There are five categories of alternative-fuel vehicles to consider. All essentially use off-the-shelf lubricants seen in ICE vehicles. But what is different in the lubrication needs for hybrids and EVs and how can lubricants provide optimum performance?

Current lubricant technology has been found acceptable for hybrids but has not been optimized for them, as OEMs continue driving toward lower viscosities in the conventional lube space and SAE 0W-XX-type products are rapidly growing. Indeed, Japanese OEMs are looking at SAE 0W-8 and 0W-12 engine oils and have just introduced JASO GLV1, which is the first industry specification allowing these grades. Three European OEMs – BMW, Daimler and VW – are considering SAE 0W-12 and 0W-16 for passenger car gasoline and diesel engines, in efforts to meet the latest European Union fleet emissions requirements across their platforms, which are increasingly electrified.

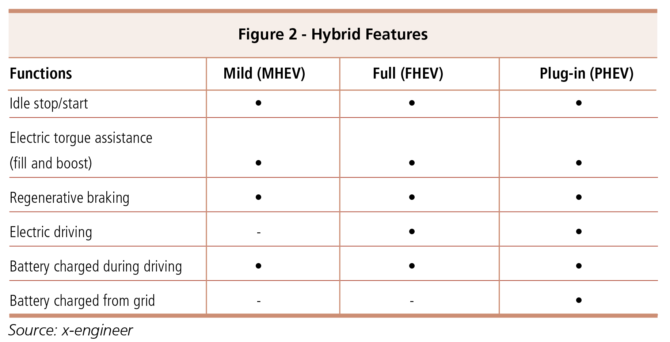

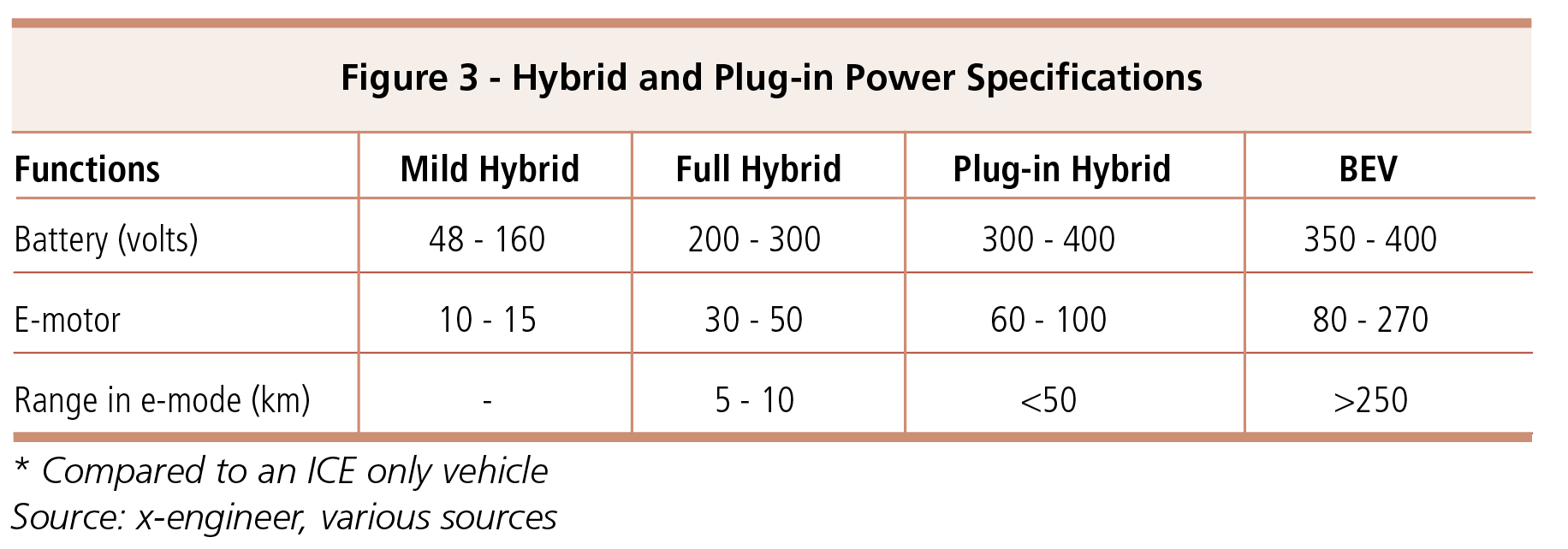

Mild hybrids, also known as power- or battery-assist hybrids, have an ICE that still does most of the work and a small 48-volt electric motor on a separate electrical system from the onboard electronics that boosts power and allows the ICE to turn off when the vehicle coasts, brakes or stops. They have advanced transmissions and often feature regenerative braking but do not have a large battery to store the generated energy.

In a mild hybrid, the ICE turns off repeatedly during city driving because of the frequent stops, and this causes the engine oil’s operating temperature to fluctuate. Of course, for most, these engines’ typical driving cycles will also include continuous highway driving, allowing for fuel and water to vaporize. Current lubricant technology appears to be fit for purpose for these conditions.

