The hopes and expectations for EV sales to rapidly scale up are based on assumptions that their costs will drop significantly – enough for them to reach price parity with ICE vehicles. BEVs generally cost more than PHEVs today, but many think that BEV costs will drop faster and sooner, allowing them to achieve price parity in the near term. In fact, because they contain both electric and internal combustion engines, as well as a battery, it is less certain whether PHEVs will ever reach cost parity, despite PHEVs gaining market share in new registrations.

Market share: BEVs captured about 15% of new car registrations and hybrids 27% toward the end of 2023 in Europe. In the USA, BEVs accounted for 9% and hybrids 7%. In China, BEVs took 22% and hybrids 11%.

EV batteries are central to discussions on price parity. They are by far the most expensive single components in EVs, accounting for 30-40% of the entire vehicle’s value. Of course, they differ in cost depending on the size and manufacturer.

The average cost per kilowatt-hour was U.S. $137 in 2020, according to a survey conducted by BNEF. Tesla paid an estimated $115/kWh in December 2020. At that price, the leading EV manufacturer’s 80.5 kWh battery pack in its Model Y cost the automaker about $9,250.

The value of power: The cost per kilowatt hour gives the battery pack a comparable value. A battery pack that has capacity of 100 kWh and cost $15,000 has a cost per kilowatt hour of $150.

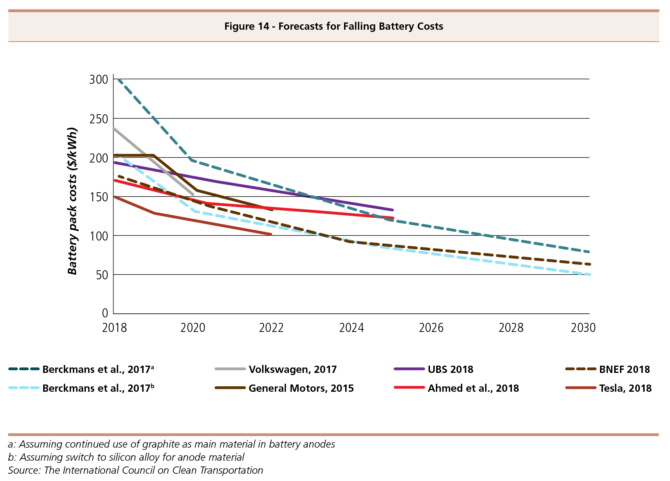

That cost has dropped fast and steadily for the past decade, from $1,000/kWh in 2010. Automakers and outside analysts predict it will continue to fall, though their forecasts vary. Per-unit battery pack costs differ between automakers, partly because of technology and manufacturing techniques, but also depending on sales numbers; companies with higher sales can spread out fixed costs more than competitors.

Some predict costs will take step decreases if the industry is able to switch to battery designs that have not yet been commercialized, for example changing the lithium nickel manganese cobalt oxide cathode in today’s lithium-ion batteries to lithium nickel manganese aluminum oxide; or switching the anode material from mostly graphite to a silicon alloy; or, more radically, switching to solid state batteries that use solid electrolytes instead of the liquid or polymer electrolytes in today’s lithium-ion batteries.

Predictions were that battery pack costs would decrease to $130 to $160/kWh between 2020 and 2022, though Tesla stated that it would reach an average of $100/kWh by 2022. BNEF predicted in December 2020 that the industry would reach that number by 2023. Researchers at Vrije University in Brussels believed costs could fall to $62/kWh by 2030. Any of these outcomes would more than offset the increased cost of shifting to larger battery packs, which is an ongoing trend. The reality is that the price per kilowatt hour increased by 7% in 2022 due to the rising costs of cobalt and nickel. Expectations are that costs will still fall.

Other costs are falling, however. A 2019 analysis by the International Council for Clean Transportation estimated that combined costs for nine items ranging from the power distribution module to the inverter/converter, the electric drive module and the charging cord will fall 12% between 2017 and 2025 to $2,800. Bigger savings will come from indirect costs, such as administration, research and development as increasing sales allow them to be spread across greater numbers of vehicles. ICCT estimated that the per-unit tally for these indirect costs will be slashed by more than $7,000 over the same time period to just $3,200.

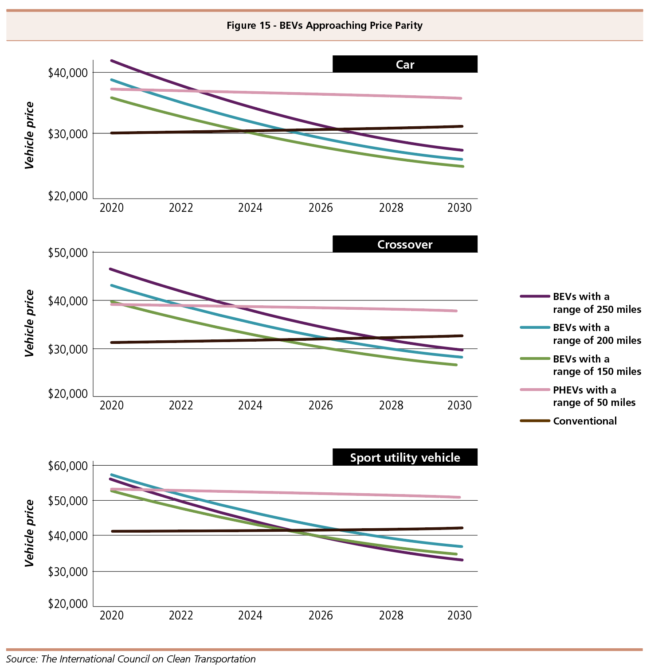

Adding it all together, ICCT predicted that BEVs with a range of 150 miles will reach cost parity in 2024, and that those with range of 200 and 250 miles will do so in 2025 and 2027, respectively. Parity for the same categories of crossover and SUV will come in 2025-2028 and 2025-2027, respectively.

