Afton Chemical, Quaker Chemical, and HollyFrontier’s lubricants and specialty products segment all reported increased profits for the second quarter, while revenues were strong for Heritage-Crystal Clean’s oil business segment. Companies noted strong improvements compared to the same quarter last year, when the COVID-19 pandemic had significant impact.

Afton Chemical

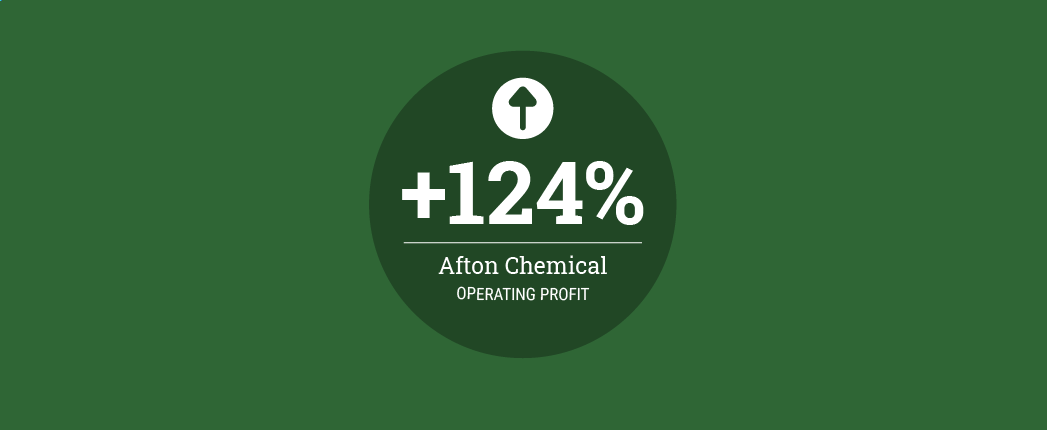

Afton Chemical, the petroleum additives segment of Richmond, Virginia-based NewMarket Corp., reported operating profit of $74.2 million for its second quarter, improving 124% from $33.1 million in 2020’s second quarter. The low operating income a year earlier was driven by lower shipments, impacted by the COVID-19 pandemic and resulting government restrictions on movement of people, goods and services to combat the spread of the virus.

Sales in the second quarter for the segment increased 44% to $586.6 million, compared to $408.7 million in the year-earlier period.

The company attributed the increase to several factors, including higher shipments and favorable changes in selling prices, partly offset by higher raw material costs. Shipments increased 41% for the quarter, driven by increases in all regions in both lubricant additives and fuel additives.

Petroleum additives operating margin – calculated by dividing operating profit by sales – was 12.7% in the quarter, which the company said was significantly lower than its historical average. Operating margin measures the profit a company turns on a dollar of sales after paying for production costs, but before paying interest or tax.

“We are encouraged by our petroleum additives operating results and the strong shipments for the first half of 2021, but disappointed with our operating margins,” NewMarket Chairman and CEO Thomas Gottwald said in the company’s earnings report. Gottwald noted its product shipments for the first half of 2021 were the highest since the first half of 2019.

“However, we are seeing downward pressure on our operating margins due mainly to the steady increase in raw material costs throughout the year,” he said. “While our efforts have been focused on recovering these cost increases, we have been experiencing the lag between when price increases go into effect and when margins start to improve. Margin improvement will continue to be a priority until we see margins consistently within our historical ranges.”

NewMarket reported net income of $52 million, or $47.5 per diluted share, up 133% from $22.3 million, or $2.05 per diluted share in the second quarter of last year.

Quaker Chemical

Quaker Chemical – also known as Quaker Houghton – reported $33.6 million in net income for the second quarter, rebounding from a $7.7 million net loss in the year-earlier period.

Net sales grew 52% to $435.3 million in the second quarter, up from $286 million.

The company attributed the increased net sales primarily to sales volumes, which increased 40%. The significant increase in sales volumes was due to 2020’s second quarter being the most severely impacted by COVID-19 globally, as well as the continued improvement in end market conditions and continued market share gains realized in the current quarter.

“We had a strong second quarter despite unprecedented increases in raw material costs and supply chain issues,” Chairman, CEO and President Michael F. Barry said in the company’s earnings news release.

HollyFrontier

Dallas-based HollyFrontier Corp.’s lubricants and specialty products segment posted $59.9 million in income from operations in the second quarter, recovering from a loss of $209.3 million in income from operations in 2020’s second quarter. Revenues from external customers rose 87% to $662.8 million in the second quarter, improving from $353.6 million.

The lubricants and specialty products segment includes Petro-Canada Lubricants and its refinery in Mississauga, Ontario, which makes such products as base oils, white oils, specialty products and finished lubricants, along with specialty lubricants from HollyFrontier’s Tulsa refineries. Acquired companies Red Giant Oil Co. and Sonneborn are also part of the company’s lubricants and specialty products segment.

“HollyFrontier delivered strong financial results in the second quarter, driven by improvement in refining margins in both the West and Mid-Continent regions and strengthening base oil margins in the quarter,” President and CEO Michael Jennings said in the company’s earnings news release.

Heritage-Crystal Clean

Revenues for Heritage-Crystal Clean’s oil business segment – which includes oil collection activities, rerefining activities and sales of recycled fuel oil – grew 126% to a record $44.6 million in the second quarter ending June 19, improving from $19.7 million in the same quarter in 2019.

An increase in base oil prices was the main driver of the increase, along with an increase in base oil sales volume compared to the prior year quarter, the Elgin, Illinois-based company noted in its earnings news release

“We continued to execute well at our rerefinery during the second quarter, which enabled us to produce more base oil volume compared to the prior year quarter, when we intentionally idled the facility due to the negative impact of the COVID-19 pandemic,” Heritage-Crystal Clean President and CEO Brian Recatto said in the earnings news release. “This allowed us to take advantage of very favorable base oil pricing conditions to produce record profitability in our Oil Business segment during the second quarter.” The oil business segment’s operating margin increased sharply to a record 34.2% in the second quarter, up from 28.2%. The company explained that its higher operating margin in the quarter was mainly due to an increase in the price spread between the netback – sales price net of freight impact – on its base oil sales and the price paid and charged to its customers for the removal of their used oil, along with less downtime at Heritage-Crystal Clean’s rerefinery.