Typically, the e-motors in mild hybrids have been a mix of 12 and 48 V systems, but as OEMs move toward making more 48 V full hybrids, and engines operate less, stress on the lubricant is likely to increase, but at least today, no one is sounding the alarm.

A few years ago, OEMs rolled out 48 V systems, and expect half of all hybrids to use them by 2025. They provide four times the voltage and power to provide better acceleration and an improved driving experience. This is noteworthy because it demonstrates how fluids used in these systems will be exposed to more electrical current as we drive toward greater electrification of the global car parc.

Time will tell if increased voltage will drive the need for improved lubricants that can deal with higher current along with the different operating cycles ICE engines will experience, as well as anticipate potential but unknown issues. It should also be noted that if the cost of these 48 V systems is competitive, this will impact the pace of change from mild to full battery EVs.

Full hybrids have similar features to mild hybrids, but have larger batteries and e-motors that allow the ICE to turn off and for the e-motor to take over during various operational states. The ubiquitous Toyota Prius has been successfully operating on the same lubricant technology as standard ICE vehicles since its inception more than two decades ago.

Like mild hybrids, full hybrids see more extreme start-stop conditions for the ICE and can operate on battery-only mode, in series or parallel with the ICE, for longer periods. However, in battery-only mode, lubricants and some transmission functions are not turning over during idler functionality but are subject to vibration and potential fretting corrosion. To date, there has been no hard evidence gathered that suggests this is a concern, however.

Because their e-motors are used more, ICEs in full hybrids are used less, which means more extreme periods where the lubricant is cycling at lower-than-operating temperatures and the potential to absorb moisture or fuel increases. These conditions can lead to fuel dilution and lower viscosities, where wear and sludge can become a serious issue over time. Fuel dilution decreases viscosity, while water, which is most likely to accumulate and form emulsions, will increase viscosity and both will reduce the life and performance of the lubricant.

Plug-in hybrids have a large battery that powers an e-motor, as well as having a small ICE that serves both as a range extender and charges the battery, as with the Chevrolet Volt. PHEVs may be an intermediate step toward full electrification but are also more complex than pure BEVs. Moreover, as battery technology improves and ranges increase, it would not be surprising to see automakers move away from PHEVs. Although powertrain designs in this category differ, along with capability of the ICE, the general concept is the same.

There are two major types of PHEV architecture – parallel and series – but both use ICEs and e-motors, battery packs, generators and controllers. In parallel designs, the ICE and e-motor connect to the transmission so that either can directly propel the vehicle. A controller dictates which motor is running at any particular time. In series design, only the e-motor connects to the transmission, so propulsion is always supplied by that motor, which draws power from the battery pack or the generator. ICEs in this case are used only to generate electricity, so they are smaller. A controller in the transmission determines how much is needed and whether the e-motor draws from the battery or generator.

Parallel designs are better suited for highway operation because they are more efficient than series configurations when being driven at relatively constant speeds. Parallel designs are less suited, however, for city driving because the ICE is liable to be providing propulsion during stop-start conditions. This requires instantaneous delivery of full power, which can strain the ICE and can also lead to instances where oil does not immediately flow upon start up.

Ranges of both types of PHEVs are increasing. The first-generation Chevrolet Volt, for example, has a series design and had a range of 56 kilometers in battery-only mode and 610 km with a single tank of gasoline for the ICE range extender. The 2019 Volt can travel about 85 km on the battery and 692 km in total.

Parallel architectures are less common, but one example is the BMW i3, which has a Kymco-made scooter engine. The basic i3 has a battery range of 116 km going up to 240 km with the range extender in operation.

Common to all three hybrid categories above is that they require varying quantities of engine and drivetrain lubricants. Advances will continue for lubricant technology as operating conditions change, but the foundation is well established.

It is generally expected by many legislators, the auto industry and lube companies that over time full BEVs will become the powertrain of choice, as battery range, charging infrastructure and consumer confidence grow.

As the name suggests, a BEV only has a large battery that is charged by an external power source and does not require engine oils. It still has transmission fluid, more like today’s gear oil, and only uses small quantities of lubricant for typical moving car parts. A wild card is the battery and e-motor coolant, which may create new opportunities for lubricant suppliers.

BEVs are simpler to manufacture, since they comprise far fewer components, and will eventually be less costly than cars such as Tesla Model 3 or even the more modest Chevrolet Bolt. Indeed, Chinese manufacturers already produce a wide range of EVs catering to all price brackets.

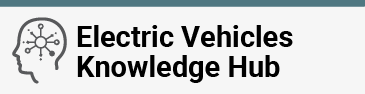

Finally, there are fuel-cell vehicles that use an onboard hydrogen tank and atmospheric oxygen to generate electricity to power an e-motor, like a BEV. However, they are yet to see significant traction in the marketplace. According to the IEA, the global fuel-cell fleet reached 11,200 units at the end of 2018. This number is, as yet, too small to pose much of a threat to lube marketers.

China’s government seems to be aggressively pursuing fuel-cell technology by offering manufacturers generous subsidies, as it did with the EV and battery sectors, according to reports in the U.K. press.1

In the West, the eye-popping sticker price for a car, virtually no manufacturing capacity and next to no refueling infrastructure have consigned these cars to the back-burner for now. But watch this space.