API staff members recommended last week that first licensing for the API SN Plus supplemental engine oil specification be delayed for six weeks until June 15 in order to allow more time for lubricant marketers to prepare for the launch.

Automakers pushed back on that suggestion, which was aired at a March 15 meeting of the Automotive Oil Advisory Panel. After representatives of the International Lubricant Standardization and Approval Committee (ILSAC) urged sticking to the current May 1 target date, API said it will settle on a position after seeking further input from lube marketers.

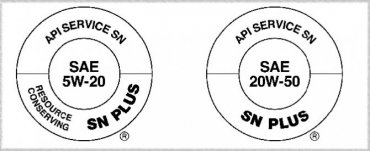

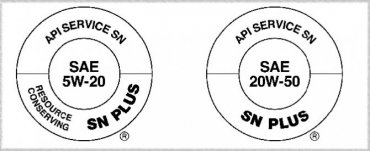

Photo courtesy of the American Petroleum Institute

SN-Plus is an interim upgrade to API SN, being hurried to market because lengthy delays to the next engine oil specification for American and Japanese passenger cars, GF-6.

API invited engine oil licensees to notify it by March 22 of any objections to May 1 being the date for first allowable use.

SN Plus is an interim upgrade to API SN, being hurried to market because lengthy delays to the next engine oil specification for American and Japanese passenger cars, GF-6. The primary reason for the supplement is that Ford wants to add a test for ability to protect against pre-ignition in modern gasoline direct injection engines.

API staff members cited two reasons to delay the date for first available use of SN Plus into June. Base oil interchange rules for the new Ford-sponsored Sequence IX Low Speed Pre-Ignition Test (the key new test for API SN Plus) are currently being balloted and have not been formally accepted. Those rules would give marketers with approved oil flexibility to alter the base oils in their formulas without having to run additional engine tests, which can be both lengthy and expensive.

In addition, API heard reports that a bench test required for SN Plus, the ROBO has a significant backlog that could prevent some oil marketers from completing testing, obtaining their license, blending and packaging their products and transporting it to market by May 1.

After ILSAC pushed to keep the May 1 date, Kevin Ferrick, the senior manager of APIs engine oil program, said his association would indeed consider doing so.

After hearing feedback from stakeholders, API agreed to consider the proposed May 1 date again, he told Lube Report March 16. He added, though, that the association is trying to maintain a level playing field that will give all engine oil marketers equal and sufficient opportunity to have SN Plus products in the market for first allowable use.

It is critical to the API process that marketers have the opportunity to introduce oils meeting a new API standard but at the same time provide engine oils meeting the needs of the engine manufacturers in a prompt manner. API officially requested feedback on March 16 and asked for licensees to reply by March 22 if they had issues regarding the May 1 date. If no significant concerns are heard, the May 1 date will be maintained.

At least two major marketers, Philips 66 and Valvoline, have issued press releases that their passenger car engine oils are already capable of meeting the new performance category and protecting against pre-ignition problems with gasoline direct injection engines. Reliance Fluids technology, an independent lubricant manufacturer, also announced its readiness to meet the new requirements. Other sources indicate that most other major marketers or independents are either ready for API SN Plus or are in transition and expect to be ready by the May 1 date.

A Ford representative contended that base oil interchange and viscosity grade read-across rules should not be a problem even if they are adopted late because the direction of those rules has been clear for some months, and oil and additive companies proceeded to prepare products based on assumption that the rules would be adopted as anticipated.

The rules for base oil interchange and viscosity interchange are quite liberal and were supported by Ford and other ILSAC members, and the official ballot should be approved in April, Ron Romano said. Now everyone knows the BOI/VGRA requirements, so this should not hold up the supplement.

The Robo test may still be a concern as industry has only a finite amount of test capacity and additive companies and marketers have to qualify hundreds if not thousands of formulations to cover all base stocks and combinations of base stocks that may be commercially used.

Romano said Ford is willing to support a period of provisional licensing that would allow oil marketers that are unable to complete the Robo bench test because of its backlog to obtain temporary licenses if they meet all other requirements. Under API rules, companies granted provisional licenses would be required to pass the Robo test within a set time frame.

The market has known about the urgent need to protect GDI engines well before the official request for a supplemental category last August and that these new oils are needed to protect the fuel-efficient [gasoline direct injection] technology for engines already on the road and being introduced every day. So everyone has had plenty of time to get products completed if work started back in August.

API agreed to develop SN Plus in August 2017 and adopted it in November. Full category upgrades, normally have a 12-month waiting period between adoption and first use, though that time has occasionally been shortened. There are no official rules concerning a mandatory waiting period for category supplements. Automakers originally sought a first licensing date of Jan. 1, but API said it could not meet that date. Since then the industries have been working toward a May 1 date.