in sales, or 25%.

North American lubricant sales totaled 21.2 million gallons for the quarter, down 1%.

Quick lube lubricant sales reached 7.7 million gallons, up 5%.

International lubricant sales volumes increased 14% to 16.8 million gallons. Including unconsolidated international joint ventures, volume was up 19% at 30.3 million gallons.

Valvoline said its results were especially strong in Latin America and China. Volume also grew in unconsolidated joint ventures, particularly in India where the business saw a robust recovery from COVID-19 impacts, in addition to continued strength in its China joint venture.

“Fiscal 2021 is off to an outstanding start with record first-quarter profitability,” said Valvoline CEO Sam Mitchell. “While COVID-19 remains a headwind to miles driven, our business continues to perform well, and we remain focused on global growth.”