Other analyses have somewhat different timeframes, but most models show EVs having price tags equivalent to ICE vehicles – without any government subsidies – during the next 10 years. When that happens, EVs should jump in popularity for a broader spectrum of motorists, thanks to the fuel savings they offer. Sales would increase exponentially, analysts say, assuming that sufficient recharging networks are developed and that recharging speeds continue to progress.

Outright cost parity between ICEs and EVs could also take into consideration the total cost of ownership over the vehicle’s lifespan. However, calculating that cost is complicated and gives mixed results. Many assume that in the absence of engine oil and fuel expenses, EVs would obviously be cheaper to run over a period of time. Not necessarily so, found the automotive journal Car and Driver.

In a comparison of two cars that have both EVs and ICE variants – the Ford F-150 and F-150 Lightning EV and the Hyundai Kona and Kona Electric – the Ford EV was cheaper to run than the ICE version and the vice versa for the Hyundais.

Car and Driver found that variables including tax breaks, trim packages, depreciation and lacking ICE/EV equivalents made calculating the total cost of ownership complicated and too varied to make useful comparisons.

Some of the cost reductions necessary to reach price parity are expected to come from research and development of components such as batteries, but it is assumed that others will come from manufacturers gaining economies of scale that allow them to spread fixed costs over greater numbers of vehicles. Sales still need to increase significantly for that to happen.

That means the industry could be in a key phase – needing to grow at even faster rates and therefore needing to win over a widening range of consumers, but with government subsidies possibly starting to wind down at the same time.

Many analysts agree that navigating that transition will require governments to shift their strategy, to implement mandates that prohibit sales of cars powered solely by ICEs or that require purchases of EVs and other low-emission models.

A number of countries are indeed moving in that direction. In the U.S., a California policy followed by nine other states began in 2018 to require large automakers to ensure that portions of cars sold in those states be zero-emissions vehicles – a category that includes fuel-cell vehicles but that for now mostly means BEVs. In Europe, a few countries have resolved or proposed to prohibit sales of new ICE-only vehicles – bans that have been targeted to take effect as early as 2022 and as late as 2040.

According to the International Energy Agency, more than 20 countries had either announced bans on sales of conventional cars or mandated all new sales be zero-emission vehicles by the end of 2020.

In China, by far the biggest EV market, it’s not yet clear how well mandates will work or if they will endure. Sales stalled in 2019 as the government cut back on subsidies, and the country was overtaken by Europe in 2020 sales. Those numbers could rebound, however, after the government mandated last year that EVs must make up 40% of all sales by 2030.

In the U.S., former President Donald Trump’s administration sought to revoke California’s permission to set its own emissions regulations – the basis for state-level zero-emissions vehicle requirements – arguing that it fragments the U.S. auto market and raises costs for consumers. States subsequently counter-sued, and current President Joe Biden’s administration said it was acting to withdraw the 2019 law in April of this year.

The sailing is smoother in Europe at the moment. For the first time, it overtook China in EV sales with 1.4 million new registrations in 2020 compared with China’s 1.2 million. The European Union is also set to target at least 30 million ZEVs on the road by 2030, Reuters reported in December 2020.

Still, it should be noted that pro-EV mandates have yet to take effect in Europe, and it is worth considering whether such rules could spur public opposition, such as the “yellow vest” protests that rocked France after the government raised fuel taxes in 2018.

BNEF, which has been among the most bullish forecasters for EV uptake, advises that it is not a foregone conclusion that these vehicles will gain mass market appeal.

“Mass market adoption is still, I think, very uncertain,” said Aleksandra O’Donovan, BNEF’s head of electrified transportation. “There is still a very good possibility that the middle market will not happen.”

She added, however, that the organization believes that obstacles are more likely to arise from issues such as inadequate charging networks or consumer concerns about depreciation of EVs. Given the degree to which environmental consciousness has taken hold in Europe, EVs are unlikely to be derailed there by public opposition to policies prohibiting ICE vehicles.

“To be honest, I don’t think that influences what will happen in Europe,” she said. “The overall drivers for EVs, health and environmental [considerations], are very real and widely recognized by the public.” She also predicted that European governments will make EVs easier to swallow. “At some point we’ll see some prize for using EVs. We have yet to see what that’s going to be.”

BNEF believes the 2019 slump in China was temporary.

“For China EVs are very much an industrial policy,” she said, citing the central government’s goal of helping the country become the world leader in EV technology. “It’s not going to be a hiccup-free growth. We cannot expect any market to grow at 200% every year, including China. But the long-term drivers for EV growth in China are there.”

Sorry, a technical error occurred and we were unable to log you into your account. We have emailed the problem to our team, and they are looking into the matter. You can reach us at cs@lubesngreases.com.

Click here link to homepage